EUR/GBP Price Analysis: Reaches downside target for range breakout

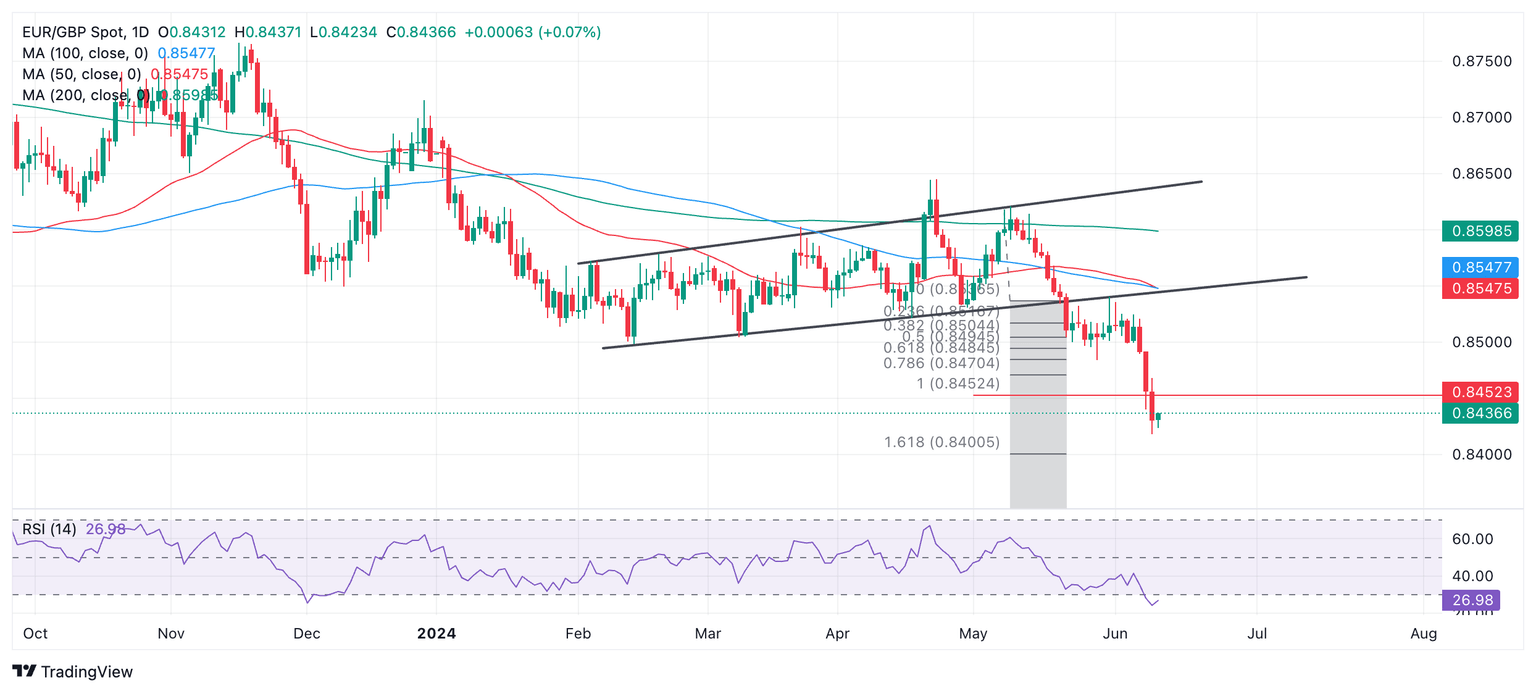

- EUR/GBP has hit the key downside target for its range breakout.

- The Relative Strength Index has fallen into the oversold zone.

- The technical picture suggests the pair is in a bearish trend but risks pulling back in the short-term.

EUR/GBP is in a downtrend with odds favoring a continuation lower whilst a heightened chance in the short-term the pair might pull back first.

EUR/GBP has broken out of a range and fallen to a key downside target based on the breakout. The achievement of the target suggests a risk that the pair may bottom out and rotate higher in a pullback.

EUR/GBP Daily Chart

The trend, both on a short, intermediate and long-term basis is bearish on balance, however, suggesting a continued risk of more downside once the pullback, if it evolves, completes.

Price has reached both the conservative and main target for the breakout from the range that evolved during 2024. The main target lies at 0.8452, the 100% extrapolation of the height of the range lower.

The Relative Strength Index (RSI) is oversold, suggesting the downtrend may be overstretched and that short-holders should not add to their positions. It also increases the probability of correction higher unfolding.

Given the dominant downtrend, the pair will probably resume its decline once any corrections complete. A break below 0.8418 (June 11 low) would create a lower low and probably result in a deeper sell-off, with 0.8400 coming in as the next target, followed by 0.8340 (August 2022 low).

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.