Dow Jones Industrial Average ends Friday on the low side of 39,500, sheds 300 points on the day

- Dow Jones trims recent gains as US equities churn.

- DJIA eases back after failing to capture 39,900.00

- Markets hit a wide range heading into the Friday close.

The Dow Jones Industrial Average (DJIA) was forced into the low side around three-quarters a percent as US equities drifted in multiple directions on Friday. US markets are running the gamut to wrap up the trading week, with the DJIA testing down, the NASDAQ Composite lifting around a sixth of a percent on the day and the S&P 500 stumbling around a sixth of a percent on Friday.

Most of the US equity market’s major sectors were in the red on Friday, with Real Estate down around 1.25%, closely followed by the Financial Sector which fell 1.21%. The Communications Services Sector closed up around 0.85% as telecoms rebounded from recent selling pressure.

Dow Jones news

Nike Inc. (NKE) led the charge down the Dow Jones index, tumbling around 7% on Friday after reporting slowing sales in China, despite beating expectations on their top and bottom lines in their latest quarter. The day's top gained was Boeing Co. (BA), climbing six-tenths of a percent

Apple Inc. (AAPL) ended up around half a percent on the day as the stock recovers from recent selling. Investors pared back on exposure to Apple recently after it was announced that the US Department of Justice sued the company for anti-competitive practices and monopolization in the cellphone market with their iPhone products.

Investors will be pivoting to next Thursday’s US Gross Domestic Product (GDP) figures. US GDP growth in Q4 is expected to hold steady at 3.2%. Next Friday also brings the latest print of the Federal Reserve’s (Fed) preferred inflation metric, the Personal Consumption Expenditure (PCE) Price Index. Median market forecasts expect MoM Core PCE in February to tick down to 0.3% from the previous 0.4%.

