- The cross is down for the second straight session on Thursday amidst increasing selling pressure around the European currency.

- The continuation of the leg lower should initially meet weekly lows in the mid-127.00s ahead of the more relevant contention area around 126.60, October’s low.

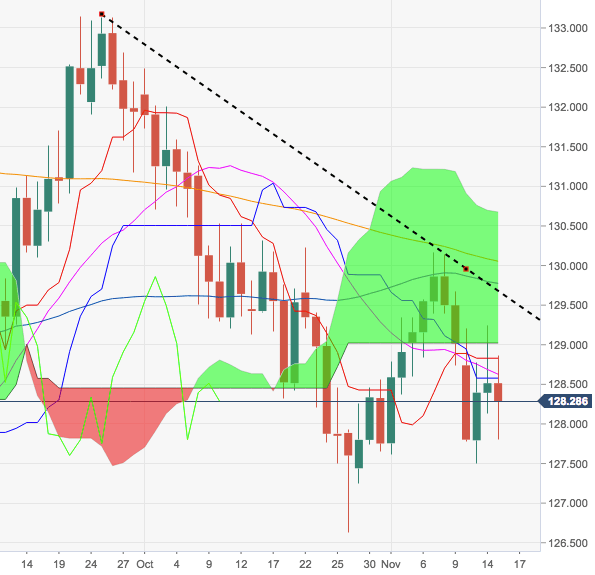

- In the meantime, the up move remains capped by yesterday’s top in the 129.20/25 band, while a tougher barrier lies in the 129.54/130.04 band, where coincide the 100-, 55- and 200-day SMAs.

- Looking at the broader picture, the stance on EUR/JPY should remain negative as long as the resistance line at 129.67 caps.

EUR/JPY daily chart

EUR/JPY

Overview:

Last Price: 128.24

Daily change: -27 pips

Daily change: -0.210%

Daily Open: 128.51

Trends:

Daily SMA20: 128.64

Daily SMA50: 129.85

Daily SMA100: 129.53

Daily SMA200: 130.11

Levels:

Daily High: 129.24

Daily Low: 128.13

Weekly High: 130.16

Weekly Low: 128.6

Monthly High: 132.49

Monthly Low: 126.63

Daily Fibonacci 38.2%: 128.82

Daily Fibonacci 61.8%: 128.56

Daily Pivot Point S1: 128.01

Daily Pivot Point S2: 127.52

Daily Pivot Point S3: 126.9

Daily Pivot Point R1: 129.13

Daily Pivot Point R2: 129.74

Daily Pivot Point R3: 130.24

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats to 1.0700 after US data

EUR/USD lost its traction and turned negative on the day near 1.0700 in the American session on Tuesday. The data from the US showed that Employment Cost Index rose more than expected in Q1 and provided a boost to the USD.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar gathers strength following the strong wage inflation data, forcing the pair to stay on the back foot.

Gold extends daily slide toward $2,300 after US data

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.