Australian Dollar depreciates due to deflation concerns in China

- The Australian Dollar declines following the lower CPI data from its largest trading partner, China.

- The Commonwealth Bank of Australia expects the RBA to implement a 25 basis point rate cut in December.

- The US Dollar appreciates as traders expect the Fed to slow the pace of borrowing cost reductions.

The Australian Dollar (AUD) edges lower after two days of gains against the US Dollar (USD) on Monday. The AUD/USD pair receives downward pressure from the lower-than-expected September Consumer Price Index (CPI) data from its major trading partner China released on Sunday.

The AUD may have attracted sellers after a detailed note from the Commonwealth Bank of Australia indicated expectations that the Reserve Bank of Australia (RBA) will implement a 25 basis point rate cut by the end of 2024. The report suggested that a stronger disinflationary trend than the RBA anticipates is essential for the Board to consider easing policy within this calendar year.

The decline of the AUD/USD pair could also be linked to a stronger US Dollar (USD), fueled by expectations that the US Federal Reserve (Fed) will slow the pace of borrowing cost reductions more than previously anticipated. According to the CME FedWatch Tool, the markets are pricing in an 86.9% chance of a 25 basis point rate cut in November, with no expectation for a 50-basis-point reduction.

Daily Digest Market Movers: Australian Dollar depreciates following lower inflation data from China

- The risk-sensitive AUD/USD pair might have received downward pressure due to escalating tensions in the Middle East that have sparked concerns of a broader regional conflict. According to CNN, at least four Israeli soldiers were killed, and over 60 people were injured in a drone attack in north-central Israel on Sunday.

- China's military initiated drills in the Taiwan Strait and around Taiwan on Monday. A spokesperson for the US Department of State expressed serious concern regarding the People's Liberation Army's (PLA) military actions. In response, Taiwan's Defense Ministry stated, “We will not escalate conflict in our response.”

- The National Bureau of Statistics of China reported that the country's monthly Consumer Price Index (CPI) remained unchanged at 0% in September, down from August's 0.4% increase. The annual inflation rate rose by 0.4%, falling short of the anticipated 0.6%. Additionally, the Producer Price Index (PPI) decreased by 2.8% year-on-year, a larger drop than the previous decline of 1.8% and exceeding expectations of a 2.5% decrease.

- On Saturday, the National People’s Congress expressed an optimistic outlook following a briefing from China’s Ministry of Finance (MoF). The MoF emphasized key priorities focused on stabilizing the property market and tackling local government debt issues. The ministry indicated that special bonds would be issued to support both bank recapitalization and efforts to stabilize the real estate sector.

- The US Producer Price Index (PPI) for September remained unchanged at 0%, below August’s 0.2% month-on-month increase. Meanwhile, the monthly core PPI, which excludes food and energy prices, expanded by 0.2% as expected, down from 0.3% the prior month.

- Chicago Fed President Austan Goolsbee spoke to Bloomberg, commending the progress made on inflation and the labor market. Goolsbee noted that despite the positive jobs report for September, there are no indications of overheating in the economy.

- Last week, the Reserve Bank of Australia released the Minutes from its September monetary policy meeting, suggesting that board members examined potential scenarios for both lowering and raising interest rates in the future. The discussion indicated that future financial conditions may need to be either tighter or looser than current levels to meet the Board's objectives.

