Australian Dollar dips amid a stronger US Dollar, awaits Fed Chair Powell's speech

- Australian Dollar extends losses amid an improved US Dollar on Friday.

- The decline in the ASX 200 could have undermined the Australian Dollar.

- S&P Global Manufacturing PMI rose to 52.5 against the expected 51.7 and 52.2 prior.

The Australian Dollar (AUD) depreciates for the second consecutive session on Friday, as the US Dollar (USD) strengthened following mixed S&P preliminary Purchasing Managers Index (PMI) data and robust weekly Jobless Claims from the United States (US).

The Australian Dollar receives downward pressure from the decline in the ASX 200 Index. The Australian equity market experienced losses, particularly in energy and consumer stocks, despite the positive performance on Wall Street, where all three major benchmarks set record highs.

The US Dollar Index (DXY) continues to extend its gains despite lower US Treasury yields. However, the US Dollar faced challenges due to the Federal Reserve's (Fed) reaffirmation of expectations for three interest rate cuts in 2024. The prevailing consensus suggests the start of an easing cycle in June, with the timing of the next cut contingent upon incoming data.

Daily Digest Market Movers: Australian Dollar falls to near 0.6540; next key support at 61.8% Fibonacci retracement

- Australian Employment Change for February surged to 116.5K, surpassing expectations of 40.0K and the previous figure of 15.3K.

- Australia’s Unemployment Rate flashed by 3.7%, lower than the anticipated 4.0% and the previous 4.1%.

- The preliminary Judo Bank Services PMI rose to 53.5, up from the previous figure of 53.1. Composite PMI showed a slight increase, reaching 52.4 compared to the previous 52.1.

- People’s Bank of China (PBoC) has kept its interest rate unchanged at 3.45%.

- Federal Open Market Committee (FOMC) maintained interest rates at 5.5% during Wednesday's policy meeting. The remarks made by US Federal Reserve (Fed) Chair Jerome Powell in the post-meeting press conference, signaling a dovish stance, exerted additional downward pressure on the Greenback.

- S&P Global Services PMI showed a slight decrease in March, dropping to 51.7 from 52.3. The expected reading was 52.0. Manufacturing PMI rose to 52.5 against the expected 51.7 and 52.2 prior. Composite PMI showed a slight dip to 52.2 from 52.5 prior.

- Initial Jobless Claims for the week ending on March 15 came in at 210K, below the 215K expected and 212K prior.

- US Building Permits (MoM) increased to 1.518 million in February, against the expected 1.495 million and 1.489 million prior.

- US Housing Starts (MoM) rose to 1.521M from the previous figure of 1.374M, exceeding the market expectation of 1.425M in February.

- The preliminary US Michigan Consumer Sentiment Index for March decreased to 76.5 from 76.9. This decline contrasts with expectations of it remaining unchanged.

