EUR/GBP Price Forecast: Finds temporary support at the bottom of a range

- EUR/GBP has touched down on support from the bottom of a range.

- It is diverging with momentum and could be about to pull back.

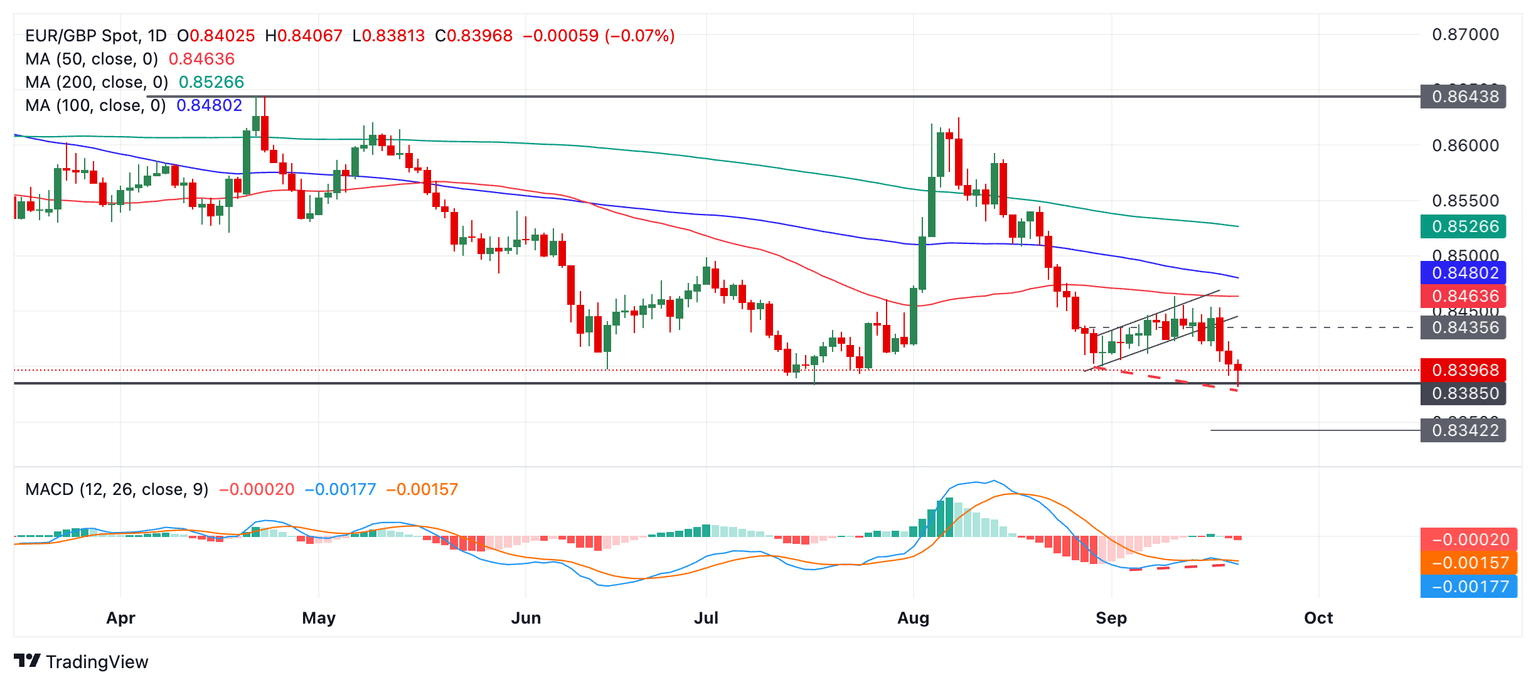

EUR/GBP has extended its break out of a rising channel and fallen to the major support level at 0.8385, which lies at the bottom of a broader range for the pair.

EUR/GBP Daily Chart

The trend is bearish both in the short and medium-term, and given the principle that “the trend is your friend,” this means the odds favor more downside. A close below 0.8380 would provide confirmation of a continuation lower to a probable target at 0.8342, the 61.8% Fibonacci extrapolation of the prior down move.

At the same time, bears should be cautious. There are growing signs the EUR/GBP might be bottoming.

Firstly, the pair has reached a solid level of historic support at the base of its range.

Secondly, the most recent move down over the last few days has been accompanied by relatively weak momentum. Price is now showing a bullish divergence with the Moving Average Convergence Divergence (MACD) momentum indicator (red dashed lines). This happens when the price falls to a new low, but the momentum does not match. This is so if the MACD level at the August 29 bottom is compared to the MACD at the September 20 bottom. The price has declined over time, but the MACD has not. The divergence is a sign a pullback higher might form.

Thirdly, EUR/GBP is forming a bullish hammer candlestick on September 20 (today) and this could also suggest a near-term reversal is in the offing, however, this is provisional and depends on the final level of the day’s close.

(This story was corrected on September 20 at 15:38 GMT to say that EUR/GBP price is diverging with momentum indicator, not converging.)

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.