AUD/USD Price Analysis: Bulls stay the course, eyes on 0.6800

- AUD/USD bulls have taken back control rom a peak bottom formation.

- Focus is on a move into the 0.68s for the days ahead.

As per the prior day's analysis, while the overall thesis is for a move to 0.6500, there has been a meanwhile prospect for 0.6800.

In the latest price action, we have seen a sweep of liquidity to 0.6630 which has seen 0.6700 taken out

AUD/USD prior analysis

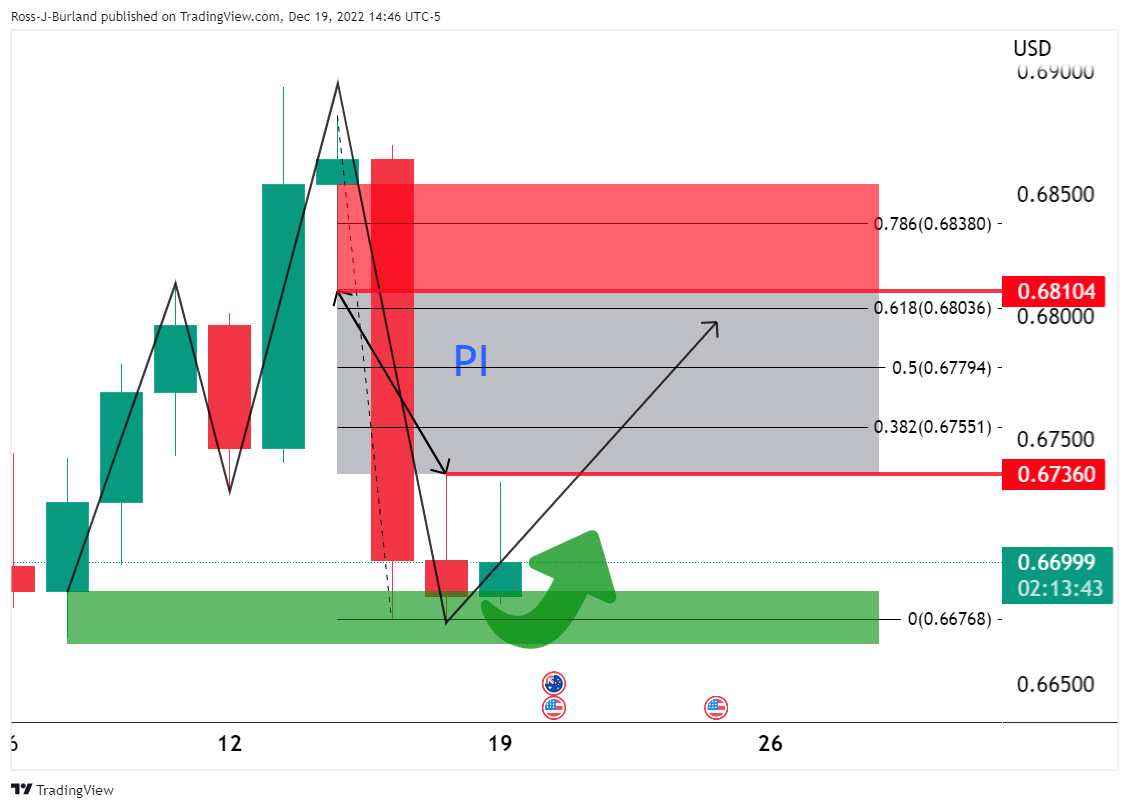

On the daily time frame it was shown that there is a price imbalance (PI) between 0.6736 and 0.6810 with the 61.8% ratio eyed as a confluence:

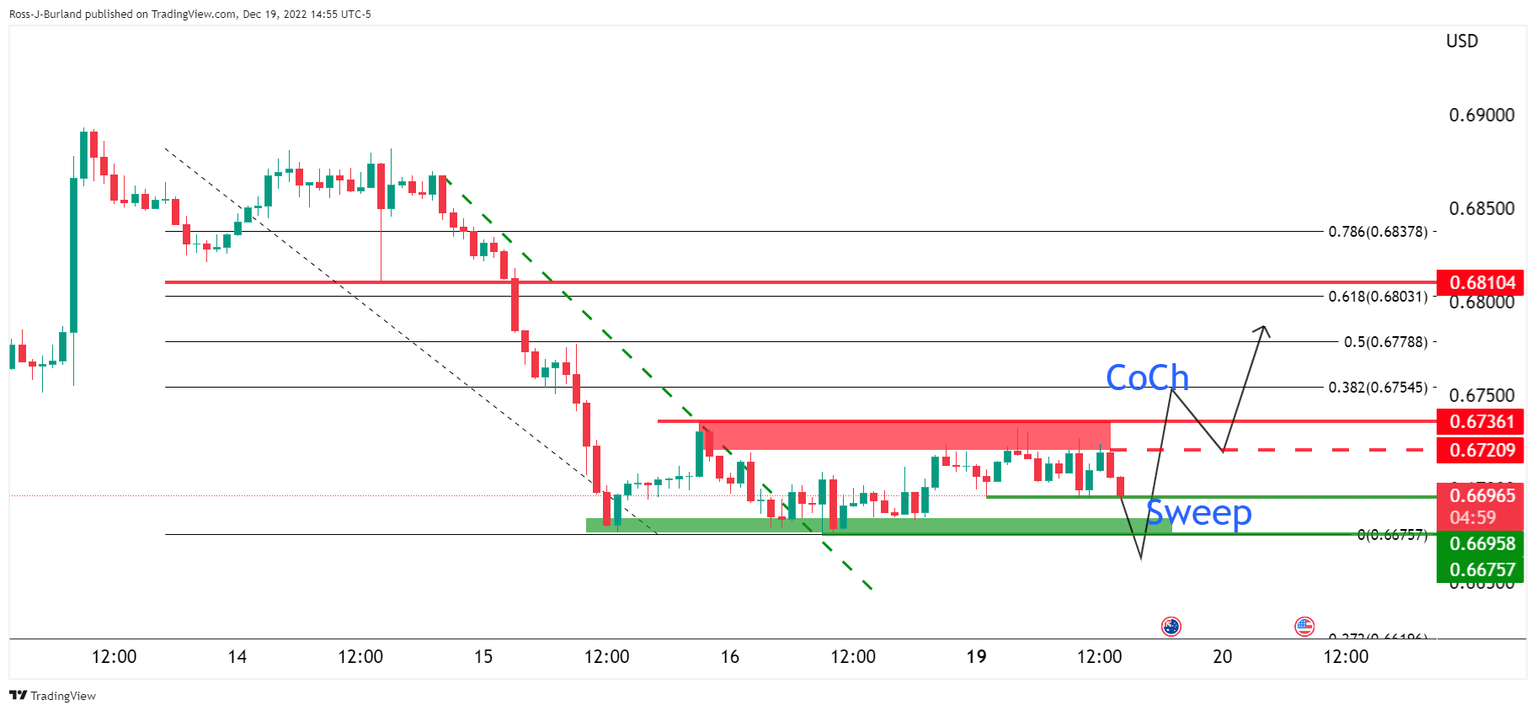

On the lower time frames, it was stated that the bulls will want to see a break of the trendline and prior lower high to confirm a bullish bias:

It was shown that there was a break in the trendline on the hourly chart but the market was coiling sideways.

There were equal lows at 0.6695 that were being pressured with liquidity in market orders expected below and under 0.6675 lows.

It was stated that a ''sweep' of the liquidity could result in a surge of demand from the bulls and ultimately provide enough fuel to take out the 0.6720 and then the 0.6736 resistance and create a change of character (CoCh) in the structure to bullish.

However, for the immediate future, 0.6700 is key support:

AUD/USD update

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.