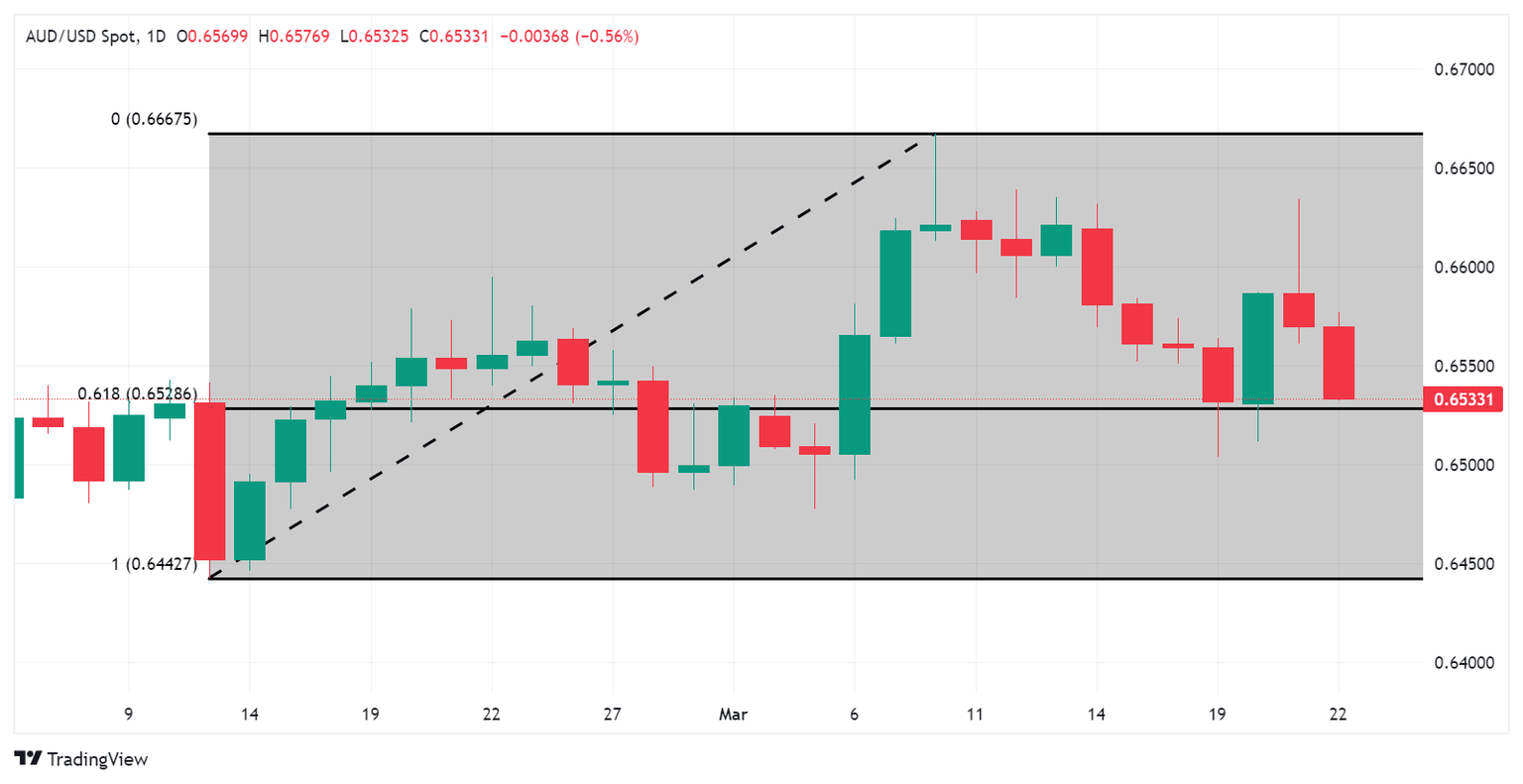

Technical Analysis: Australian Dollar falls to near 0.6540 followed by 61.8% Fibonacci

The Australian Dollar trades near 0.6540 on Friday. The immediate support appears at the 61.8% Fibonacci retracement level of 0.6528. A break below this level could lead the AUD/USD pair to test the support area around the weekly low at 0.6503 and the psychological level of 0.6500. On the upside, an immediate resistance level stands at 0.6550. A breakthrough above the latter could exert upward support for the AUD/USD pair to explore the psychological region around 0.6600, followed by the weekly high at 0.6634 level.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.44% | 0.58% | 0.30% | 0.88% | -0.12% | 0.68% | 0.30% | |

| EUR | -0.45% | 0.13% | -0.13% | 0.44% | -0.57% | 0.23% | -0.14% | |

| GBP | -0.58% | -0.13% | -0.26% | 0.31% | -0.70% | 0.11% | -0.28% | |

| CAD | -0.32% | 0.13% | 0.28% | 0.59% | -0.44% | 0.35% | -0.01% | |

| AUD | -0.89% | -0.44% | -0.32% | -0.59% | -1.02% | -0.21% | -0.61% | |

| JPY | 0.11% | 0.55% | 0.70% | 0.46% | 0.99% | 0.79% | 0.41% | |

| NZD | -0.68% | -0.23% | -0.10% | -0.35% | 0.21% | -0.80% | -0.37% | |

| CHF | -0.31% | 0.15% | 0.28% | 0.02% | 0.60% | -0.42% | 0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought-after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.