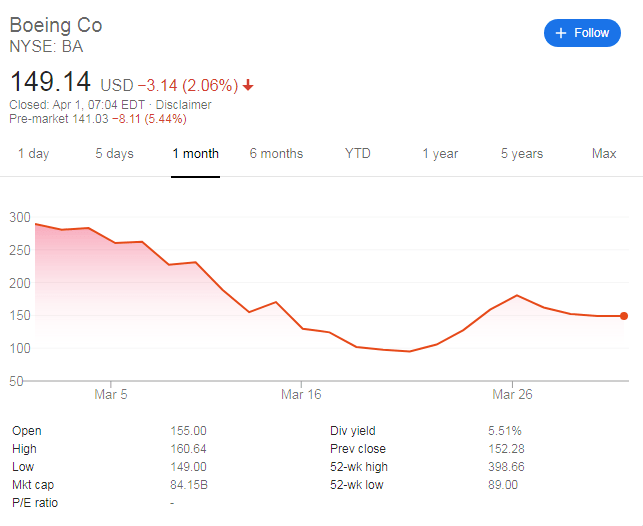

- Boeing has closed March below $150, significantly below the $180 recovery peak.

- The relative calm in broader markets has not been reflected in the planemaker's shares.

- Bailout by the government is on the cards amid the crisis.

Boeing has closed the turbulent month of March below $150 per share. The NYSE traded planemaker has been hit by the coronavirus crisis. Flights are grounded amid travel restrictions, and airlines are not keen to buy additional aircraft as the future remains highly uncertain.

The Chicago-based company has large factories around Seattle, the first cluster of Covid-19 cases in the US, and has also suffered from production issues as workers could not perform their jobs. The current crisis joined the Max 737 debacle that had dogged the firm earlier and caused a change in management.

However, Boeing's stock price recovered from the lows around $95. One reason was a broad recovery in equities amid liquidity injections from the Federal Reserve. Moreover, the firm may receive support from the government as part of the fiscal rescue package passed by Congress.

Boeing Stock Forecast

But now, the fresh fall is indicating that investors may be losing faith in a potential bailout. The share of the company led by Dave Calhoun has shed some 15% while the S&P index has seen ups and downs since then.

Boeing is a national champion – with competition coming only from Airbus, Europe's planemaker. It is hard to believe that Washington will let it fail, under whatever circumstance.

BA traded close to $300 in early March, when the crisis had already hit Asia and Europe. It may have room to rise from its lows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops to near 1.0850, further support at nine-day EMA

EUR/USD continues to lose ground, trading around 1.0860 during the Asian hours on Friday. From a technical perspective on a daily chart analysis indicates a sideways trend for the pair as it continues to lie within the symmetrical triangle.

GBP/USD posts modest gains above 1.2650, focus on the Fedspeak

The GBP/USD pair posts modest gains near 1.2670 during the Asian session on Friday. Meanwhile, the USD Index recovers some lost ground after retracing to multi-week lows near 104.00 in the previous session.

Gold price gains ground, with Fed speakers in focus

The Gold price trades with a positive bias on Friday. The bullish move of precious metals in the previous sessions was bolstered by the softer-than-expected US inflation data in April, which triggered hope for rate cuts from the US Fed.

XRP steadies at $0.51 as Ripple plans to expand XRP Ledger, custody services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US SEC and amid new commitments from the firm to expand its services in Africa.

Disputes and De-risking: US-China trade dispute changes trade flows

The bilateral trade dispute between the US and China is entering a new round and is leading to renewed discussions about the deglobalisation of global trade in goods.