Australian Dollar pares gains amid improved US Dollar, Fed's Beige Book due today

- Australian Dollar recovers recent losses on improved market sentiment on Wednesday.

- Australian labor data for March are scheduled to be released on Thursday.

- US Dollar Index (DXY) maintains its position close to a five-month high of 106.51.

The Australian Dollar (AUD) ends its three-day decline on Wednesday, bouncing back from levels not seen since mid-November. Nevertheless, hawkish remarks from Federal Reserve (Fed) officials and the influx of safe-haven flows could bolster the US Dollar (USD) and potentially limit the upside of AUD/USD in the short term.

The Australian Dollar gains upward momentum as the ASX 200 Index rebounds after three consecutive days of losses. However, AUD encountered obstacles, possibly due to risk aversion, as investors awaited Israel's response to Iran's air strike on Saturday with caution. A Reuters report indicated that a third meeting of Israel's war cabinet, scheduled for Tuesday to determine a reaction to Iran's unprecedented direct attack, was postponed until Wednesday. Meanwhile, Western allies are considering swift imposition of new sanctions against Tehran to dissuade Israel from escalating the situation further.

The US Dollar Index (DXY) pulls back from a five-month high of 106.51 reached on Tuesday. This decline could be attributed to a slight decline in US Treasury yields. Fed Chairman Jerome Powell's remarks on Tuesday, stating that recent data suggests little progress on inflation this year and that it will take longer than anticipated to reach the 2% target, may have contributed to a hawkish stance and provided some backing to the US Dollar.

Daily Digest Market Movers: Australian Dollar recovers losses on improved sentiment

- Westpac Leading Index declined by 0.1% month-over-month in March, compared to February’s increase of 0.8%.

- Australian Employment Change and Unemployment Rate for March are scheduled to be released on Thursday.

- China’s Gross Domestic Product (GDP) rose by 1.6% QoQ in the first quarter of 2024, against the previous quarter’s increase of 1.0%. GDP year-over-year rose by 5.3%, exceeding the expected 5.0% and 5.2% prior.

- China’s Industrial Production (YoY) increased by 4.5% in March, against the market expectations of 5.4% and 7.0% prior.

- Late on Tuesday, US National Security Advisor Jake Sullivan announced that new sanctions targeting Iran, along with sanctions against entities supporting the Islamic Revolutionary Guard Corps and Iran's Defense Ministry, will be implemented in the coming days.

- Federal Reserve Bank of San Francisco President Mary Daly has emphasized that although there has been significant progress regarding inflation, there is still more to be done. She stressed the necessity of being assured that inflation is heading towards the target before making any decisions.

- According to the CME FedWatch Tool, the likelihood of interest rates remaining unchanged in the June meeting has been increased to 84.8% from Monday’s 78.7%.

- US Building Permits (MoM) fell to 1.458 million in March, compared to the expected 1.514 million and 1.523 million prior. Housing Starts declined to 1.321 million MoM from 1.549 million, falling short of the expected 1.480 million.

- US Retail Sales (MoM) increased by 0.7% in March, exceeding the market expectations of 0.3%. The previous reading was revised to 0.9% from 0.6% in February.

