- EUR/GBP consolidates recent gains despite printing mild gains on the D1.

- Corrective recovery can extend amid normal RSI conditions but lower high formation test bulls.

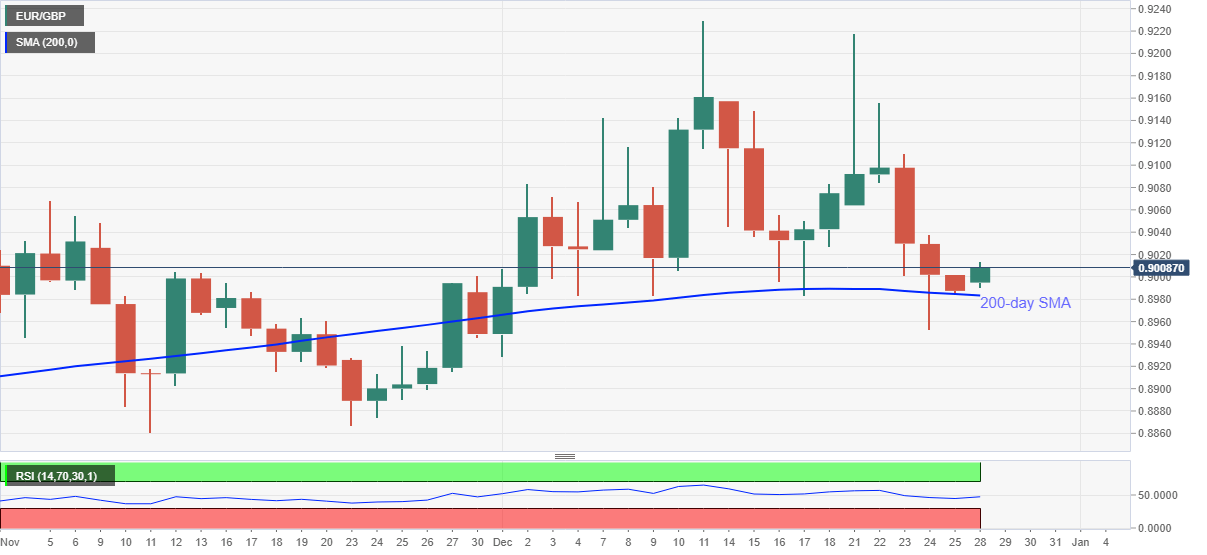

EUR/GBP wavers around 0.9000 ahead of Monday’s European session. In doing so, the quote eases from the intraday high of 0.9013 but keeps U-turn from 200-day SMA.

Considering the absence of overbought RSI conditions, coupled with the previous bounce off the key SMA, EUR/GBP is up for a fresh run-up targeting the 0.9100 threshold.

Though, lower high formation so far in the current month could challenge the buyers ahead of the 0.9200 round-figure.

It should, however, be noted that a sustained trading past-0.9200 enables the bulls to refresh the monthly top near 0.9230.

Alternatively, a downside break of 200-day, currently around 0.8983, offers the key support, for now, a break of which can direct EUR/GBP sellers toward the monthly low around 0.8930.

During the quote’s further weakness past-0.8930, the 0.8900 mark and November’s bottom near 0.8860 will be the key to watch.

EUR/GBP daily chart

Trend: Further recovery expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.