Australian Dollar holds position amid tepid US Dollar ahead of Fedspeak

- Australian Dollar appreciates as the ASX 200 Index continues to gain ground on Thursday.

- Australia’s Employment Change came in at -6.6K and the Unemployment Rate increased by 3.8% in March.

- US President Joe Biden calls for tripling the existing 7.5% tariff rate on Chinese steel and aluminum.

- The decline in the US Treasury yields exerts pressure on the US Dollar.

The Australian Dollar (AUD) continues to gain ground for the second consecutive day on Thursday. The decline in the US Dollar (USD) contributes support for the AUD/USD pair. However, the mixed Australian employment data appear to exert downward pressure on the AUD.

The Australian Dollar gains momentum as the ASX 200 Index continues to climb on Thursday. The domestic equity market is bolstered by gains in mining stocks, supported by firmer metals prices. Additionally, according to a Westpac report, while the Reserve Bank of Australia (RBA) has indicated that rates are unlikely to be raised further, it requires greater confidence in the inflation outlook before contemplating the possibility of rate cuts.

The US Dollar Index (DXY) loses ground, primarily influenced by subdued US Treasury yields. This correction in the US Dollar is further reinforced by renewed selling pressure and an overall risk-on sentiment in the market. Investors watch for the release of weekly Initial Jobless Claims and Existing Home Sales later on Thursday, which could provide further insight into the state of the US economy and potentially impact the direction of the US Dollar.

Daily Digest Market Movers: Australian Dollar extends gains amid mixed labor data

- Australia’s Employment Change posted a reading of -6.6K for March, against the expected 7.2K and 117.6K prior.

- Australia’s Unemployment Rate rose to 3.8% in March, lower than the expected 3.9% but higher than the previous reading of 3.7%.

- US President Joe Biden spoke at the heart of the American steel industry in Pittsburgh on Wednesday, emphasizing the need for increased pressure on the Chinese steel sector. He has directed US Trade Representative Katherine Tai to consider tripling the current 7.5% tariff rate on Chinese steel and aluminum, as reported by CBS News.

- Federal Reserve Bank of Cleveland President Loretta Mester, speaking on Wednesday, acknowledged that inflation has exceeded expectations, and the Fed needs further assurance before confirming the sustainability of 2% inflation. She also stated that monetary policy is well-positioned, with the possibility of a rate cut if labor market conditions worsen.

- Fed Governor Michelle Bowman commented on Wednesday that progress in inflation is slowing, with a potential stall. Bowman also noted that monetary policy is currently restrictive, and its sufficiency will be determined over time.

- The Federal Reserve's Beige Book survey of regional business contacts indicates that the US economy has "expanded slightly" since late February. Furthermore, firms reported facing increased challenges in passing on higher costs.

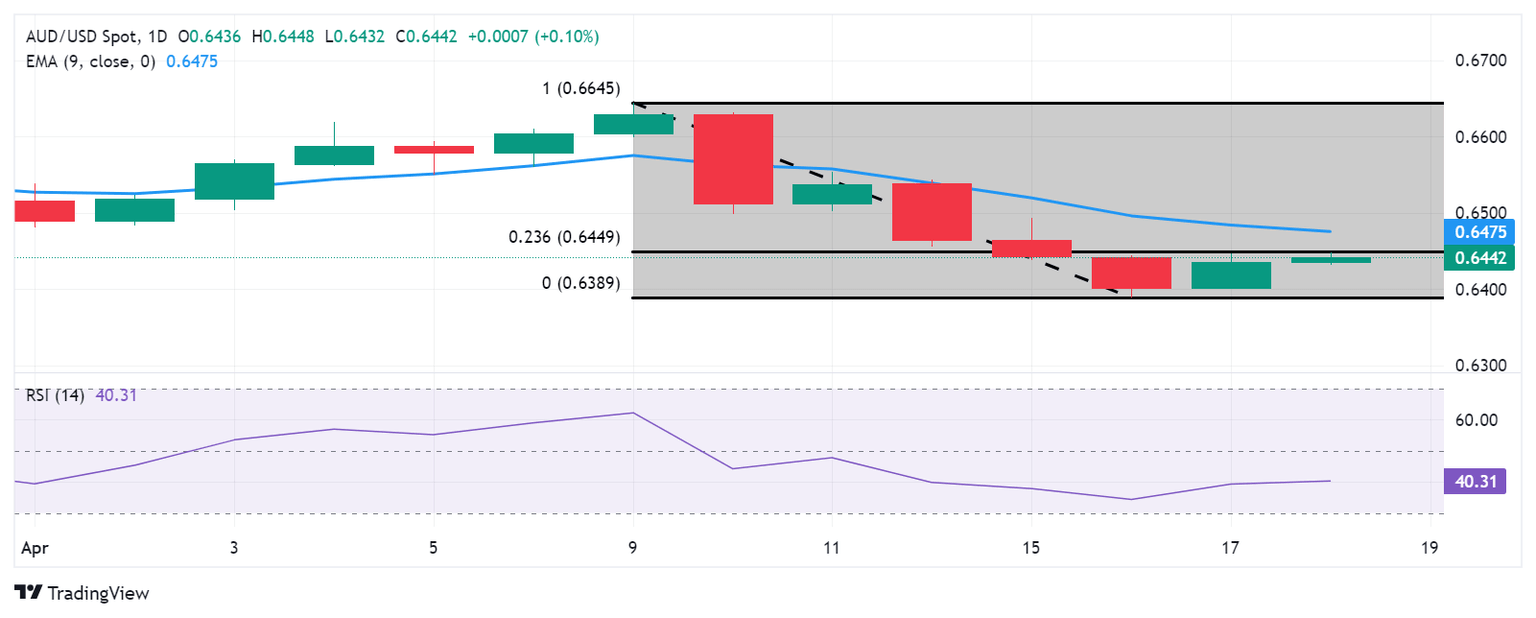

Technical Analysis: Australian Dollar hovers around the major level of 0.6450

The Australian Dollar traded around 0.6440 on Thursday. The 14-day Relative Strength Index (RSI) suggests a bearish sentiment for the AUD/USD pair as it remains below the 50 level. Key resistance for the pair is anticipated at the 23.6% Fibonacci retracement level of 0.6449, coinciding with the significant level of 0.6450. A breach above this level could strengthen the pair's momentum, potentially testing the nine-day Exponential Moving Average (EMA) at 0.6475, followed by the psychological barrier of 0.6500. On the downside, notable support is identified at the psychological level of 0.6400. A breach below this level might increase downward pressure on the AUD/USD pair, potentially leading it towards the major support level at 0.6350.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | -0.17% | -0.18% | -0.20% | -0.05% | -0.27% | -0.12% | |

| EUR | 0.16% | 0.00% | -0.01% | -0.05% | 0.12% | -0.10% | 0.01% | |

| GBP | 0.17% | 0.01% | -0.01% | -0.03% | 0.13% | -0.11% | 0.03% | |

| CAD | 0.18% | 0.03% | 0.01% | -0.02% | 0.13% | -0.09% | 0.04% | |

| AUD | 0.19% | 0.03% | 0.02% | 0.01% | 0.15% | -0.08% | 0.05% | |

| JPY | 0.05% | -0.12% | -0.13% | -0.16% | -0.15% | -0.22% | -0.10% | |

| NZD | 0.27% | 0.12% | 0.11% | 0.09% | 0.07% | 0.22% | 0.13% | |

| CHF | 0.15% | 0.00% | -0.03% | -0.05% | -0.07% | 0.11% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate, and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.