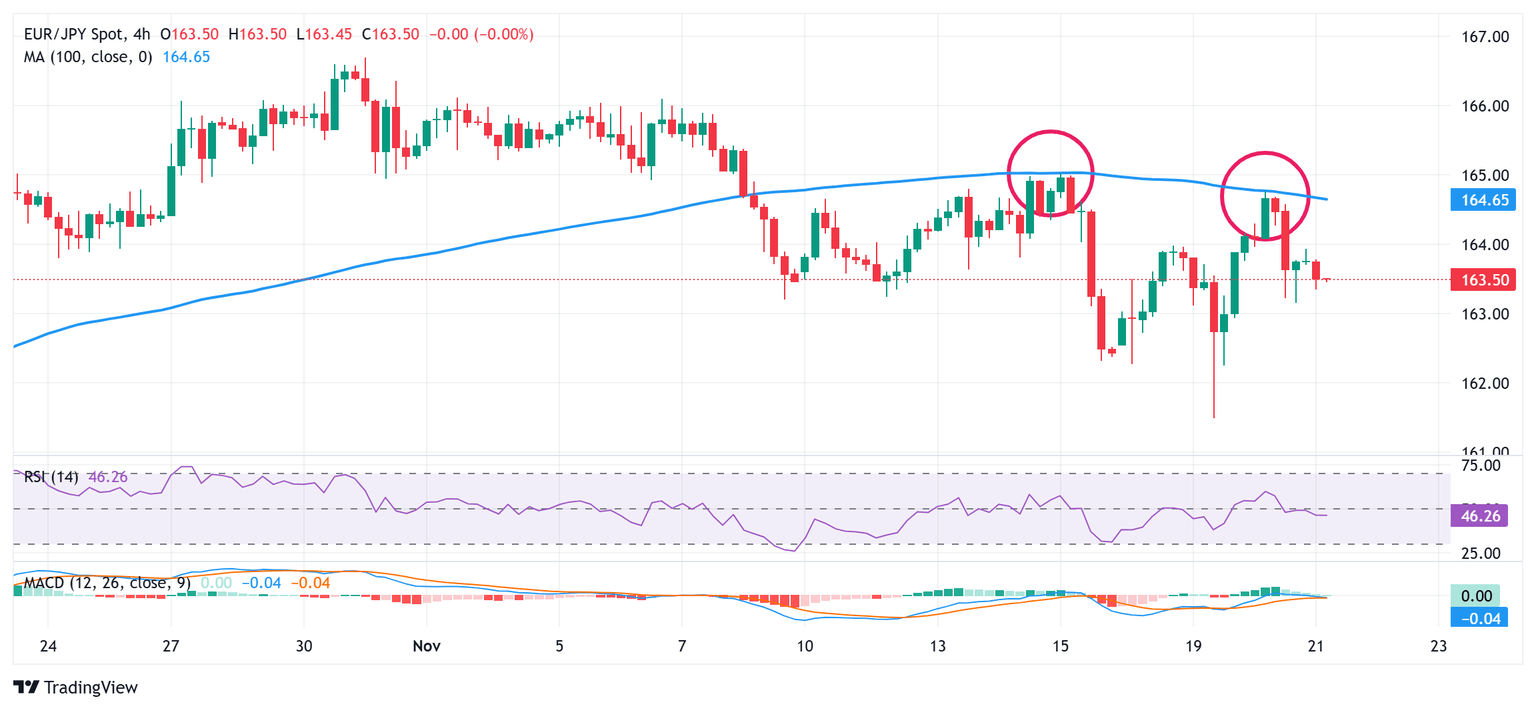

EUR/JPY Price Forecast: Bears have the upper hand while below 200-period SMA on H4/164.00

- EUR/JPY once again faces rejection near the 200-period SMA on the 4-hour chart.

- A combination of factors underpins the JPY and exerts some pressure on the cross.

- Bears might still wait for a break below the 163.00 mark before placing fresh bets.

The EUR/JPY cross meets with a fresh supply following the previous day's good two-way price swings and trades around the mid-163.00s during the Asian session on Thursday, down 0.20% for the day.

Against the backdrop of intervention fears and geopolitical uncertainties, hopes that Bank of Japan (BoJ) Governor Kazuo Ueda might signal another interest rate hike as early as next month underpin the safe-haven Japanese Yen (JPY). This, in turn, is seen as a key factor exerting some pressure on the EUR/JPY cross. That said, an uptick in the shared currency, bolstered by subdued US Dollar (USD) price action, limits losses for the currency pair.

From a technical perspective, the recent repeated failures near the 200-period Simple Moving Average (SMA) on the 4-hour chart favor bearish traders. Moreover, oscillators on the daily chart have just started gaining negative traction and suggest that the path of least resistance for the EUR/JPY cross is to the downside. That said, any further slide might continue to find support ahead of the 163.00 mark and the 162.50-162.40 horizontal zone.

Some follow-through selling might expose the weekly trough, around the 161.50-161.45 region, or the lowest level since October 4 touched on Tuesday, with some intermediate support near the 162.00 round figure. The downward trajectory could extend further and drag the EUR/JPY cross to the 161.00 round figure en route to intermediate support near the 160.55 area and the 160.00 psychological mark.

On the flip side, the 164.00 mark now seems to act as an immediate hurdle ahead of the 200-period SMA, currently pegged near the 164.70 region. A convincing breakout through the said barrier, leading to a subsequent move beyond the 165.00 psychological mark, will be seen as a key trigger for bullish traders. The EUR/JPY cross might then accelerate the positive momentum towards the 165.40 area and then aim to reclaim the 166.00 round figure.

EUR/JPY 4-hour chart

Economic Indicator

BoJ Governor Ueda speech

Kazuo Ueda is the Governor of the Bank of Japan, he replaced Haruhiko Kuroda on April 2023. Before being appointed, Ueda was an economics professor at the University of Tokyo and held a PhD from the Massachusetts Institute of Technology. Mr. Ueda is the first academic economist to run the bank in post-war Japan, breaking with the tradition that the governor is drawn from the BoJ or finance ministry.

Read more.Next release: Thu Nov 21, 2024 05:10

Frequency: Irregular

Consensus: -

Previous: -

Source: Bank of Japan

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.