Dow Jones Industrial Average sheds 300 points on Tuesday

- Dow Jones backslides as other indexes gain ground.

- DJIA gets dragged down by steep declines in large caps.

- US data softened slightly on Tuesday, but not enough to appease rate cut hopes.

The Dow Jones Industrial Average (DJIA) shed weight on Tuesday, declining around 300 points as heavy-hitters like Home Depot Inc. (HD) and Walmart Inc. (WMT) dragged the large-industry index into the red. US equities are gaining ground in a lop-sided index performance, with losses concentrated in key securities on the Dow Jones.

The CB Consumer Confidence survey index declined to 100.4 in June, down from the previous print of 102.0 but falling just short of the expected decline to 100.0. The Richmond Fed’s Manufacturing Index dropped sharply to -10.0 in June, far below the forecast increase to 2.0 from the previous 0.0.

Financial markets broadly hopeful for softly-weakening economic figures from the US will be pivoting to watch for US Durable Goods, Gross Domestic Product (GDP), and Personal Consumption Expenditure Price Index (PCE) inflation figures all slated for release in the back half of the trading week beginning on Thursday. Tuesday’s mid-tier releases weren’t enough to spark firm market flows in either direction.

According to the CME’s FedWatch Tool, rate markets continue to price in around 66% odds of at least a quarter-point rate cut from the Federal Reserve (Fed) in September. Rate-cut-hungry investors are running out of room to hope that a downturn in US economic figures will spark an early rate cut from the Federal Open Market Committee (FOMC), while a too-sharp drop in US economic activity could spark a broad risk-off flight into safe havens like the US Dollar. On the other hand, a resurgence in US economic activity would likewise spoil investor sentiment, as rate cut hopes hinge on a slow trudge into a soft-landing recession within the US’ domestic economy.

Dow Jones news

The Dow Jones is getting dragged lower by downside in key securities on Tuesday. The DJIA is broadly in the red for the day, with only a third of the index’s securities in the green, but steep losses are concentrated in key stocks. Home Depot Inc. (HD) tumbled around 4% to $337.70 per share, followed by Walmart Inc. (WMT) which shed 2.78% and fell below $67.00 per share. Boeing Co. (BA) and Nike Inc. (NKE) were close behind, backsliding around 2.33% apiece to $53.35 and $95.11 per share, respectively.

Tuesday gainers remain notably thin, with Amazon.com Inc. (AMZN) and Apple Inc. (AAPL) climbing a little over 1% each. Amazon gained ground to $187.64 per share while Apple crossed above $210.00 per share after Monday’s decline below $208.00.