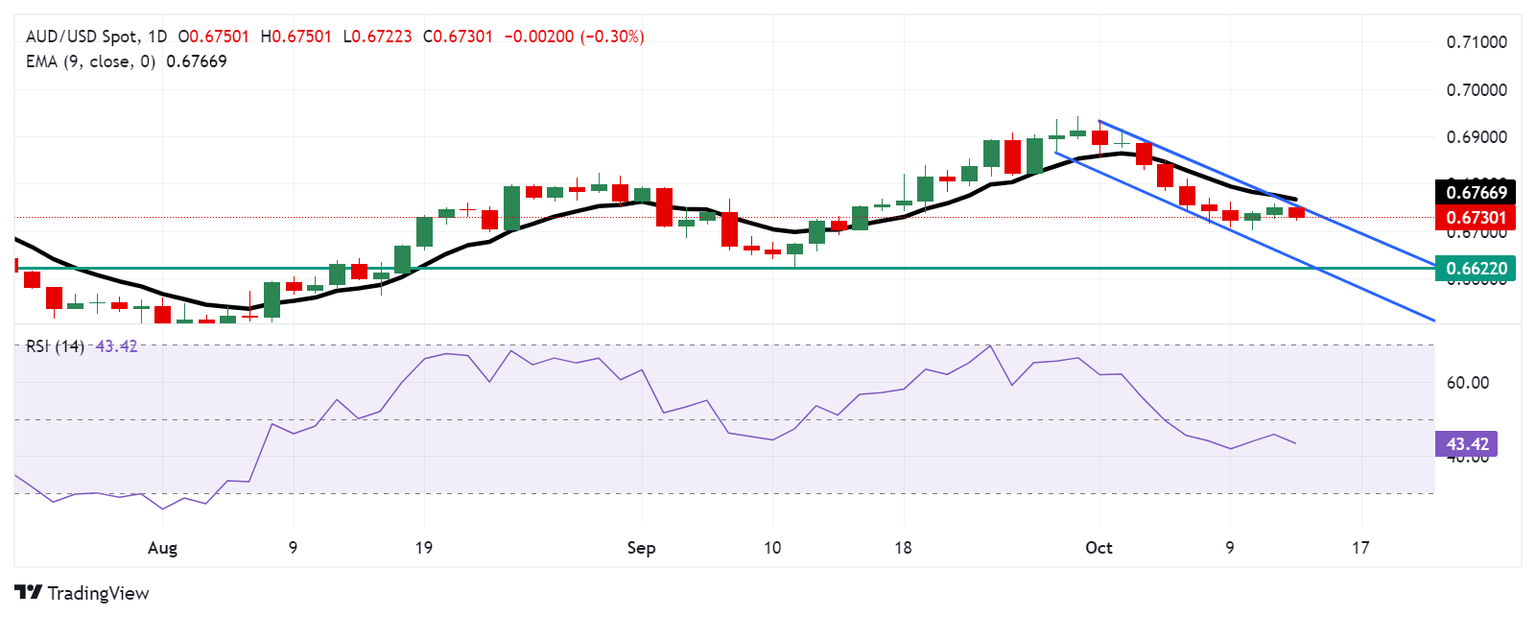

Technical Analysis: Australian Dollar holds position below 0.6750, lower boundary of the descending channel

The AUD/USD pair trades near 0.6730 on Monday. Technical analysis of the daily chart indicates that the pair is testing the upper boundary of the descending channel. A successful breach would indicate a potential for momentum change from bearish to bullish bias. However, the 14-day Relative Strength Index (RSI) is positioned below the 50 level, suggesting that bearish momentum is still active.

Regarding resistance, the AUD/USD pair could test the nine-day Exponential Moving Average (EMA) at 0.6766 level, followed by the psychological level of 0.6800.

On the downside, the AUD/USD pair could explore the region around the lower boundary of the descending channel at 0.6640 level, followed by its eight-week low of 0.6622, recorded on September 11.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.02% | 0.09% | 0.06% | 0.22% | 0.19% | 0.27% | |

| EUR | -0.07% | -0.12% | -0.07% | 0.07% | 0.17% | 0.03% | 0.10% | |

| GBP | -0.02% | 0.12% | 0.04% | 0.05% | 0.32% | 0.17% | 0.20% | |

| JPY | -0.09% | 0.07% | -0.04% | -0.04% | 0.14% | 0.15% | 0.16% | |

| CAD | -0.06% | -0.07% | -0.05% | 0.04% | 0.11% | 0.16% | 0.04% | |

| AUD | -0.22% | -0.17% | -0.32% | -0.14% | -0.11% | -0.01% | 0.02% | |

| NZD | -0.19% | -0.03% | -0.17% | -0.15% | -0.16% | 0.00% | 0.01% | |

| CHF | -0.27% | -0.10% | -0.20% | -0.16% | -0.04% | -0.02% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.