EUR/CHF drifting into 0.9480 ahead of ECB rate call

- The EUR/CHF is grinding higher heading into Thursday, in play around 0.9475.

- Swiss business sentiment worsened, helping to keep the Euro in play above 0.9450.

- Up Next: ECB rate call, Monetary Policy Statement.

The EUR/CHF is floating into the top side heading into Thursday trading, and the pair caught a brief lift into 0.9490 before falling back into Wednesday's range, and the pair now gears up for another showing from the European Central Bank (ECB).

Swiss business confidence is declining according to the ZEW Expectations Survey for October, which worsened from -27.6 to -37.8.

Economic conditions continue to deteriorate across the European continent, and Euro (EUR) traders are gearing up for another showing from the ECB on Thursday, which will be dropping their latest rate call and Monetary Policy Statement during the European market session.

The ECB is broadly expected to keep rates steady where they are for the time being, but as ECB President Christine Lagarde noted recently during a television interview in Greece, the fight against inflation isn't over yet, but President Lagarde and the other policymakers at the ECB remains confident they will see inflation return to 2%i at some point in the future.

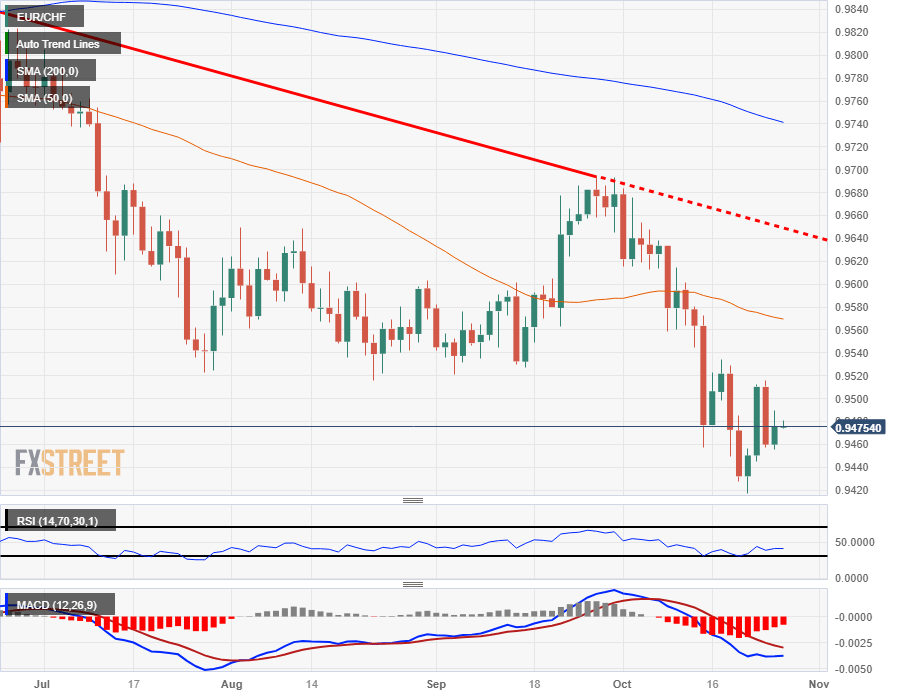

EUR/CHF Technical Outlook

Despite Wednesday's mild rebound, the Euro remains firmly planted in bear country against the Swiss Franc, with the pair caught near yearly lows currently marked in at 0.9420. A resistance zone from 0.9520 to 0.9600 will complicate matters for any bulls that try to jumpstart a trend reversal, and a break below last November's lows near 0.9409 will see the EUR/CHF making new all-time lows.

EUR/CHF Daily Chart

EUR/CHF Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.