Crude Oil Futures: Potential correction lower

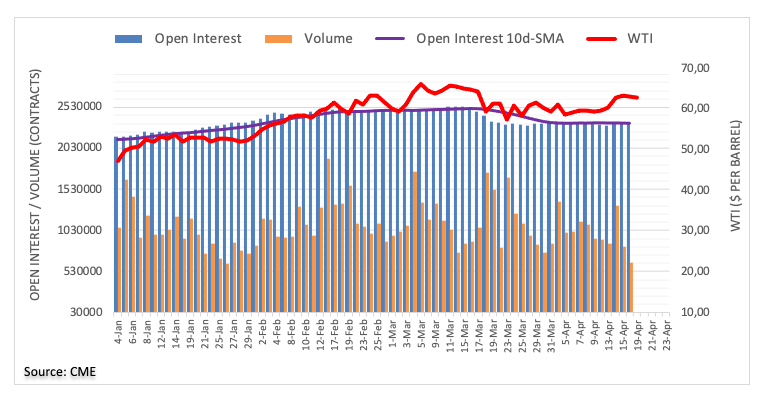

CME Group’s flash data for Crude Oil futures markets noted traders increased their open interest positions by around 3.8K contracts at the end of last week, partially reversing the previous pullback. Volume, instead, went down for the second session in a row, now by around 201.1K contracts.

WTI: Further upside targets the 2021 highs

While further correction in WTI prices is likely in the very near-term, the resumption of the uptrend is forecast to meet the next target at the YTD highs near the $68.00 mark per barrel (March 8). The $57.50 area, in the meantime, keeps acting as a strong contention on occasional bouts of weakness.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.