BNGO Stock Forecast: BioNano Genomics Inc crashes by 15% over new shares issuance

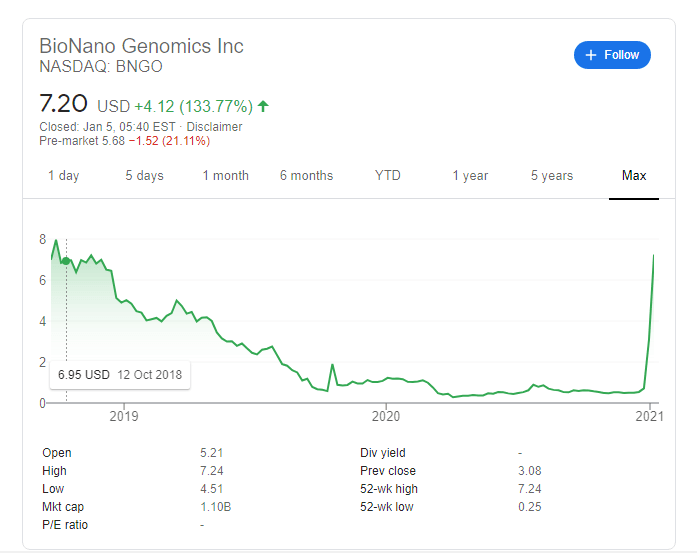

- NASDAQ: BNGO has surged by 133% on Monday, sending to levels last seen in 2018.

- BioNano Genomics Inc reported substantial advances in caring for people with autism.

- The pharma firm's valuation allows it to escape delisting but may trigger a correction.

Update: Investors are expressing their displeasure with Bionano Genomics announcement that it is tapping capital markets. NASDAQ: BNGO shares are down some 15% on Friday, struggling to hold onto the $4.30 level. It seems that management is trying to ride on the recent encouraging announcement of medical progress and fix the hole it has in finances. On the other hand, it is essential to note that the gargantuan leap was always bound to be followed by a downside correction. Will bargain-seekers step in? Seasoned traders will likely wait for more developments, such as the earnings report, before jumping on the bandwagon once again.

Bionano Genomics surged by 5% in Thursday's trade and closed at the round level of $5.00. However, Friday's premarket trading is pointing to a loss of around 11.68% and a fall to $4.42. As previously mentioned, high volatility is set to continue in an ongoing response to firm's achievement in getting down to the basics of autism and its spectrum. One of the reasons for its fresh turbulence comes due to the company's announcement that it will offer more shares to the public. That has initially sent NASDAQ: BNGO down and may continue weighing on the stock on Friday. The dilution of current shareholders and the implicit admission that the company needs more funds. Will investors see the move as a buying opportunity? More Five factors moving the US dollar in 2021 and not necessarily to the downside

Even those on the autism spectrum that are highly functional would welcome better care – and that is what Bionano Genomics (NASDAQ: BNGO) aims to achieve. The San Diego-based pharmaceutical company announced that Lineagen, its subsidiary, concluded a full analysis of a single genome of a person suffering that is on Autism Spectrum Disorder (ASD).

Update: NASDAQ: BNGO is on course to advance by around 1.4% or seven cents on Thursday, bouncing after a much-needed correction. Bionano Genomics' shares suffered a setback on Wednesday and especially on Tuesday, correcting the massive losses. Examining the chart, there is potentially more from to the downside. However, the reasons described below – breakthroughs in researching the autism spectrum. Trading volume will likely remain elevated for a considerable time, amid the excitement about the news. Later on, the focus is set to shift to BNGO's earnings due out later in the quarter.

Professor Temple Grandin is the high-functioning academic that underwent the evaluation. It revealed sequence variants in three ASD risk genes and this could be improving his health. Bionano Genomics now wants to expand its study to other people and provide care solutions.

The ASD field has been receiving more attention in recent years. Prominent climate activist Greta Thunberg also revealed she was diagnosed with autism, helping raise awareness of how individuals with ASD can function and lead.

BNGO stock price

NASDAQ: BNGO has closed Monday's trading at $7.20, a leap of 133.77%, after hitting a high of $8.25. These levels were last seen when Bionano Genomics IPOed back in 2018. Can share continue even higher?

BNGO was a penny stock just until Christmas 2020, threatening its delisting from NASDAQ. The recent price surge has saved the firm from losing this status.

However, Bionano has reached a valuation of $1.1 billion, which may raise some eyebrows given its relatively limited array of products at this point. Shares may suffer a downward correction after the knee-jerk rally. Premarket trading on Tuesday is pointing to a slide of over 20% to below $6.

The company would have to provide additional scientific breakthroughs and to sell products in order to rally.

More Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.