EUR/GBP hobbled by European election turmoil, but soft UK labor limits losses

- EUR/GBP tumbles to its lowest bids in nine months as EU elections shake Euro.

- Sterling bidders Looking ahead to UK GDP after weak-kneed UK labor print.

- Flurry of ECB speeches expected throughout the week.

EUR/GBP shed weight on Tuesday, extending recent losses and falling a third of a percent as turbulent EU Parliamentary elections destabilize European markets. UK labor data disappointed with an upswing in unemployment claims, and Sterling traders will be looking ahead to Wednesday’s UK Gross Domestic Product (GDP) update.

An upswing in support for center-right to far-right political parties during the European Parliamentary elections has jostled market stability in Europe this week. France has called for a snap election after a large shift in the key European country’s voting base as French President Macron sees his support evaporate among voters. France will return to the voting polls in a two-round election to select a new government on June 30 and July 7.

The European Central Bank (ECB) recently delivered a much-anticipated rate cut, but policymakers are broadly cautioning that a follow-up rate cut may not be on the cards unless economic data deteriorates further. A slew of mid-tier appearances from ECB heads are due throughout the week.

UK labor figures broadly missed the mark on Tuesday, with an unexpected uptick in the 3-month ILO Unemployment Rate to 4.4% in April versus the forecast hold at 4.3%. May’s Claimant Count Change also surged to 50.4K versus the expected 10.2K, while the previous month saw a slight revision to 8.4K. A surge of 50.4K new unemployment claims represents the worst MoM upswing in unemployment benefits seekers since March of 2021.

GBP traders will be looking ahead to Wednesday’s UK GDP print, which is forecast to hold at 0.0% MoM compared to the previous 0.4%.

