EUR/GBP Price Analysis: Monthly bullish swing-trade target, 0.9250

- Bulls rubbing hands together with 4HR MACD positive above zero and the price well above the 4-hour 21 EMA.

- The monthly chart offers a firm bullish swing trading setup opportunity to 0.9250.

This was a developing story

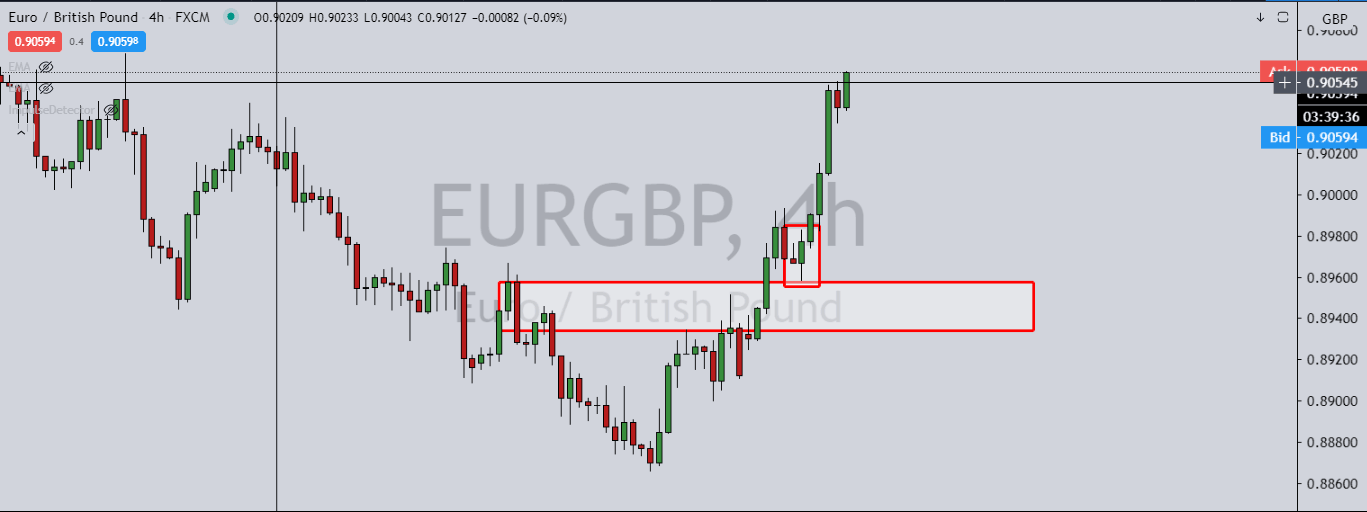

Having recently climbed out of a bearish channel, EUR/GBP is testing a resistance while in the bullish territory on the 4Hr charts.

The monthly chart offers a bullish scenario with the price now testing support and a confluence of the 61.8% Fibonacci retracement level.

The following is a thorough market structure analysis which favours a buy limit approach to a long swing trade to target 0.9250.

4HR bullish

Daily chart bullish

The daily chart offers a positive outlook on a restest of the channel and support structure.

Monthly chart bullish

Hourly chart bullish

As can be seen, the price is holding a support structure made up of a 50% mean reversion and prior resistance.

However, this could be a slow burner with some sideways drift until later in the week and a swing trade opportunity is preferable.

Swing trade setup

The 4HR chart is offering bullish conditions but the price is a little rich still while at resistance.

A pullback to the structure would offer a more favourable risk to reward ratio.

This story will evolve with the market's price action.

Price action update

Depending on your broker, the buy limit may never have been filled and the opportunity to catch a breakeven position possibly left the station before you could get on board:

However, that depends on the broker:

For the sake of argument, this swing trade entry has been missed and there are always plenty of opportunities each and every day.

Never get attached to a trade!

Next step: Never buy at resistance

Providing that the conditions are bullish, it would be prudent to wait for the next 38.2% Fibonacci retracement before buying.

Never buy at resistance and always buy low.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637351006410003161.png&w=1536&q=95)

-637351017391701783.png&w=1536&q=95)

-637351020294128574.png&w=1536&q=95)

-637351008652579989.png&w=1536&q=95)

-637351027125776007.png&w=1536&q=95)

-637351825676783919.png&w=1536&q=95)

-637351831368262393.png&w=1536&q=95)