Dow Jones Industrial Average technical outlook

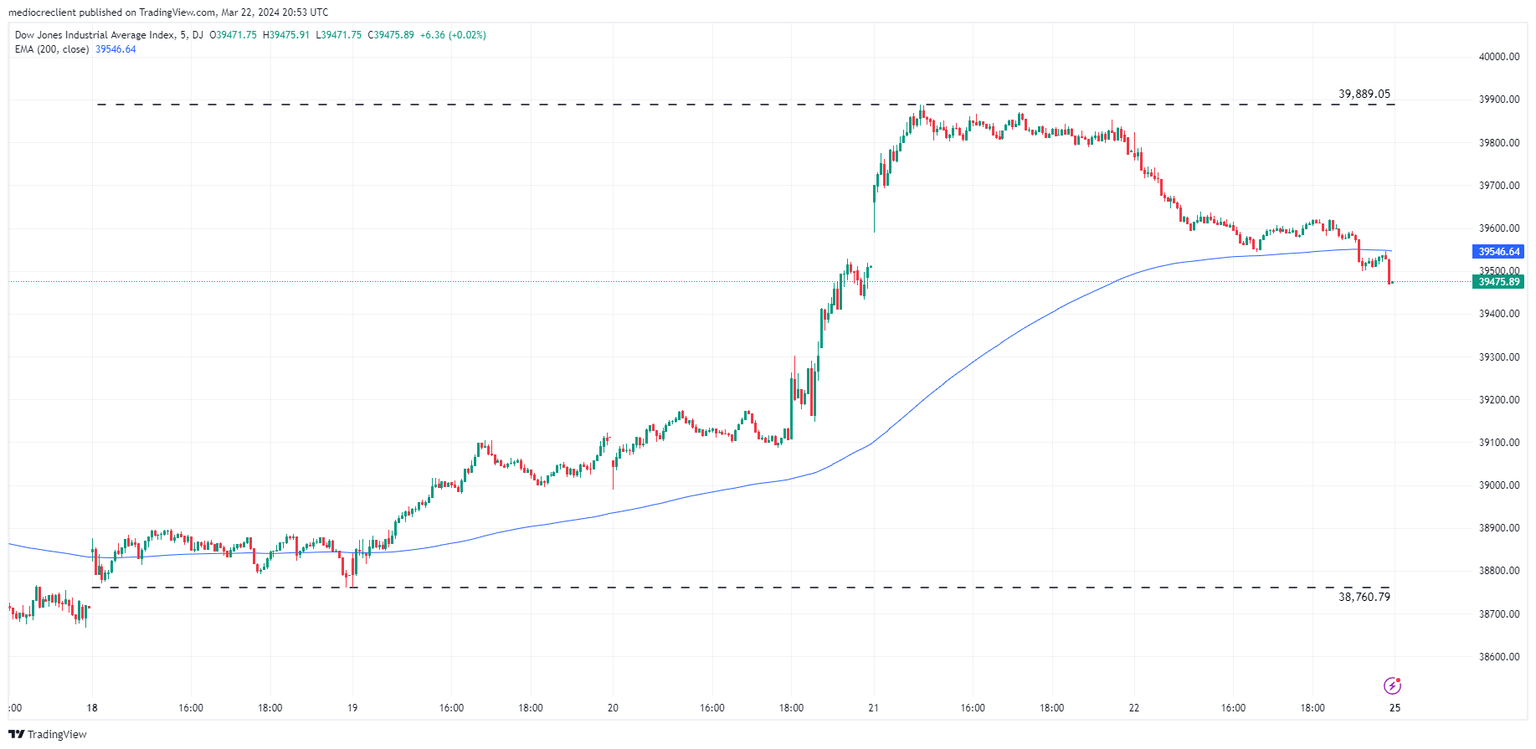

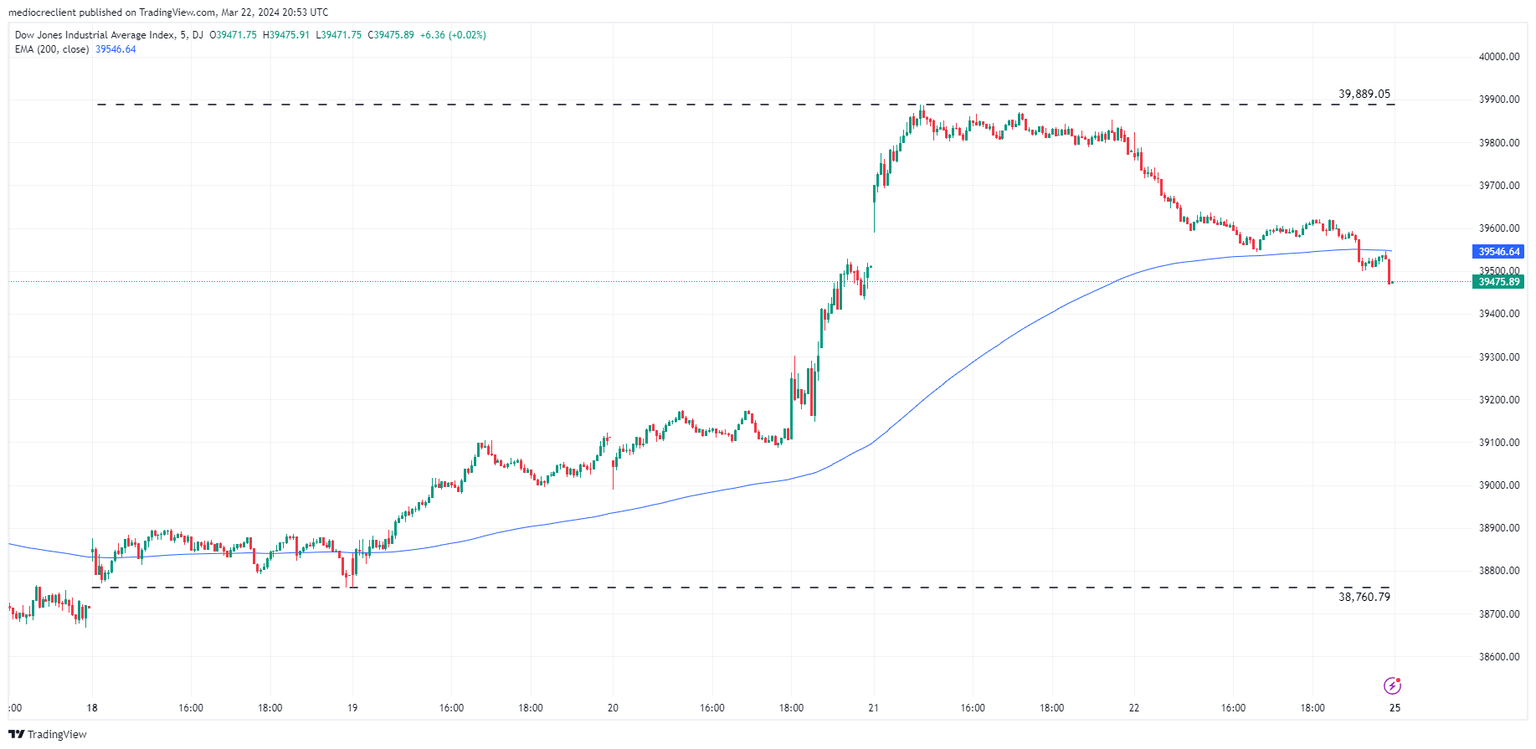

It’s been a stellar week for the Dow Jones, with the index climbing nearly 3% bottom-to-top from the week’s early low bids near 38,760.79. The index broke into new all-time highs twice in two days, etching in a fresh record peak at 39,889.05 before settling into a tight range near 39,600.00 ahead of Friday’s closing bell.

The DJIA is on pace to close in the green for a fifth consecutive month, and the index is up around 2.9% from the last swing low into 38,500.00. The Dow Jones is trading deep into bull country, with price action well above the 200-day Simple Moving Average (SMA) at 38,257.84.

Dow Jones Industrial Average 5-minute chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.