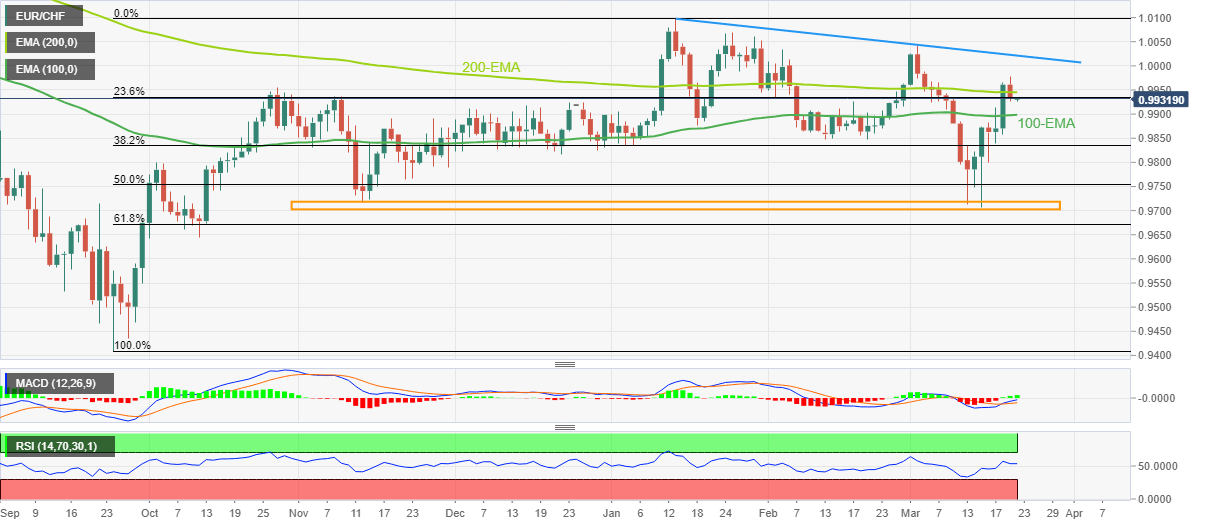

EUR/CHF Price Analysis: Drops back below 200-EMA with eyes on 0.9900

- EUR/CHF keeps the previous day’s pullback from 13-day high, stays pressured of late.

- Failure to stay beyond key EMA joins unimpressive oscillators to favor bears.

- 100-EMA appears immediate support; 4.5-month-old horizontal suppot is the key barrier for sellers.

EUR/CHF holds lower ground near 0.9930 during a sluggish Asian session on early Wednesday, following a pullback from the two-week high the previous day.

The exotic pair rose to the highest levels in more than two weeks the previous day before reversing from 0.9978 as it failed to extend the 200-day Exponential Moving Average (EMA). The reason could be linked to the unimpressive RSI and MACD signals.

With the failure to stay beyond the 200-EMA and lackluster oscillators, namely the RSI (14) and MACD, EUR/CHF is likely to decline further, which in turn highlights the 100-EMA support of 0.9900 as the immediate attraction for the pair sellers.

Following that, the 38.2% and 50% Fibonacci retracement level of the pair’s up-move from September 2022 to January 2023, respectively near 0.9835 and 0.9755, will be in focus.

It’s worth noting, however, that a broad support zone comprising multiple lows marked since the mid-November 2022, between 0.9705 and 0.9720, appears a tough nut to crack for the EUR/CHF bears to break.

On the flip side, a successful break of the 200-EMA becomes necessary for the EUR/CHF bulls to keep the reins.

Even so, the 1.0000 psychological magnet and a downward-sloping resistance line from late January, close to 1.0022 by the press time, becomes crucial to challenge the upside moves.

EUR/CHF: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.