AUD/USD stalls on US jobless claims, as China’s economic weakness dampens mood

- AUD/USD trades flat at 0.6375 as Australia posts a trade surplus of A$8 billion in July, missing estimates and sparking risk-off sentiment.

- US jobless claims of 216K beat estimates, reinforcing the Fed’s ‘higher for longer’ stance and putting downward pressure on AUD/USD.

- Traders eye upcoming economic indicators from Australia and the US, including Westpac Consumer Confidence and US inflation figures.

The Aussie Dollar (AUD) pared its losses versus the US Dollar (USD) on Thursday after US economic data showed the US Federal Reserve (Fed) work is far from done, while weakness in China’s exports weighed the market mood. At the time of writing, the AUD/USD is trading at 0.6375, flat as Friday’s Asian session commences.

The Aussie Dollar remains flat against the US Dollar as strong US jobless claims and China’s export slowdown create a mixed trading environment

Australia’s economic docket showed that Imports surpassed Exports, but still, it showed a surplus on its Trade Balance of A$8 billion in July. Although the data is encouraging, missed estimates. That, alongside a weaker improvement of China’s exports, spurred a risk-off impulse that carried on throughout the whole trading day, with Wall Street finishing with losses, except for the Dow Jones, witnessing decent gains of 0.22%.

Aside from this, US economic data revealed by the US Department of Labor reinforced the Federal Reserve’s need to hold rates higher for longer, as said by its Chairman Jerome Powell. Unemployment claims for the last week rose by 216K, below estimates, while Continuing Claims gave signals that conditions are tightening.

The data bolstered the US Dollar (USD), which, as shown by the US Dollar Index, printed gains of 0.20%, standing near yearly highs above 105.000. Therefore, the AUD/USD was downward pressure near the 0.6350s area.

Meanwhile, US Treasury bond yields retreated somewhat, as money market futures slashed bets the US Federal Reserve would continue to tighten monetary policy, past the current Federal Funds Rate (FFR) at 5.25%-5.50%, Odds for a 25 bps rate hike in November, are at 43.4%.

Recently, Federal Reserve officials have kept their options open regarding deciding the forward path of monetary policy. John Williams from the New York Fed said that policy is “restrictive” but refrained from commenting on his decision. Of late, Chicago’s Fed President Austan Goolsbee said the Fed could reach the “golden path” where inflation falls but recession is avoided.

AUD/USD traders should be attentive to next week’s data. The Australian economic docket would feature the Westpac Consumer Confidence, NAB Business Confidence, and employment data. On the US front, inflation figures, Retail Sales, Industrial Production, unemployment claims and Consumer Sentiment would shed some light regarding the Fed’s future decision.

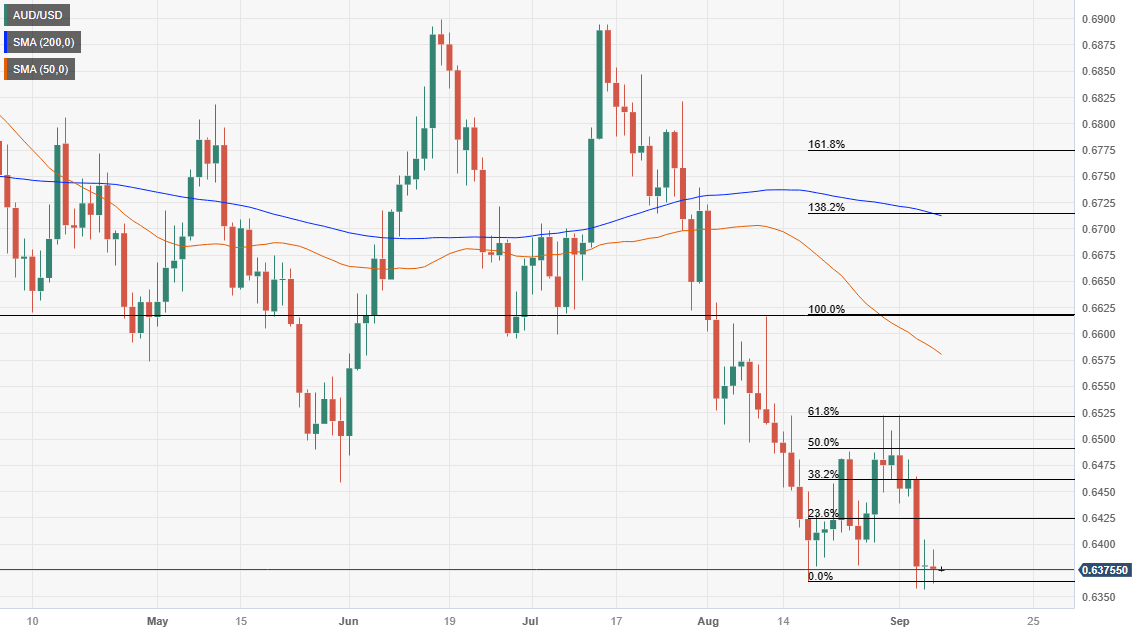

AUD/USD Price Analysis: Technical outlook

The daily chart portrays the pair subdued at around the year lows of 0.6357, printing back-to-back sessions of spinning tops, suggesting that neither buyers nor sellers are in charge. However, the trend remains downward, and if the AUD/USD drops below 0.6357, expect a challenge of the 0.6300 figure. Once cleared, the major would test the November 22 low of 0.6272. On the flip side, upside risks emerge above the September 6 high of 0.6405, with the next resistance at the September 5 high at 0.6464.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.