EUR/GBP edges lower on contrasting growth prospects

- EUR/GBP falls after Eurozone growth is expected to slow in 2024 whilst UK growth revised up.

- ECB concludes its March policy meeting and in the UK the Chancellor delivers the spring budget.

- The technical outlook is bearish but with important caveats.

The Euro (EUR) is down over a tenth of a percent, trading in the 0.8540s against the Pound Sterling (GBP) on Thursday, on the back of diverging growth forecasts for the Eurozone and UK economy.

EUR/GBP slides on diverging growth stories

In Frankfurt, the European Central Bank (ECB) concluded its March policy meeting and announced its decision to keep interest rates unchanged. The ECB staff projections, however, indicated lower growth and inflation going forward, with the growth rate projected to average 0.6% for the region in 2024, and inflation 2.3%. This was below the 0.8% and 2.7% respectively of the ECB’s previous forecasts.

Across the channel in Britain, the UK’s Chancellor of the Exchequer, Jeremy Hunt, was sounding more optimistic, however. In his spring budget, presented to the House of Commons, Hunt estimated the UK economy growing by 0.8% in 2024 – stronger than the 0.7% forecast by the Office for Budget Responsibility (OBR) in November. Whilst Hunt may not be an independent source the forecast revision may still have bolstered GBP in the short-term.

The outcome appears to have been a slight depreciation of the Euro against the Pound as reflected in the EUR/GBP exchange rate.

Technical Analysis: Possible Inverse Head and Shoulders

The long-term technical outlook for the pair is sideways with a slight bearish bias in the intermediate and short-term.

At the same time, there are some signs on the daily chart indicating that the pair has the potential to reverse the bearish trend and recover. It is too early to say for sure, however, and confirmation from price action first would be required to alter the bearish outlook.

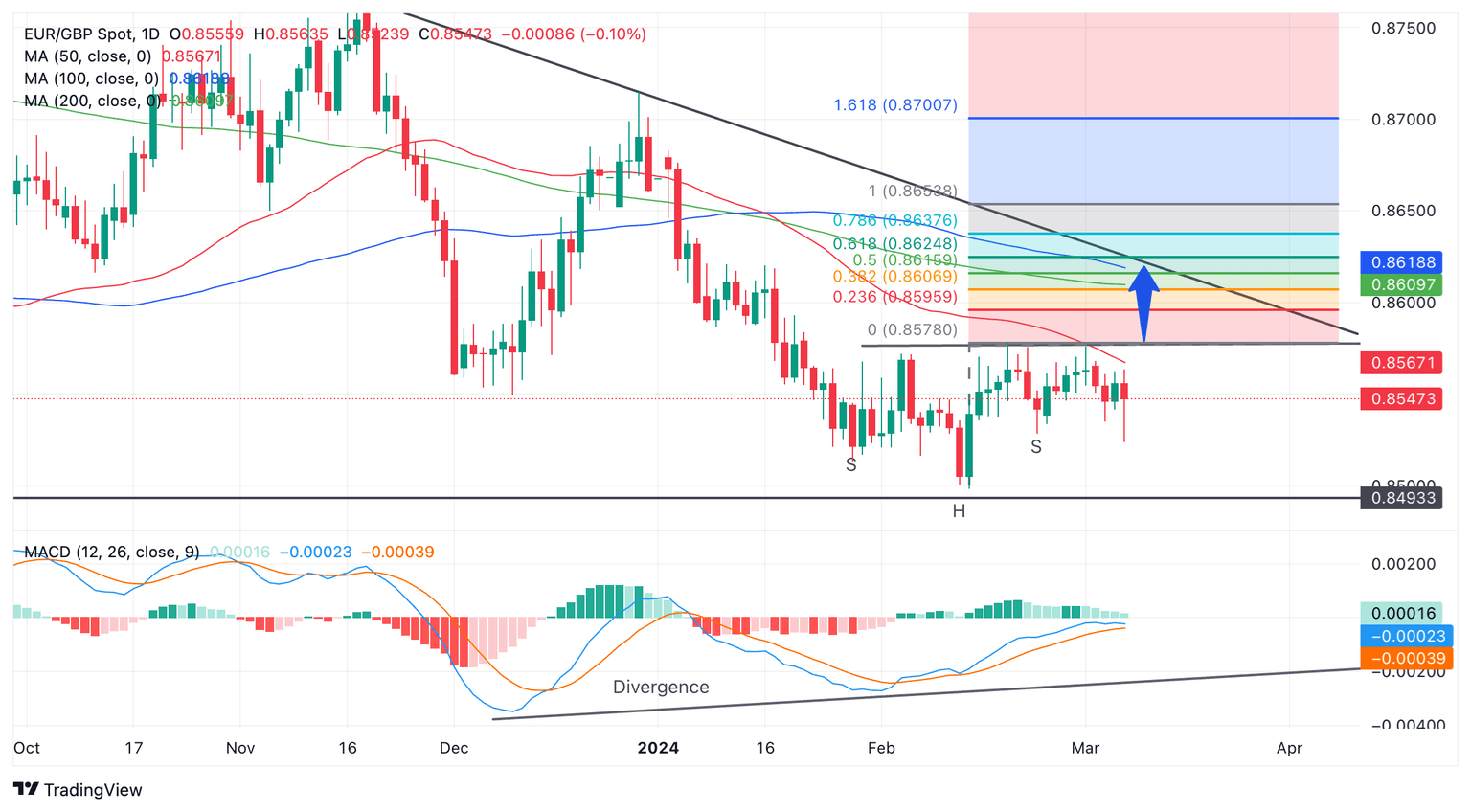

Euro vs Pound Sterling: Daily chart

The first hint is that the Moving Average Convergence/ Divergence (MACD) is converging bullishly with price action, suggesting the possibility of a recovery on the horizon.

Price made a lower low in February compared to December 2023, but the MACD failed to reflect this and made a higher low on the second trough in February instead. This nonconfirmation and convergence between the indicator and the exchange rate is a bullish sign.

Another bullish sign is that EUR/GBP may have formed a bottoming pattern called an Inverse Head and Shoulders (H&S) in January and February. This could be a sign the market may be reversing on the intermediate time frame.

If an inverse H&S is forming then it will break higher if price confirms the pattern by pushing above what is known as “the neckline”. The neckline is drawn as a resistance line at the highs. On EUR/GBP this is at 0.8750.

A break above the neckline could be followed by a rise of either the same length as the height of the pattern extrapolated higher, or a Fibonacci 61.8%.

Given the confluence of resistance from the 100 and 200-day Simple Moving Averages (SMA) at around 0.8615, as well as resistance from the trendline nearby, this zone provides a potential conservative estimate for the pattern, although it may well go higher if accompanied by a major shift in fundamentals.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.