AUD/USD stabilizes below 0.6900 despite hawkish RBA minutes and upbeat Feb PMI

- AUD/USD has shifted its auction profile below 0.6900 amid the risk-off mood.

- Federal Reserve policymakers have been citing it would be premature to consider a pause in the policy tightening spell this year.

- Reserve Bank of Australia also considered the option of a 50 bps rate hike as the Australian inflation has not peaked yet.

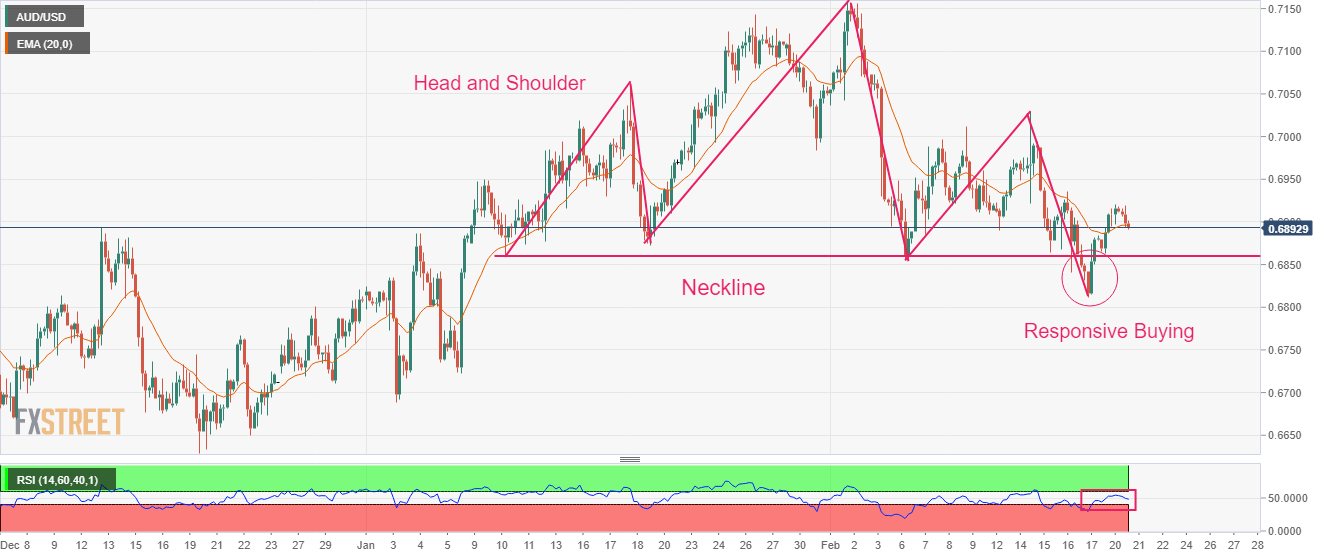

- AUD/USD has confidently shifted above the neckline of the Head and Shoulder formation, indicating a bullish reversal.

AUD/USD has surrendered the round-level support of 0.6900 in the early European session as investors getting worried that higher interest rates by western central banks are getting nightmares for the producers. The market sentiment is turning risk-averse ahead of the opening of the United States markets after a long weekend.

S&P500 futures have extended their losses as the renewal of higher inflation projections after a significant jump in US Retail Sales has triggered fears of more rate hikes beyond March. The US Dollar Index (DXY) is making deliberate efforts in shifting its auction profile above 103.70. The recovery move by the USD Index in the Asian session was higher confident, however, further range extension is facing pressure.

This week, the show-stopper will be the release of the Federal Open Market Committee (FOMC) minutes, which will release on Wednesday. Investors are expecting a sheer hawkish stance on the interest rate guidance as Federal Reserve (Fed) policymakers have been citing it would be premature considering a pause in the policy tightening spell this year. This has trimmed demand for US government bonds. Lower demand for government bonds has propelled the 10-year yields above 3.85%.

Hawkish Reserve Bank of Australia minutes fail to support the Australian Dollar

It was widely anticipated that Reserve Bank of Australia Governor Philip Lowe and his mates would be advocating for more interest rate hikes as Australian inflation is critically stubborn. The Australian Consumer Price Index (CPI) has refreshed its multi-decade of 7.8% and is showing no signs of softening ahead in spite of the fact that the Official Cash Rate (OCR) has been already pushed to 3.35%.

The message from the RBA minutes was clear that more interest rates are warranted as strong consumer demand is not allowing Australian inflation to soften from its peak.

According to the RBA minutes, policymakers also considered the option of 50 basis points (bps) interest rate hike considering the persistence of inflation. The RBA members also highlighted that the Unemployment Rate is the lowest in the past 50 years and job vacancies are extremely high, which is delighting households for flushing surplus funds into the economy.

Aussie PMI is out, US PMI is due yet

Apart from the hawkish RBA minutes, upbeat preliminary Australian S&P PMI (Feb) data has also failed to strengthen the Australian Dollar. The Manufacturing PMI landed at 50.1, higher than the consensus of 49.9 and the former release of 50.0. The Services PMI scaled firmly to 49.2 versus the estimates of 48.4 and the prior release of 48.6.

Economic activities in the Australian economy are accelerating despite higher interest rates by the Reserve Bank of Australia, which indicates that consumer demand is extremely robust.

In Tuesday’s New York session, preliminary US S&P PMI numbers will be keenly watched. The Manufacturing PMI (Feb) is seen lower at 46.8 vs. the prior release of 46.9. And the Services PMI is seen at 46.6 against the former release of 46.8.

There is no denying the fact that producers have trimmed their dependency on borrowings from commercial banks due to higher interest rates by the Federal Reserve. And are exploiting their retained earnings to avoid higher interest obligations. Firms have postponed their expansion plans, therefore, a continuation of contraction in economic activities is highly expected.

FOMC minutes to guide further movement to the FX market ahead

The minutes from the Federal Reserve will provide a detailed explanation of hiking interest rates by 25 basis points (bps) in the February monetary policy meeting.

The street always tries to remain ahead of the Federal Reserve (Fed) policymakers. Therefore, the major focal point for investors in the Federal Open Market Committee (FOMC) minutes is the meaningful cues that could provide guidance on interest rates. Information on the terminal rate and targets for inflation will be keenly watched.

AUD/USD technical outlook

AUD/USD has shifted its business above the neckline of the Head and Shoulder chart pattern plotted from January 10 low at 0.6860 on a four-hour scale. The responsive buying action from the market participants negated the downside break of the above-mentioned chart pattern. The 20-period Exponential Moving Average (EMA) at 0.6900 is acting as a cushion for the Australian Dollar.

The Relative Strength Index (RSI) (14) has rebounded into the 40.00-60.00 range, which indicates a bullish reversal. A break into the bullish range of 60.00-80.00 will trigger the bullish momentum.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.