AUD/USD rebounds as investors eye Fed’s decision, as Chinese data boosts the Aussie

- AUD/USD trades at 0.6435, recovering from a daily low of 0.6416, as Chinese economic data boosts market sentiment.

- US Federal Reserve expected to hold rates steady, with a 99% chance of no change, as investors await ‘dot-plots’ for future rate path.

- Michelle Bullock to begin her term as the new RBA Governor with Australian economic data, including PMIs and inflation, on the week’s docket.

The Australian Dollar (AUD) recovers some ground against the US Dollar (USD) as investors brace for a busy week in the central bank space, as the US Federal Reserve is expected to hold rates unchanged. Improvement in Chinese economic data, propelled by its government, cushioned the Aussie’s fall. The AUD/USD is trading at 0.6435 after hitting a daily low of 0.6416.

Australian Dollar gains against the US Dollar ahead of a busy central bank week, buoyed by positive economic data from China

Market sentiment has improved due to Chinese data portraying a more optimistic outlook, which was threatened by deflation and a sudden economic slowdown. That boosted the Aussie Dollar (AUD), which is staging a recovery amid an absent economic docket.

Last week, the US economy witnessed an uptick in inflation on the consumer and producer side while the jobs market remains hot. Retail sales expanded slower than estimated but remained solid above the 2% threshold. Nevertheless, consumer sentiment slipped, blamed on elevated gasoline prices, as revealed by a University of Michigan poll (UoM).

A tranche of US housing data will be revealed ahead in the week, but all eyes are set on Jerome Powell and co. Money markets are not expecting a surprise by the Fed, with the odds of holding rates unchanged at 99%. Aside from the monetary policy statement, traders are looking for the ‘dot-plots’ to see Fed officials’ expectations regarding the Federal Funds Rate (FFR) path.

On the Australian front, the calendar would reveal the Judo Bank Services and Manufacturing PMIs alongside inflation data. However, the main highlight of the week is that Michelle Bullock is beginning her term as the new Reserve Bank of Australia (RBA) Governor.

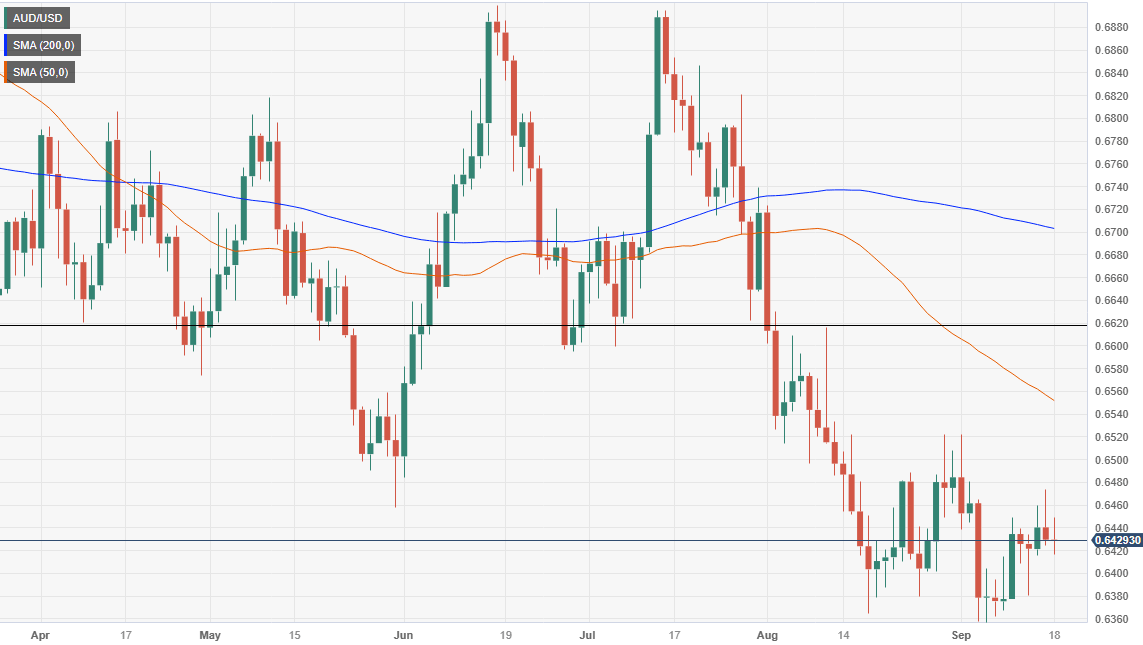

AUD/USD Price Analysis: Technical outlook

Price action portrays the pair printed a hammer preceded by a slim uptrend, peaking at around last week’s high of 0.6475. However, if buyers clear that area, the pair could test 0.6500 and resume its upward direction to test the 50-day Moving Average (DMA) at 0.6551. Conversely, and in the most likely scenario, the AUD/USD could extend its losses, but first, sellers must drag prices below the 0.6400 mark. A breach of the latter, and the pair could slip towards the yearly lows of 0.6357.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.