AUD/USD traders get set for this week's RBA key event

- The focus will be on the RBA as a meanwhile distraction this week for the pair.

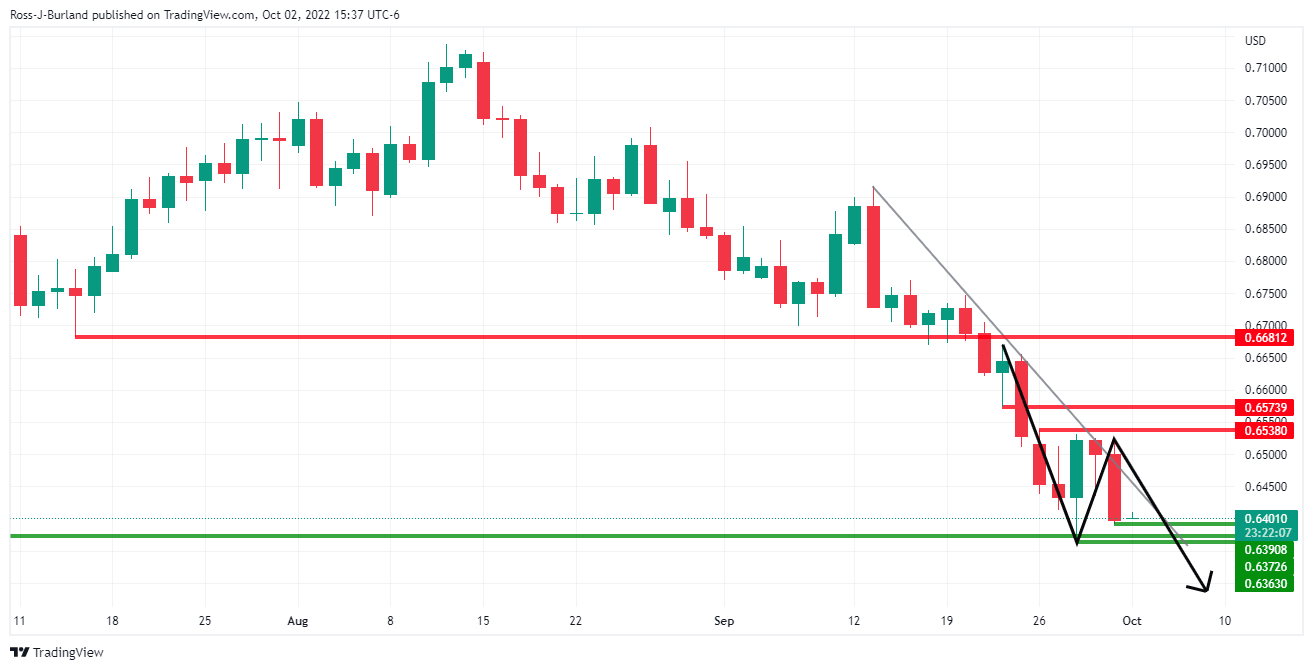

- AUD/USD bears took out key monthly support in September.

AUD/USD corrected from a key area on the charts on Friday with a test back through 0.64 the figure hardly left a mark on the downtrend that remains the bias for the start of the week and ahead of the Reserve Bank of Australia.

In the RBA Sep minutes, the Board judged that it may be appropriate 'at some point' to scale back to 25bps hikes, but we think it is too soon for that. Data on balance is still strong, which suggests the economy is holding up well, as analysts at TD Securities noted.

''Thus, this affords room for the RBA to front-load hikes further as the Governor notes the current cash rate is "still probably on the low side".''

