Australian Dollar trades with mild losses amid renewed US Dollar demand

- The Australian Dollar (AUD) edges lower in Thursday’s early European session.

- Increased bets on Fed rate cut might support the Aussie.

- The US Initial Jobless Claims, Housing data, Philly Fed Manufacturing Index, and Fed’s Neel Kashkari speech are due on Thursday.

The Australian Dollar (AUD) trades in negative territory on Thursday. The downside of the pair might be limited amid the hawkish stance from the Reserve Bank of Australia (RBA) at its June meeting on Tuesday. Additionally, weaker-than-expected Retail Sales have fueled speculation for US Federal Reserve (Fed) rate cuts later this year, which might weigh on the Greenback and create a tailwind for AUD/USD.

However, the RBA statement indicated that the economic outlook remains uncertain, and the process of taming inflation to target is unlikely to be smooth. Traders will take more cues from the preliminary Australia’s Judo Bank Purchasing Managers Index (PMI) for May on Friday. Any sign of recovery in the Australian economy might prompt the Australian central bank to delay the rate cut, which might lift the Aussie against the USD.

Daily Digest Market Movers: Australian Dollar weakens amid RBA’s hawkish hold

- The Australian central bank delivered a hawkish hold, as widely expected. The RBA kept the cash rate unchanged at 4.35% and reiterated that “the Board is not ruling anything in or out.”

- The RBA Governor Michele Bullock said during the press conference that the board discussed the option of raising rates while the case for a rate cut was not considered, adding that it “will do what is necessary” to return inflation to target.

- The first reading of the Australian Judo Bank Manufacturing PMI is projected to improve to 50.6 in June from 49.7 in May.

- Odds of a September Fed funds rate cut rose to 67% after the disappointing retail sales data. Fed funds futures also raise expectations for 50 basis points (bps) of total rate cuts this year.

- The US Initial Jobless Claims for the week ending June 15 are estimated to decline by 235,000 from the previous week's 242,000.

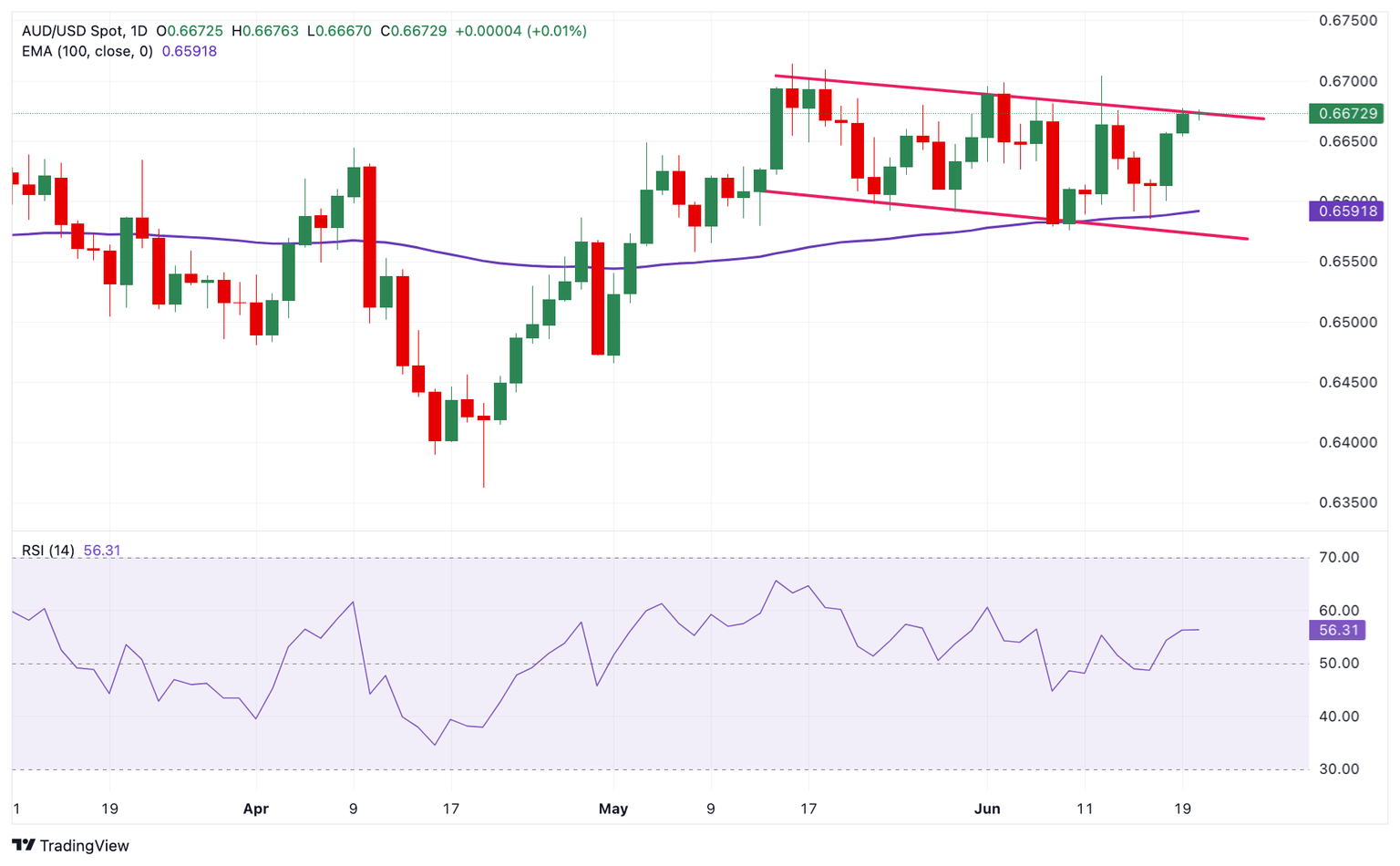

Technical Analysis: AUD/USD remains constructive in descending trend channel

The Australian Dollar trades softer on Thursday. The AUD/USD pair remains capped within a descending trend channel since May 14. The pair keeps the positive vibe beyond the key 100-day Exponential Moving Average (EMA) on the daily chart. The bullish momentum in the 14-day Relative Strength Index (RSI) continues to reinforce the pair’s upside.

A decisive break above the upper boundary of the descending trend channel of 0.6675 will attract some buyers to the 0.6700 psychological level. Extended gains will see a rally to 0.6760, a high of January 4.

On the flip side, a crucial support level for AUD/USD will emerge at 0.6590, the 100-day EMA. Further south, the next contention is seen at 0.6575, the lower limit of the channel. A breach of this level will expose 0.6510, a low of March 22, followed by 0.6465, a low of May 1.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.38% | -0.27% | -0.17% | -0.83% | 0.29% | 0.07% | -0.68% | |

| EUR | 0.30% | 0.10% | 0.12% | -0.52% | 0.69% | 0.36% | -0.49% | |

| GBP | 0.27% | -0.09% | 0.10% | -0.56% | 0.59% | 0.32% | -0.40% | |

| CAD | 0.17% | -0.22% | -0.11% | -0.66% | 0.49% | 0.23% | -0.51% | |

| AUD | 0.88% | 0.48% | 0.59% | 0.69% | 1.17% | 0.92% | 0.18% | |

| JPY | -0.31% | -0.70% | -0.60% | -0.46% | -1.15% | -0.24% | -1.01% | |

| NZD | -0.07% | -0.45% | -0.32% | -0.23% | -0.90% | 0.24% | -0.71% | |

| CHF | 0.67% | 0.31% | 0.39% | 0.50% | -0.16% | 1.00% | 0.73% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.