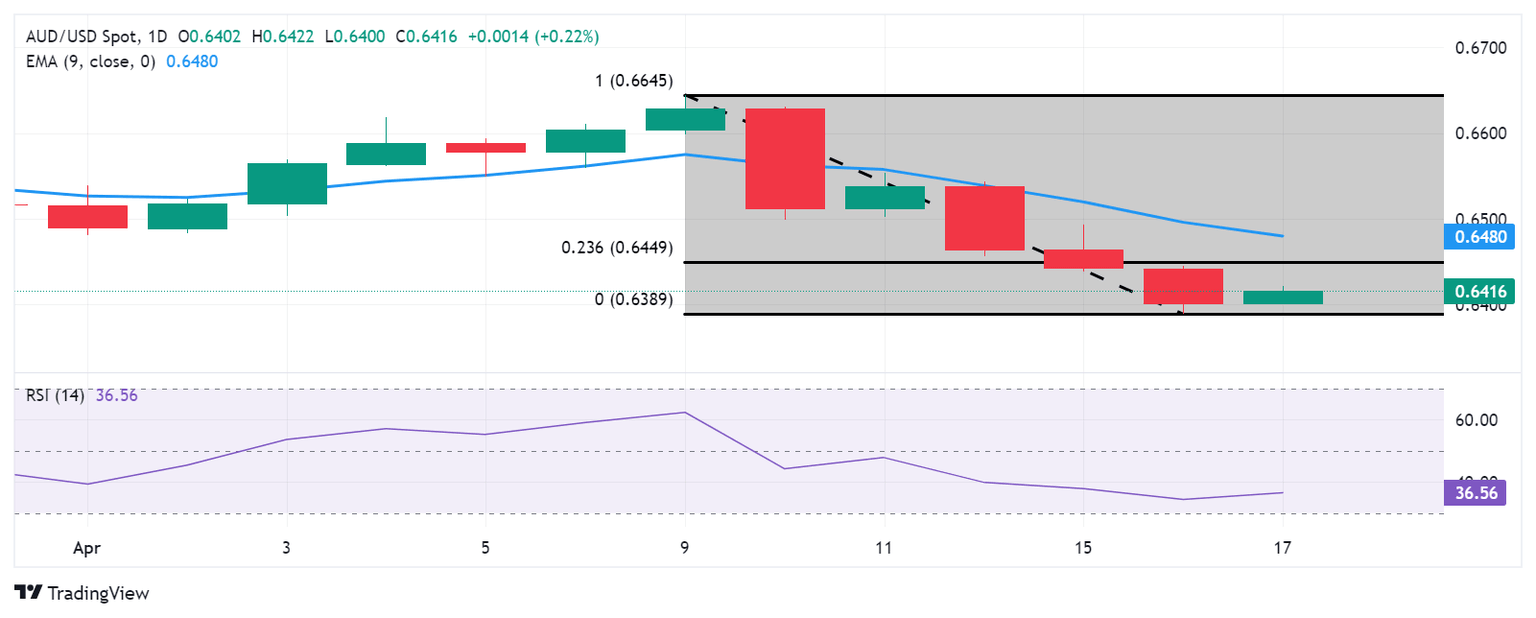

Technical Analysis: Australian Dollar holds ground above the support level of 0.6400

The Australian Dollar traded around 0.6420 on Wednesday. The 14-day Relative Strength Index (RSI) indicates a bearish sentiment for the AUD/USD pair as it sits below the 50 level. Key resistance for the pair could be encountered at the 23.6% Fibonacci retracement level of 0.6449, coinciding with the significant level of 0.6450. A breach above the latter could bolster the pair's momentum toward testing the nine-day Exponential Moving Average (EMA) at 0.6480 and, subsequently, the psychological barrier of 0.6500. On the downside, notable support is observed at the psychological level of 0.6400. A breach below this level may intensify downward pressure on the AUD/USD pair, potentially leading it toward the major support level at 0.6350, followed by November's low at 0.6318.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.03% | 0.06% | 0.05% | 0.10% | -0.02% | -0.07% | 0.01% | |

| EUR | -0.02% | 0.05% | 0.03% | 0.08% | -0.06% | -0.11% | -0.02% | |

| GBP | -0.07% | -0.05% | -0.02% | 0.05% | -0.10% | -0.16% | -0.06% | |

| CAD | -0.05% | -0.03% | 0.01% | 0.05% | -0.09% | -0.14% | -0.05% | |

| AUD | -0.12% | -0.08% | -0.04% | -0.05% | -0.14% | -0.20% | -0.09% | |

| JPY | 0.02% | 0.04% | 0.10% | 0.08% | 0.10% | -0.08% | 0.04% | |

| NZD | 0.10% | 0.10% | 0.14% | 0.13% | 0.19% | 0.05% | 0.08% | |

| CHF | 0.00% | 0.01% | 0.06% | 0.04% | 0.09% | -0.04% | -0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.