CCIV Stock News: Lucid Motors CCIV shares rebound as no jobs means no rate hikes

- CCIV shares close nearly 2% higher on Friday.

- CCIV gets a boost from yields and VIX dumping.

- CCIV shares follow meme and everything higher.

Update: CCIV shares closed out the week in the green on Friday as stock market turned bad news into good and rallied after a terrible jobs report. CCIV shares closed at $19.28 still short of the %20 psychological level. CCIV shares are also very close to the $15 PIPE level. Technically CCIV is still in bearish mode until it breaks $21.08, the short term moving average.

CCIV shares continue to retreat as the hype fizzes out of many retail meme stocks while the economy reopens. Traders are no longer confined to their rooms with screens and Robinhood to entertain them. The meme-stock universe is struggling to regain any sort of traction and with multiple ETFs suffering losses, redemptions cannot be too far away. This will put further pressure on the meme-stock segment.

CCIV is also getting close to the PIPE placement price of $15. Usually, SPAC PIPE transactions are done at $10, the issue price, but because CCIV was trading near $60 at the time of the Lucid Motors merger, the PIPE was done at the higher price of $15. Investors may not want to take a loss on what seemed a free bet and those still left with positions may cut at $15 if CCIV shares trade down there.

Stay up to speed with hot stocks' news!

Just a little recap for those of you not familiar with the story. Churchill Capital IV is a Michael Klein-backed SPAC that merged with Lucid Motors to take it public. Michael Klein is a former Citi rainmaker with myriad connections in the financial markets. Lucid Motors is an electric vehicle startup that is due to release its first EV in the second half of 2021. The company is headed by a former Tesla chief engineer, Peter Rawlinson.

CCIV shares fell victim to the retail frenzy in evidence at the start of 2021 and rallied to extraordinarily expensive levels of nearly $65. The frenzy was mainly down to retail traders, who viewed CCIV and Lucid Motors as the next Tesla. Retail traders have grown increasingly frustrated at the lack of access to IPO deals and have turned to SPAC deals as a means of getting involved in a company early, akin to an IPO.

CCIV stock forecast

CCIV shares are suffering a nonstop wave of selling as retail meme stocks suffer en masse. This will create problems for a lot of ETF's who have positions in a lot of names. ETF and fund redemptions will lead to further selling and create a self-sustaining move.

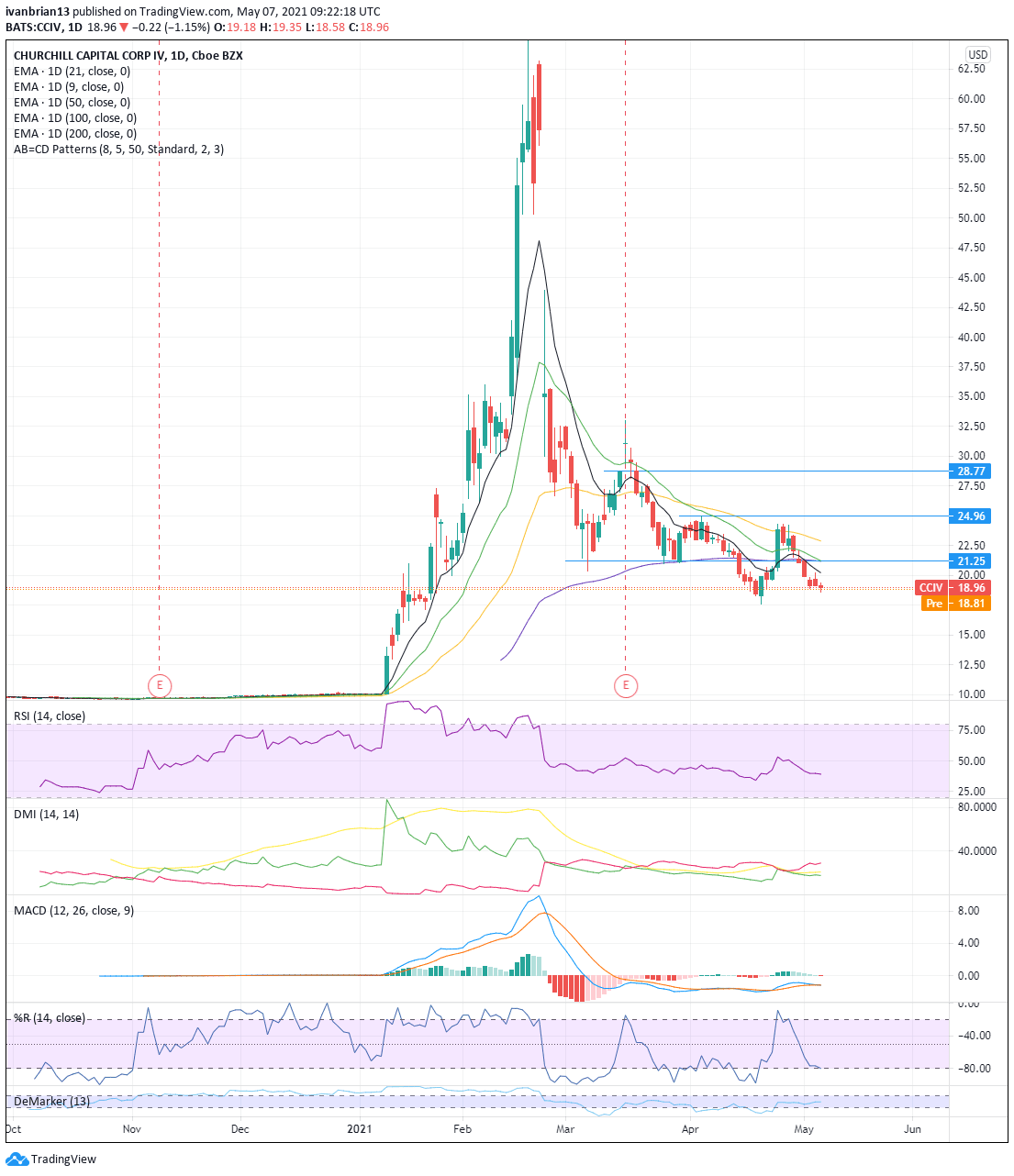

CCIV has one last major support left at $17.62, after that it is lookout below with the close from January 11 at $13.20 being the next target. The first major price spike happened on Jan 11 as we can see clearly from the chart below.

The chart is firmly in bearish territory. CCIV has broken major support at the 9 and 21-day moving averages. The SPAC has broken the range it had held since early March between $21.25 and $24.96. The Moving Average Convergence Divergence (MACD) is crossing into another bearish formation. The Direction Movement Index (DMI) is already bearish with the negative red line above the green positive line. Relative Strength Index (RSI) is neutral but is moving lower with price, confirming the trend.

All in all, it is hard to find anything positive here. A break of the 9-day moving average will change things and should bring a test of April 27 highs at $24.33. But given the trend, it may be better to initiate a short position using the 9-day moving average as an entry point, with a tight stop above on a break and a possible reversal into a long position on such a case. Those not wanting to be naked short can use put options to achieve the same effect.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.