Dow Jones technical outlook

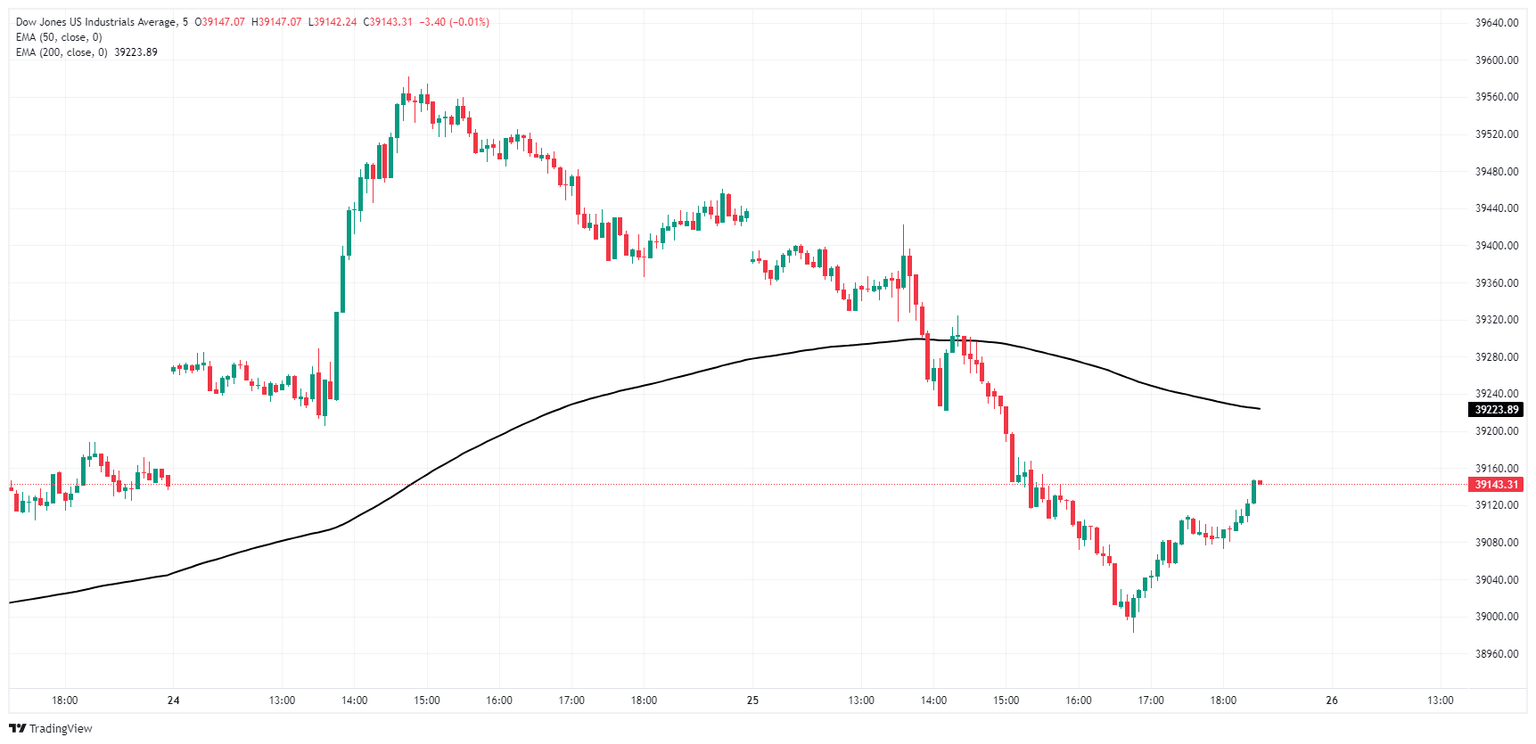

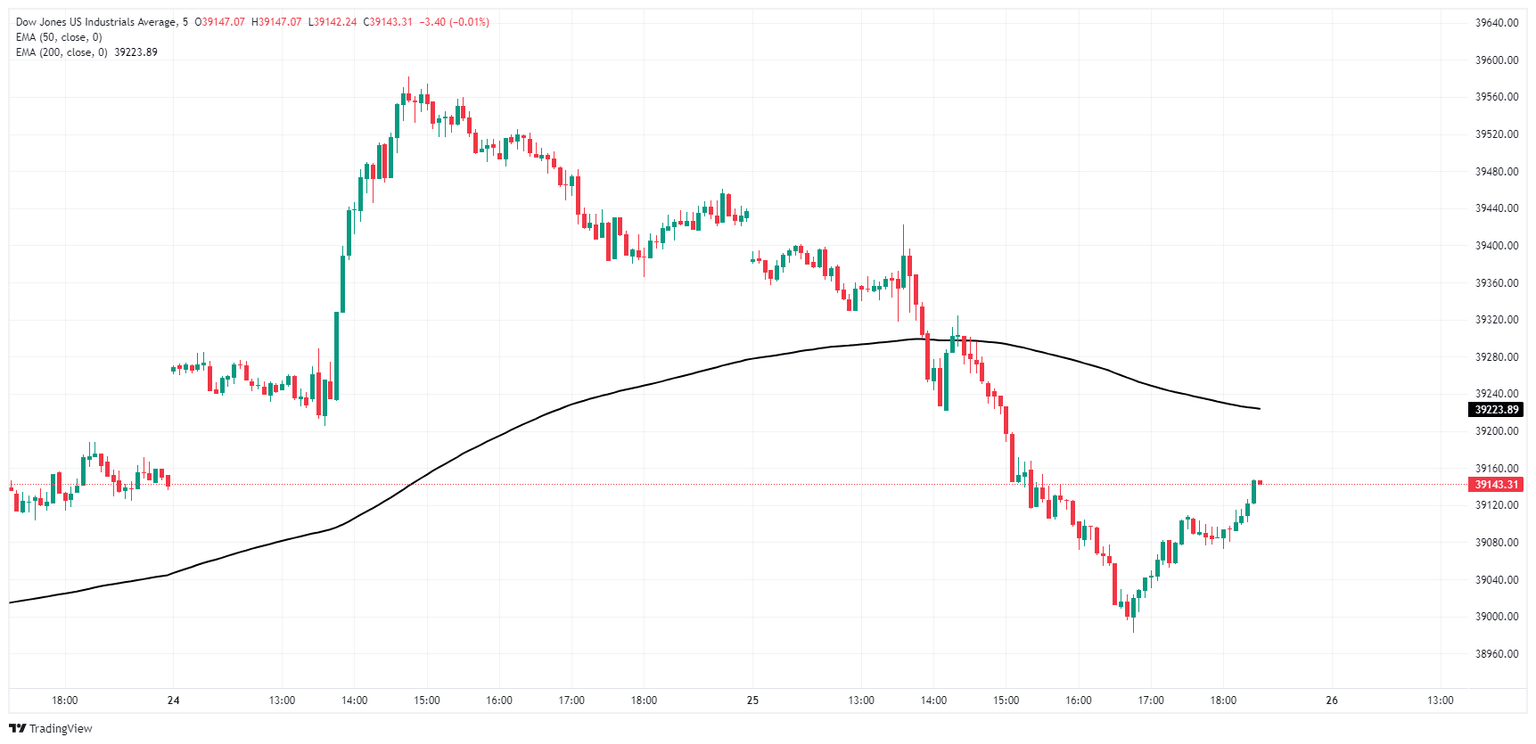

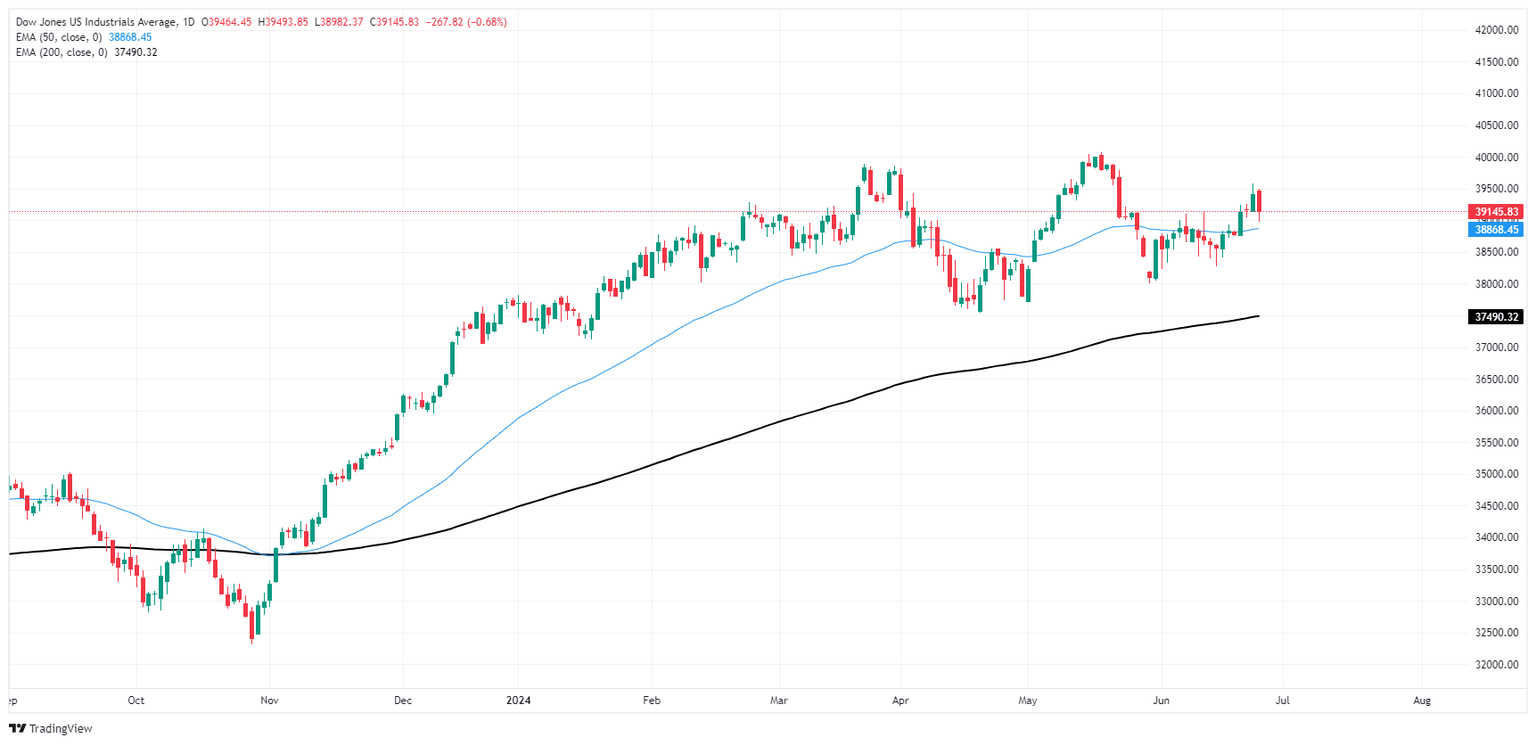

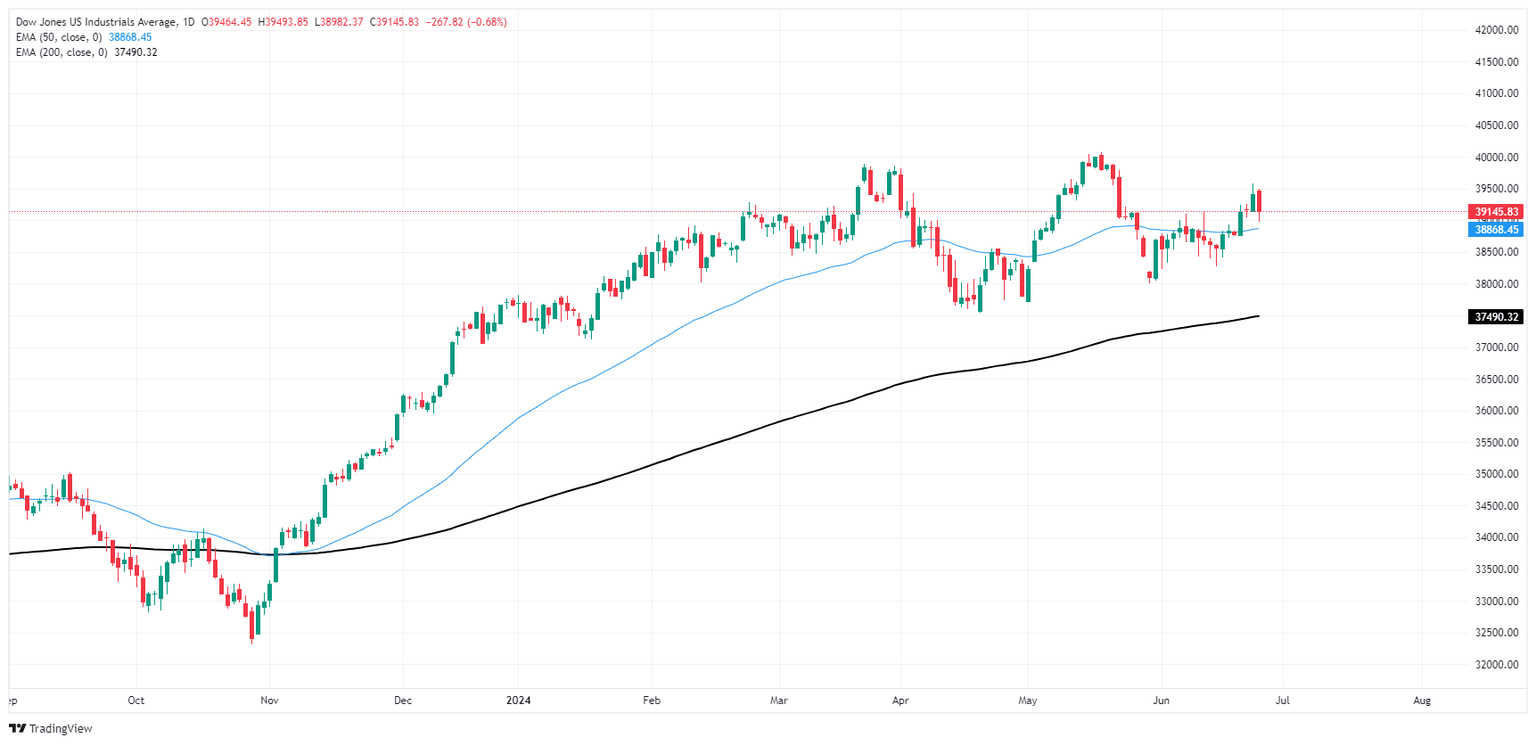

The Dow Jones is on pace to close firmly lower on Tuesday in the index’s worst single-day performance since late May as the index slumps three-quarters of one percent on the day. An intraday recovery is seeing limited effect, but is dragging Tuesday’s bids back up from the day’s bottom at 38,982.37.

Daily candlesticks continue to grind out chart paper just north of the 50-day Exponential Moving Average (EMA) at 38,864.49, with long-term technical support from the 200-day EMA at 37,455.71. Despite holding in bull country, the Dow Jones has struggled to make firm gains after a -5.15% backslide from all-time highs above 40,000.00 reached in mid-May.

Dow Jones five-minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.