AUD/USD Price Analysis: Levels to consider before Aussie CPI

- Aussie Q4 CPI is out at 11:30am AEDT, as the main event today.

- Expectations are for the Trimmed Mean (RBA's focus) to print 0.4% QoQ (prior 0.4% leaving YoY at 1.5% (prior 1.6%)).

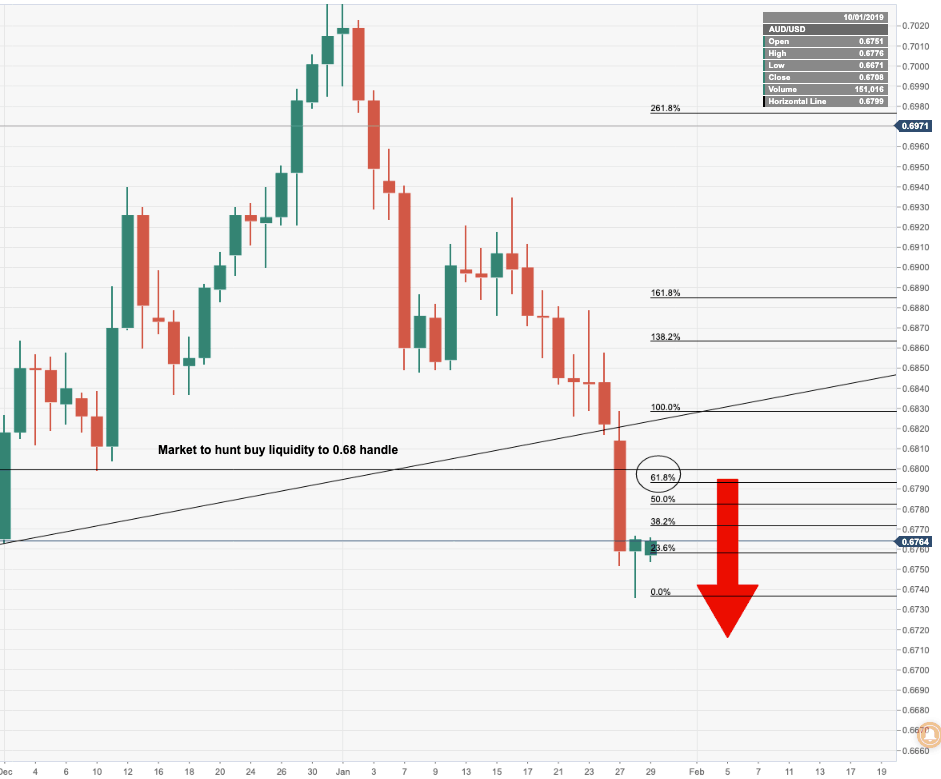

- AUD/USD hugging a 161.8% Fibonacci extension level ahead of CPI.

The Reserve Bank of Australia forecasted trimmed mean inflation to come in at 0.4% and 1.6% YoY, which had been published in the SoMP. However, the key focus will have been on the Aussie jobs data back on the 23rd which showed glimmers of positives considering the trend in a falling unemployment rate. The data boosted the Aussie into buy stop liquidity, an area forecasted ahead of the data, before the market changed course on risk-off flows and a stronger greenback.

An inline CPI result today could give the bulls some buying power and protect the price from slipping further, especially when considering the divergence between momentum and price action on the hourly charts as well as a bullish development on the daily chart in the same regard following a bullish pin bar overnight. However, the most that could be hoped for is a bullish correction back to 0.68 the Figure and buy stop liquidity slightly beyond (0.6830s).

Bullish CPI: 0.6813 comes in as a prior 61.8% Fiboretracement target of the prior downside impulse

AUD/USD can move back to the 0.68 handle. Should support hold in the 0.68 handle and prior support before the next impulse to the downside.

61.8% of recent downside impulse comes in 0.6790

The 61.8% Fibonacci may come as a resistance ahead of 0.68 handle. It is also worth noting that should the data not be a catalyst for significant price action, so long as the data is in line with the RBA's forecasts, a bullish scenario, then the price may take some time to grind higher into buy liquidity in the 0.68 handle ahead of the RBA meeting, 4th Feb.

Bears target 0.6700/20

In a bearish scenario, should CPI deteriorate significantly, there has been enough of a correction to see the bears take the price down to a -27.00% Fib target of 0.6714 and 0.6700 psychological number with a confluence of the Sep-Oct support-structure.

0.6780 comes in as a 61.8% Fibonacci retracement target of the prior downside impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.