AUD/USD Price Analysis: Pre-open points to bullish correction, eyes on the 61.8% golden ratio

- AUD/USD bulls could be stepping in at this juncture.

- Eyes on 0.6275 on the upside and 0.6170 on the downside.

AUD/USD will be at the mercy of risk sentiment and the value of the US dollar this week. However, technically, the price is decelerating on the offer and we could see a correction as the following technical analysis illustrates:

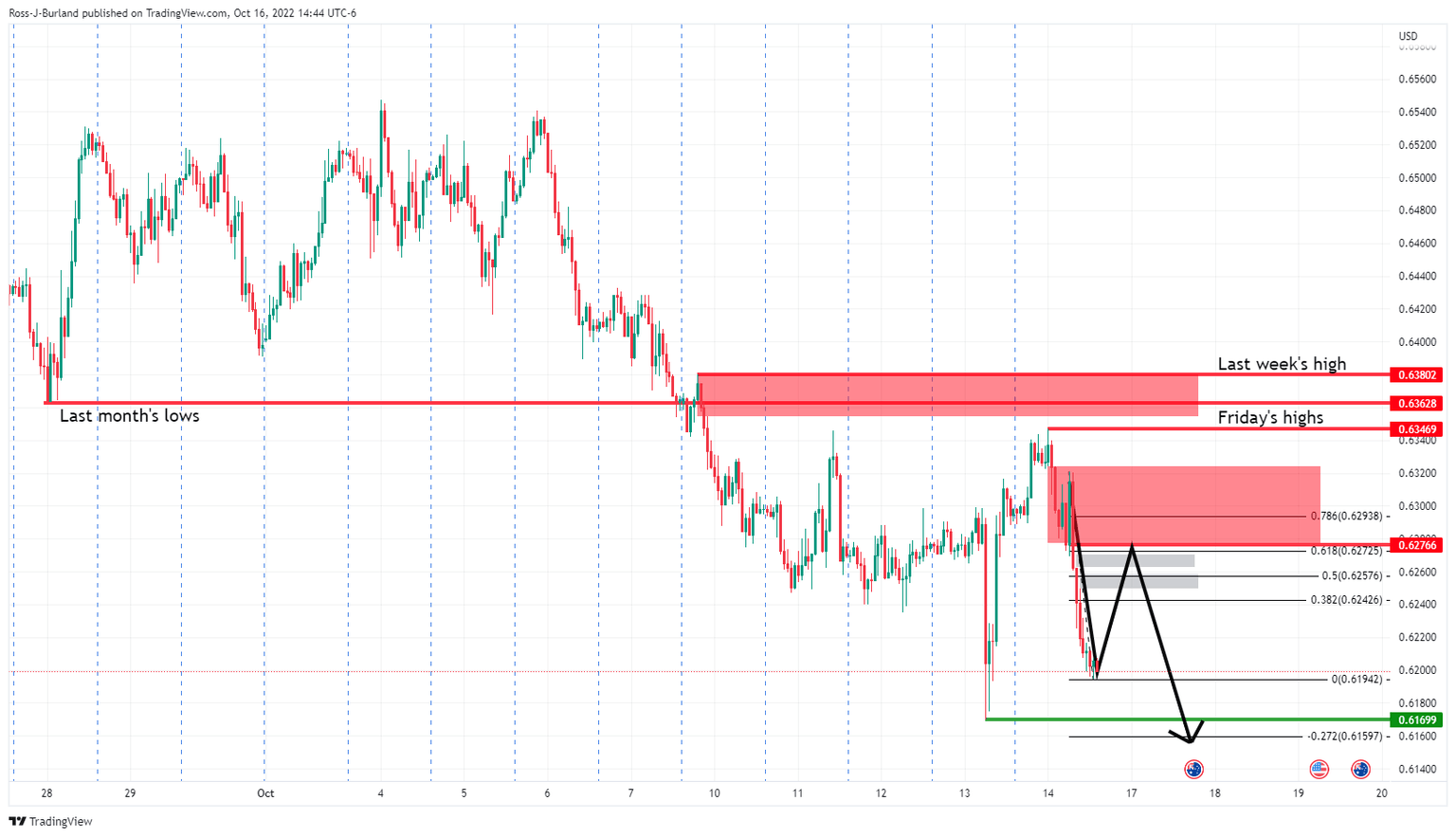

AUD/USD H1 chart

As per the hourly chart, the price is well below last month's lows and will remain in the bear's hands so long as Friday's highs of near 0.6250 are not violated. However, there are prospects of a correction into the greyed areas which are price imbalances on the hourly chart. This will put the prior bull candle's lows in focus near a 61.8% Fibonacci retracement near 0.6275. While below this area of resistance, the focus will be on a break of the fresh bear cycle lows near 0.6170 and for a downside continuation.

