US dollar Price Analysis: Bullish prospects for the start of the week

- US dollar could be ripening for a move to the upside from critical support.

- The bulls are eyeing a break of 112.70.

The US dollar has been in demand for months due to worries over growth in China, the Eurozone, and various other economies while investor confidence have been undermined even more so in the past couple of weeks.

''In our view the USD is set to remain firm until the Fed are content that US inflation is falling and that inflation expectations are well anchored. That is likely to be some months away. We remain USD bulls. We are targeting EUR/USD0.9500 but see risk of break below this level,'' analysts at Rabobank argued.

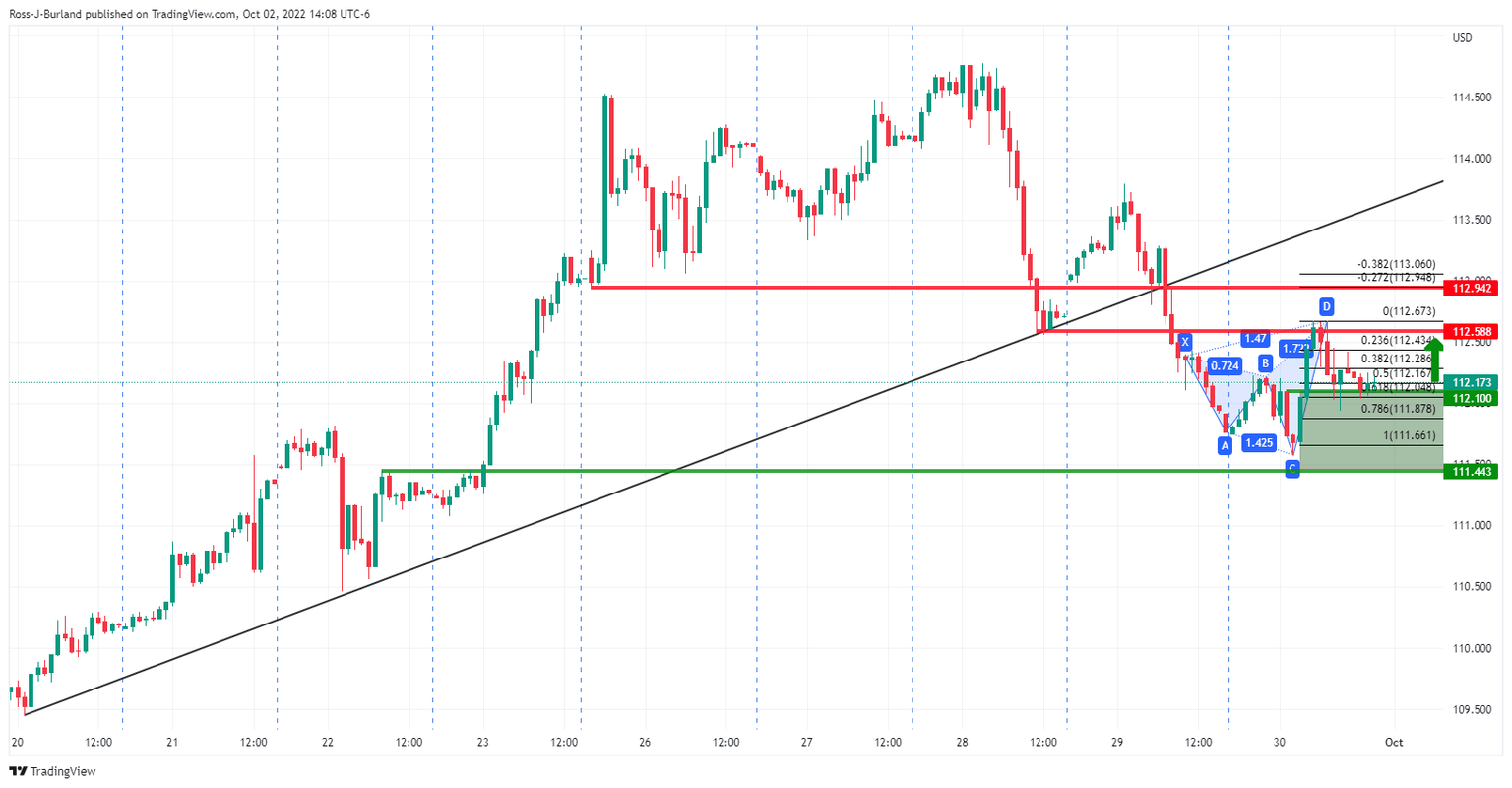

Meanwhile, the open looks set to be a bullish play for the greenback, so long as the 111.40-112.00 area holds as the following hourly chart illustrates:

DXY H1 chart

The harmonic pattern played out with the bears moving in at a key resistance structure to push the price all the way into the neckline of the formation in a significant retracement towards the 78.6% Fibonacci level. For the open, bulls will be in anticipation of a move towards the prior resistance near 112.70. This puts the focus on the downside for corresponding pairs such a cable:

(GBP/USD H1 chart)

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.