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Wed Jun 12, 2024 06:00

Frequency: Monthly

Consensus: 0%

Previous: 0.4%

Source: Office for National Statistics

EUR/GBP technical outlook

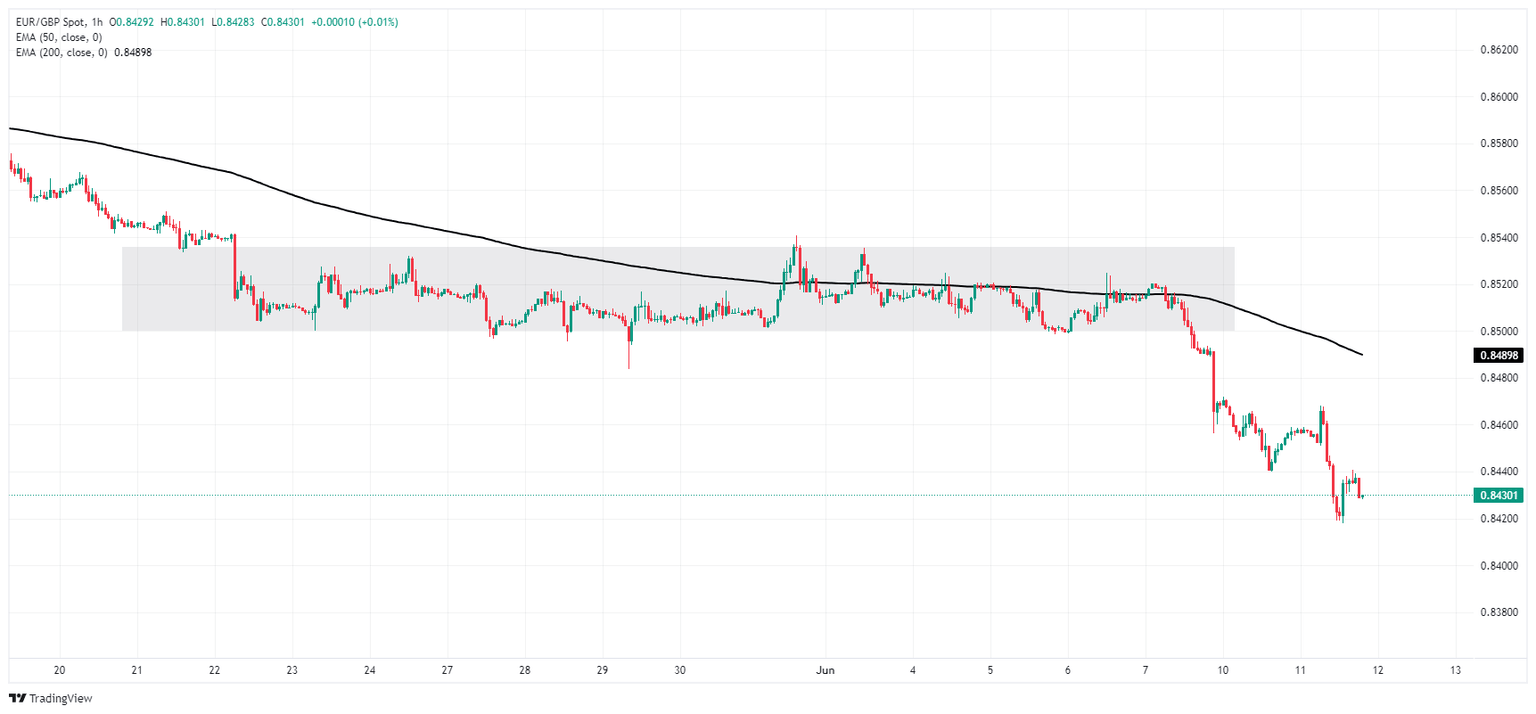

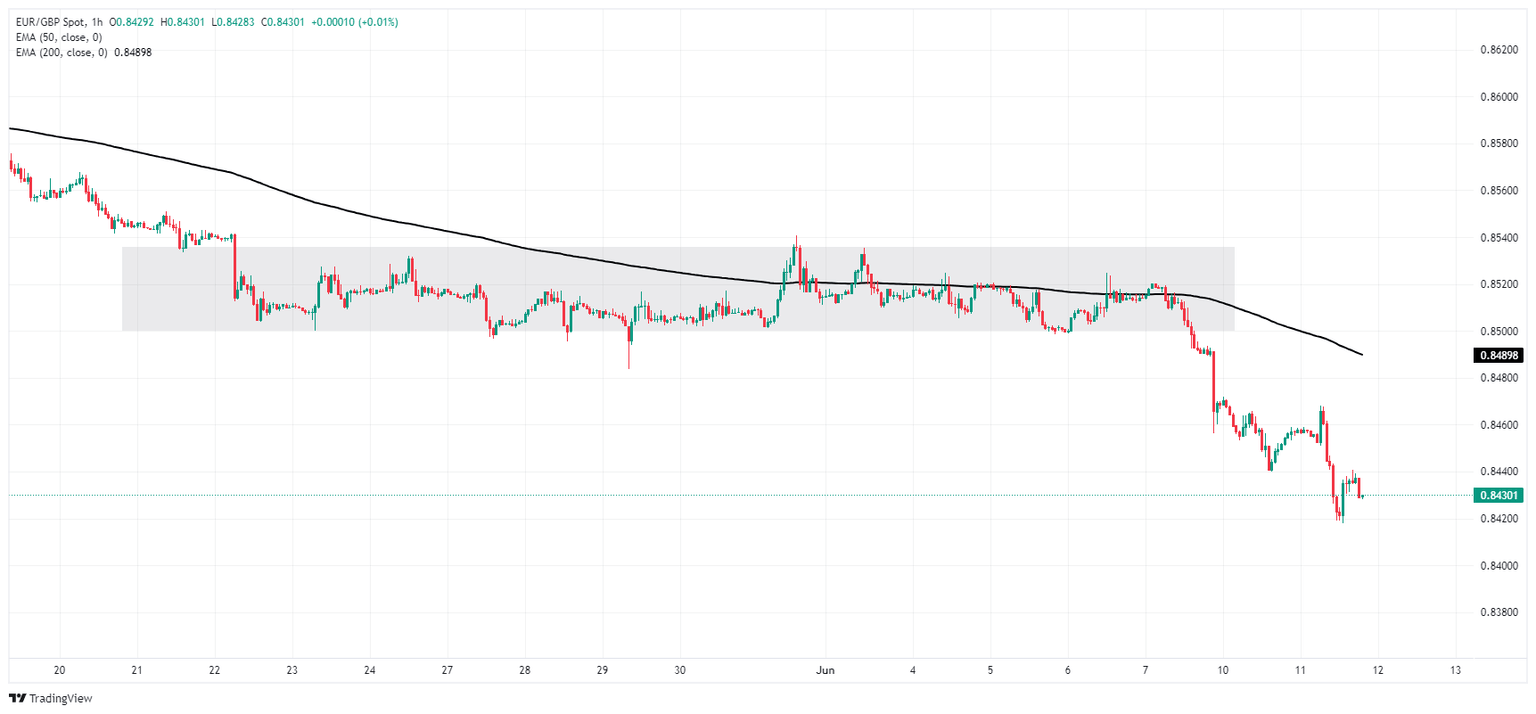

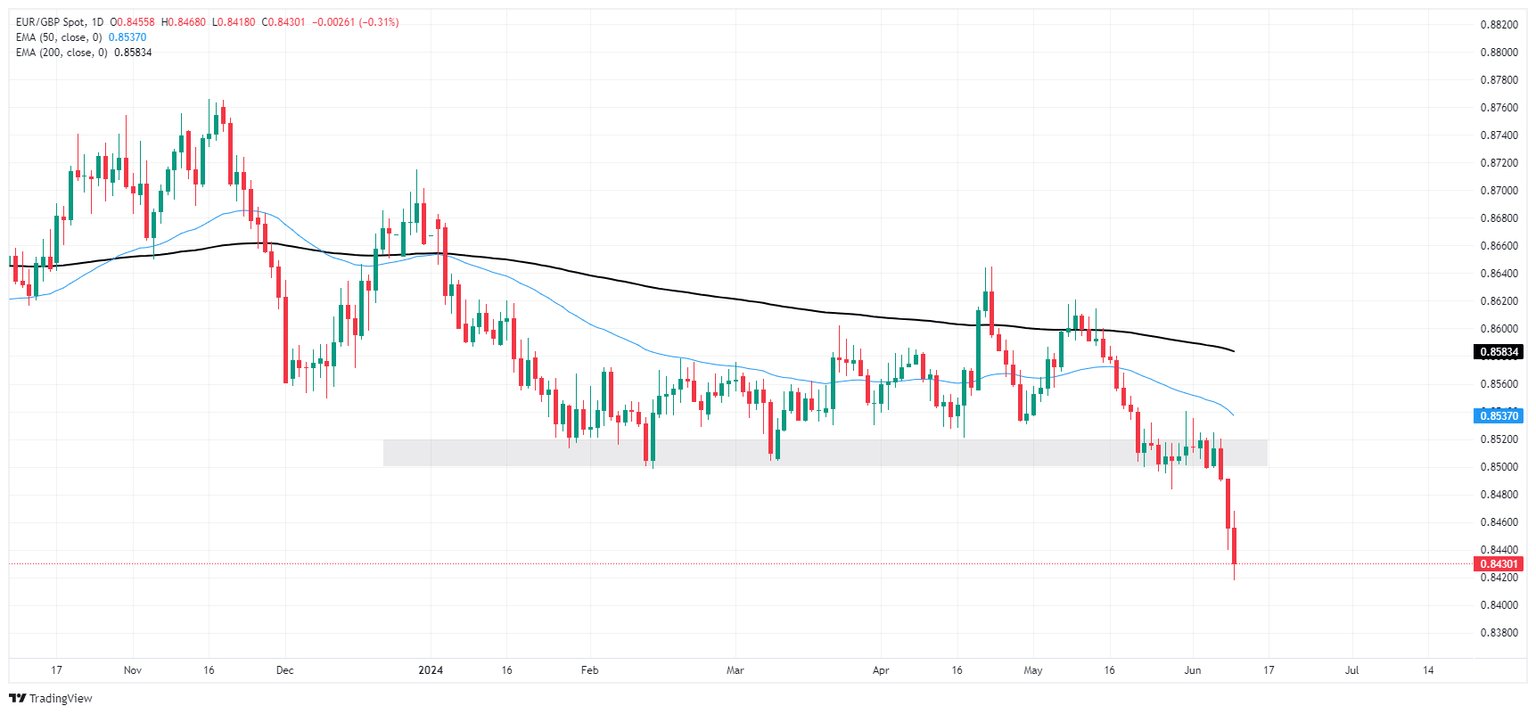

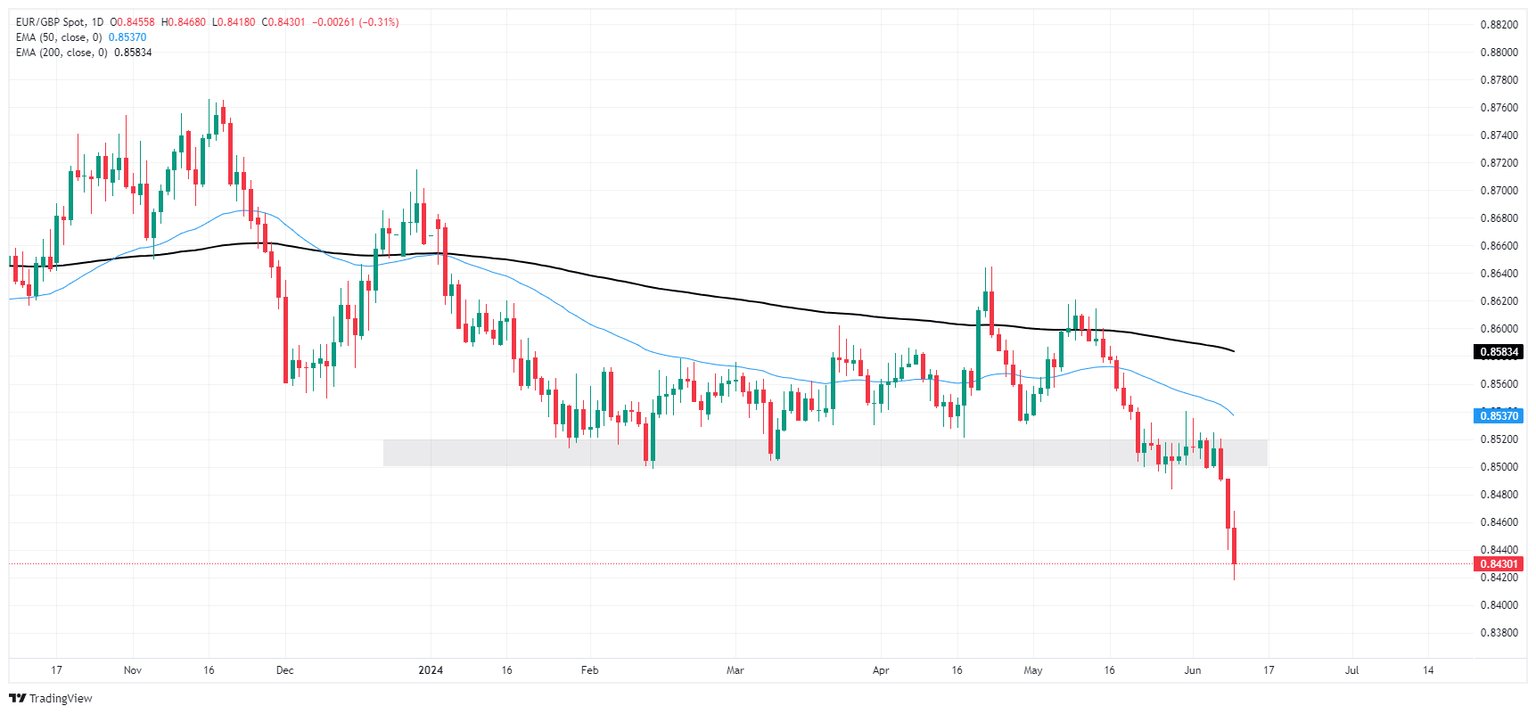

EUR/GBP has fallen out of recent consolidation to test multi-month lows as the Euro swoons against the Sterling. The pair tumbled to 0.8420 before finding the brakes, but bullish recovery remains limited as EUR/GBP wrestling with price action below 0.8460.

Tuesday’s declines are just a capstone on recent bearish pressure pushing the pair lower. EUR/GBP has closed flat or down for four straight weeks, and is firmly on pace to chalk in a fifth. The 200-day Exponential Moving Average (EMA) is turning bearish from 0.8617, and any bullish recoveries will run aground of familiar technical consolidation levels above the 0.8500 handle.

EUR/GBP hourly chart

EUR/GBP daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.