Such a thesis will stem from a strong US dollar outlook as follows:

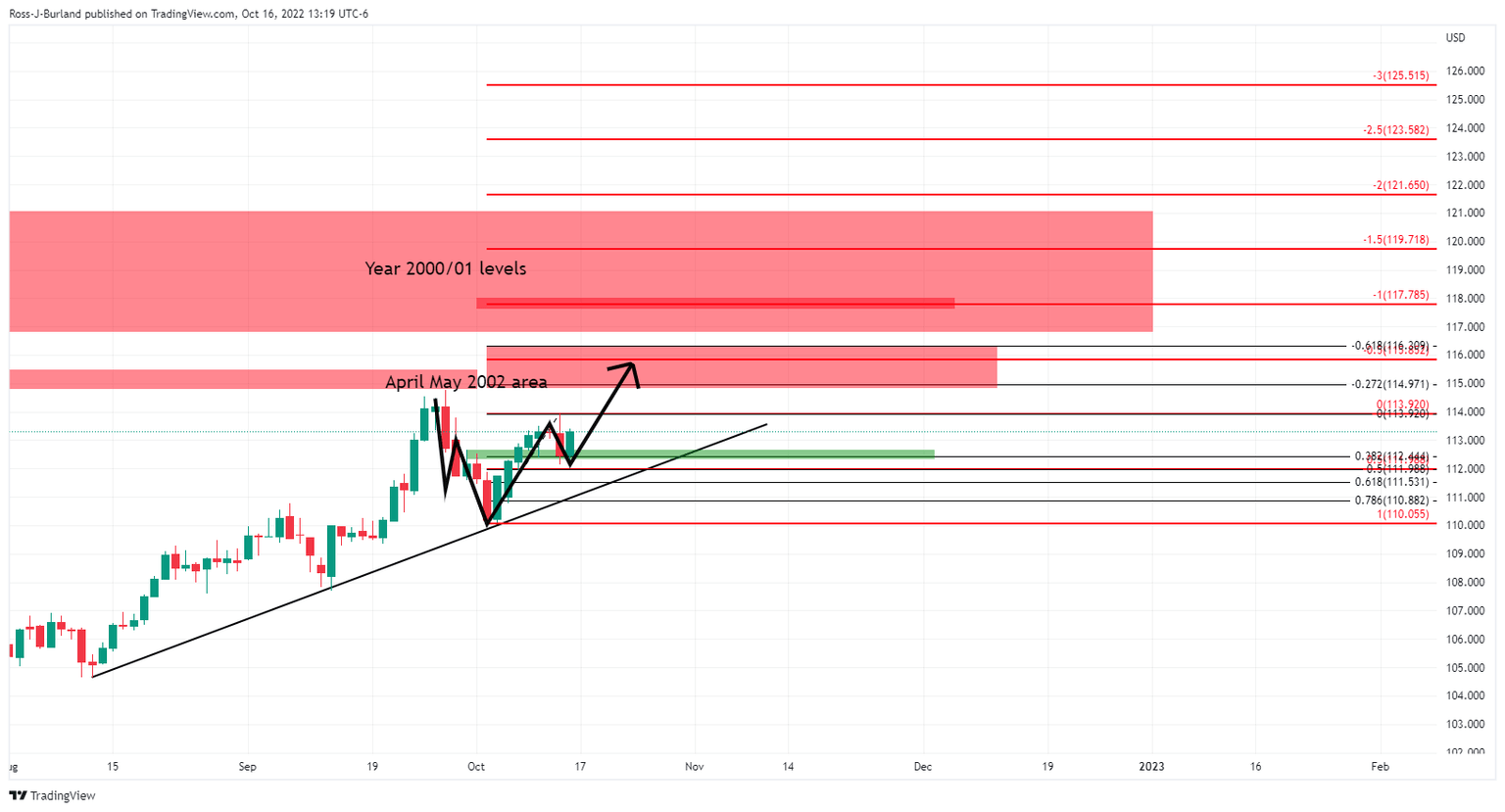

DXY daily chart

If the US dollar bulls commit to the April/May 2002 areas, then this will be expected to weigh on the Aussie for the foreseeable future.

St. Louis Federal Reserve President James Bullard said on Saturday that it is ''way too early'' to discuss the end of QT and noted that the rapid interest rate increases have contributed to the strength of the dollar against other currencies. He said that this might only ease once the US central bank reaches the point of pausing the rate hikes, "where the committee thinks we're putting meaningful downward pressure on inflation," so rates don't need to continue rising, he said.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.