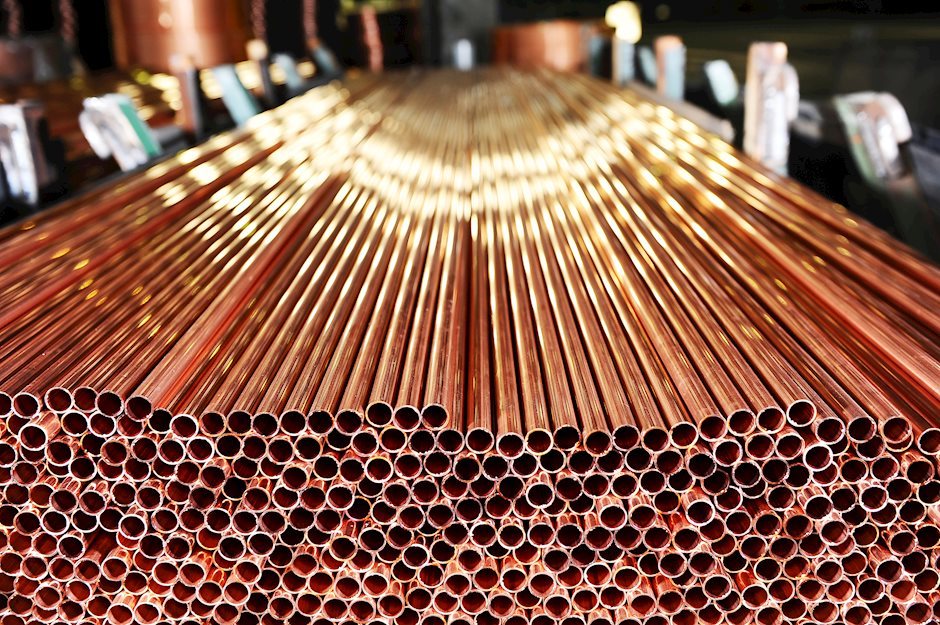

Copper prices struggling as Chinese demand continues to lag

- Copper down to $8,375 per ton, or $8.30 per kilogram.

- Copper has come under downside pressure throughout the year as demand remains weak.

- The market is struggling to increase copper demand as the Chinese economy risks stalling out.

Copper price per kilogram fell back to $8.30 on Monday after rising to a weekly high of $8.42 last Friday, and the red metal continues to struggle on the low end after the year’s rapid climb to $9.435 in January.

China’s beleaguered economic recovery has seen copper rangebound for the last quarter as prices struggles to gain traction. Chinese officials have spent significant time, effort, and resources trying to keep the Chinese economy in a successful ‘jumpstart’ state, but buyers have thus far remained largely unconvinced.

Copper down on Chinese weakness

Nearly a quarter of all Chinese copper demand comes from the construction and housing industries, with another fifth coming from consumer goods demand. Both sectors have been hammered recently, with a short-term crisis sprouting in the housing sector and waning consumer demand.

The fourth quarter is expected to bring further declines in Chinese demand growth, keeping copper prices pinned to the low end.

Chinese smelters and metal processors have posted some of their worst profitability in over ten years, driven by both a lack of domestic demand and export figures that have struggled to accelerate growth.

China is expected to resume providing stimulus programs that are targeted at bolstering domestic demand, but copper investors will be waiting for solid evidence that efforts from Chinese central planners have taken hold before stepping up prices meaningfully.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.