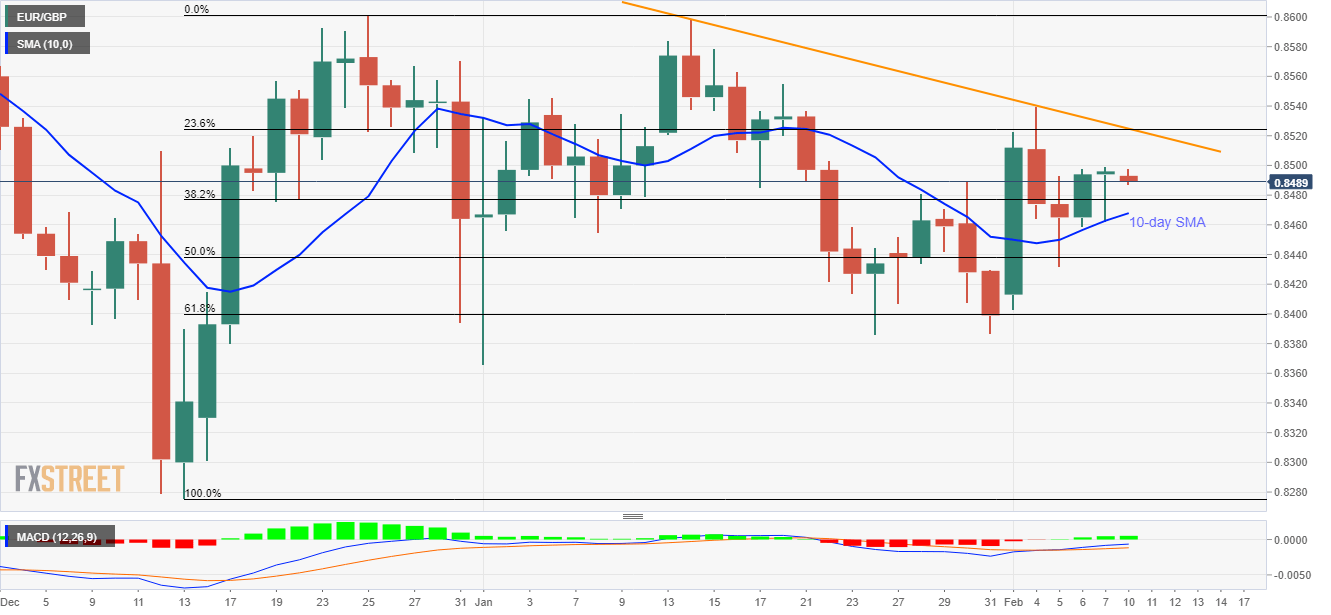

- EUR/GBP stays below 0.8500 for fourth-day in a row.

- A falling trend line since January 14 adds to the resistance.

- 50% and 61.8% of Fibonacci retracements could challenge sellers amid bullish MACD.

EUR/GBP registers another pullback from 0.8500 during the pre-Europe session on Monday. That said, the quote currently declines to 0.8490 with 38.2% Fibonacci retracement of December 2019 upside on the sellers’ radar.

While bullish MACD signals fewer chances of the pair’s further weakness, 10-day SMA around 0.8465 adds to the support below 38.2% Fibonacci retracement level of 0.8477.

In a case where the quote slips beneath 0.8465 on a daily closing basis, 61.8% Fibonacci retracement near 0.8400 and multiple bottoms near 0.8390/85 will be the keys to watch for sellers.

On the flip side, the pair’s successful rise above 0.8400 will push the buyers to confront a confluence of monthly falling trend line and 23.6% Fibonacci retracement close to 0.8525.

Additionally, 0.8540 holds the gate for the pair’s run-up beyond 0.8525 towards 0.8600.

EUR/GBP daily chart

Trend: Sideways

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.