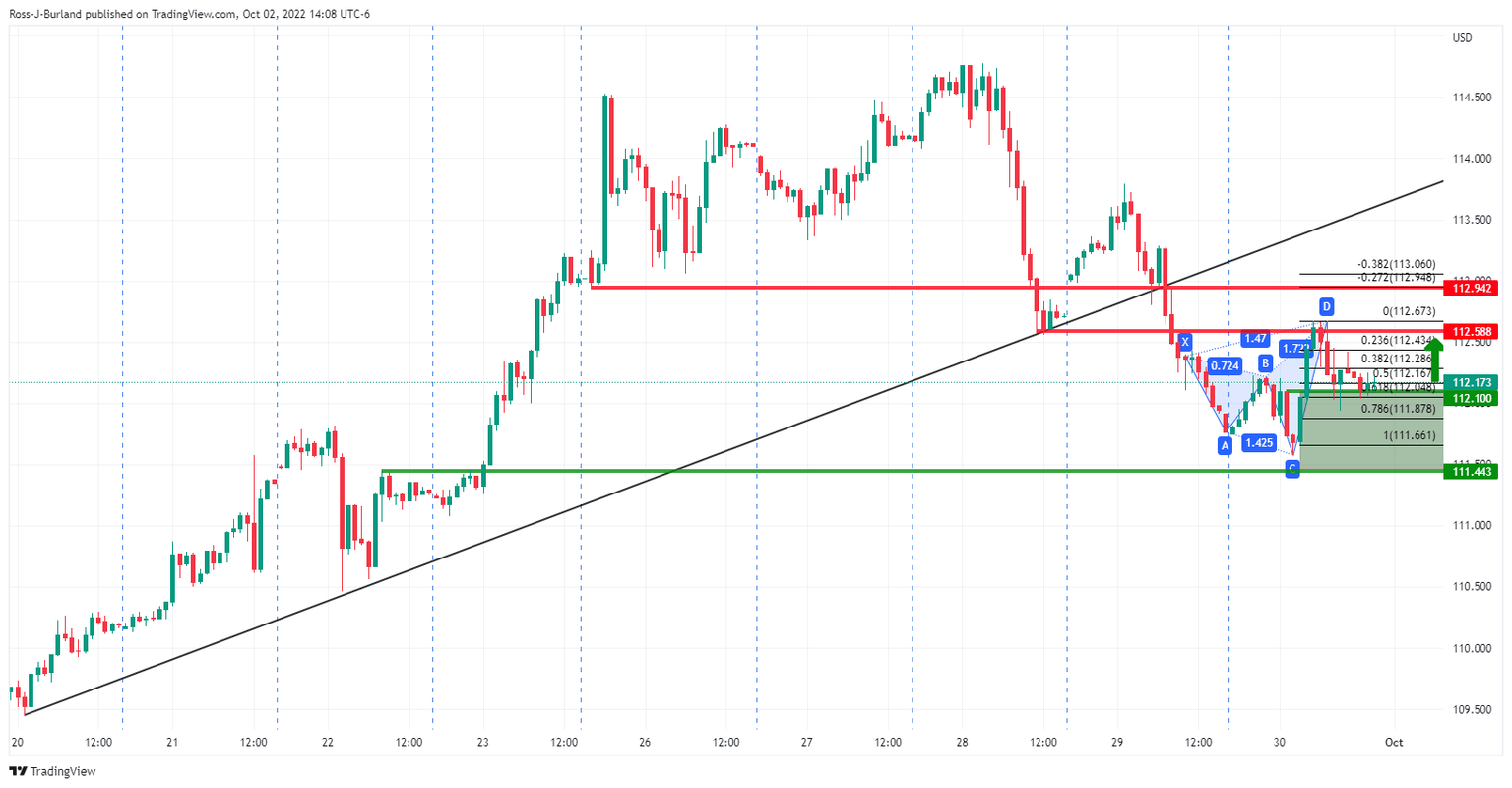

Meanwhile, the focus is firmly on the greenback, and prospects of more upside to follow as we move into a new quarter, as per the following analysis:

Meanwhile, domestically, going forward Australian growth is set to slow, analysts at Rabobank argued.

''The central bank forecasts growth at 3¼ per cent over 2022, underpinned by growth in consumption and a recovery in investment and service exports. Growth is then expected to slow to around 1¾ per cent over both 2023 and 2024. This outlook compares favorably with the Eurozone, UK and the US all of which are at risk of recession next year.''

'' We had anticipated a pullback to AUD/USD0.69 on the back of dollar strength. We continue to see scope for AUD/USD to clamber back to 0.71 on a 6-month view.''

AUD/USD technical analysis

Bears took the reigns again last month and broke a key structure as illustrated on the above chart, leaving the focus on the downside. However, breakout traders could come under heat on any corrections for the days/weeks ahead.

AUD/USD daily chart

The daily chart, however remains bearish while below the trendline resistance.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.