EUR/JPY Price Analysis: Risk of recovery after deep sell-off

- EUR/JPY finds a floor after its steep sell-off.

- The pair forms a Dragonfly Doji and recovers – a bullish close on Friday would add confidence to bulls.

- Once the pull back is complete, however, the medium-term downtrend is likely to resume.

EUR/JPY is at risk of recovering after the steep sell-off of the last two weeks has stalled. The EUR/JPY pair reached a low of 164.83 on Thursday – well below its July 11 peak of 175.43. Since then it has been edging higher as the pair recovers from oversold extremes.

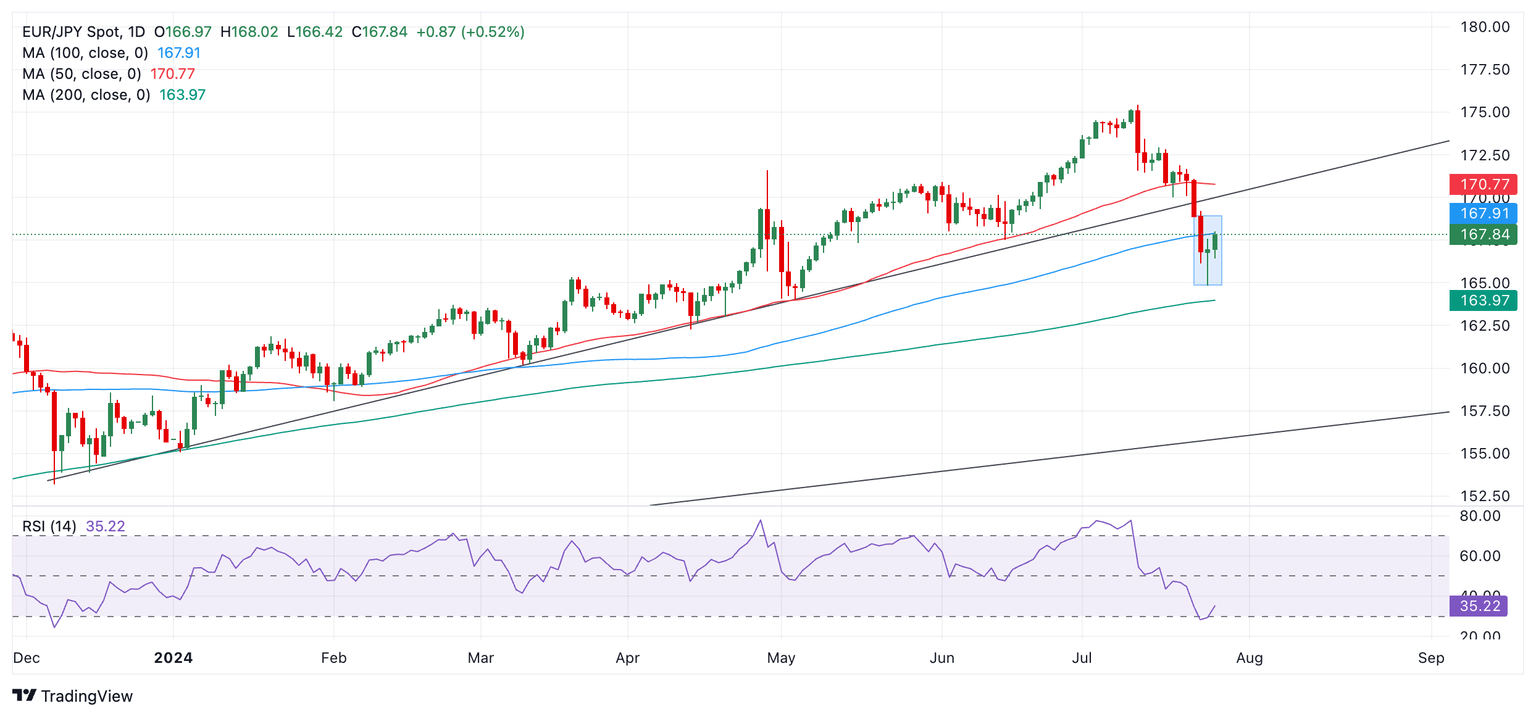

EUR/JPY Daily Chart

The pair formed a bullish Dragonfly Doji reversal candlestick on Thursday (blue shaded rectangle on chart above) and if it is followed up by a bullish close on Friday it will suggest a correction higher is underway.

Additionally, the Relative Strength Index (RSI) entered oversold territory (below 30) on Thursday and if it manages to move back above the oversold zone on Friday it will be a signal that price will probably go higher.

If the pair does recover, however, it is likely to be corrective and eventually run out of steam. This is because both the short and medium-term trends are now probably bearish, which given the old saying “the trend is your friend” suggests the bias is to the downside.

Once the recovery runs out of energy, price will probably resume its downtrend. The next support level to look out for is the 200-day Simple Moving Average (SMA) at 163.97. A close below that might see EUR/JPY fall to major trendline support at around 157.50.

The longer-term trend remains intact, however, and there is a chance the pair could make a full recovery back up to the July 11 highs, and possibly go even higher. Whether this happens or not depends on how price action unfolds and how vigorous the recovery is.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.