Aussie Retail Sales beat with 1.4% vs 1% expected, AUD steady

On a relatively quiet week of domestic data, traders were in anticipation of today's Aussie Retail Sales.

The data has arrived as follows:

Australia Retail Sales for March, preliminary arrived at +1.4% MoM sv expected +1.0%.

- ''The seasonally adjusted estimate rose 1.4% ($423.9m) from February 2021 to March 2021.

- In seasonally adjusted terms, Australian turnover rose 2.3% in March 2021 compared with March 2020.

- The March Quarter 2021 will be relatively unchanged compared to the December quarter 2020, in seasonally adjusted current price terms.''

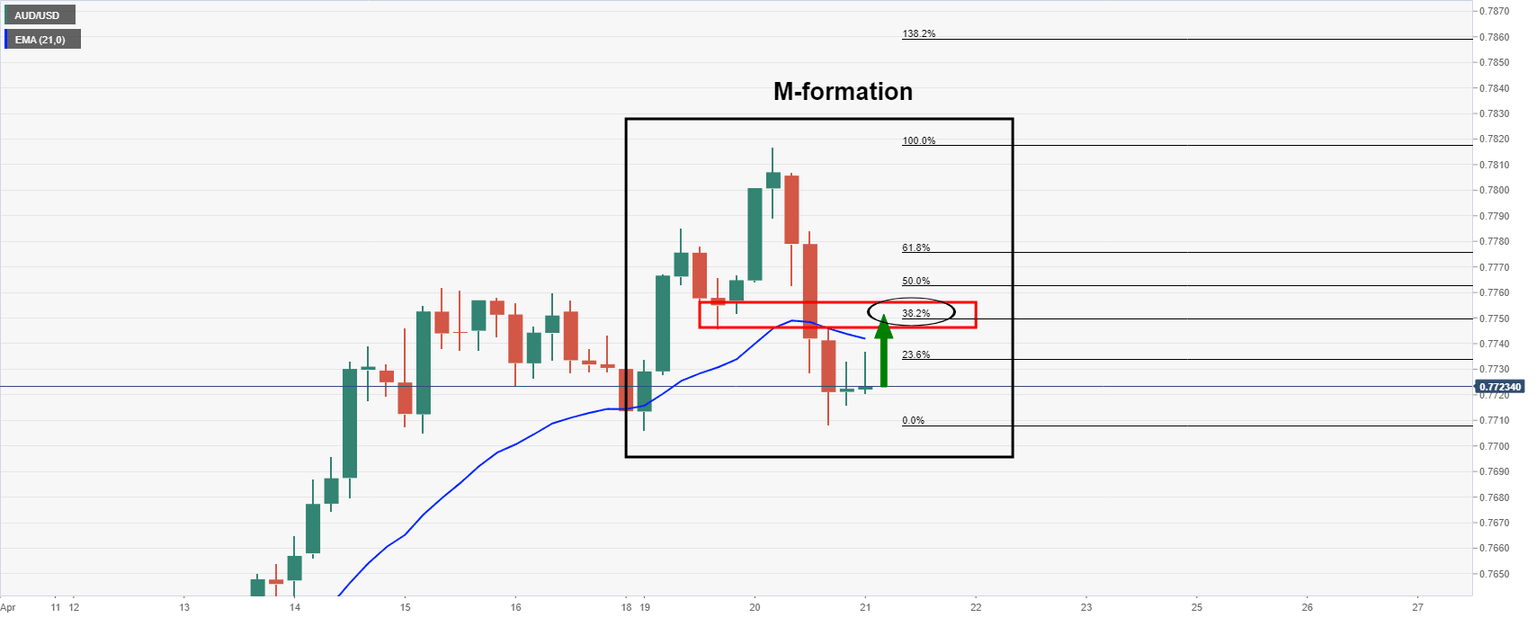

AUD/USD has stalled in its advance in recent trade and is flat in the session at 0.7722 post the data.

Given this was the preliminary data, it is subject to revisions so is less impactful on the Aussie.

"There are also signs that retail is easing in areas where the COVID reopening is more advanced – reflecting both waning 'catch-up' demand and a shift back towards non-retail spending,'" analysts at Westpac warned prior to the data today.

Meanwhile, AUD/USD is in the process of correcting to a significant resistance zone:

For more information on the thesis for the upside bias in the Aussie, see the prior analysis, AUD/NZD Price Analysis: The bulls are stepping in before next bearish impulse.

Description of Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers is based on a sampling of retail stores of different types and sizes and it''s considered as an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.