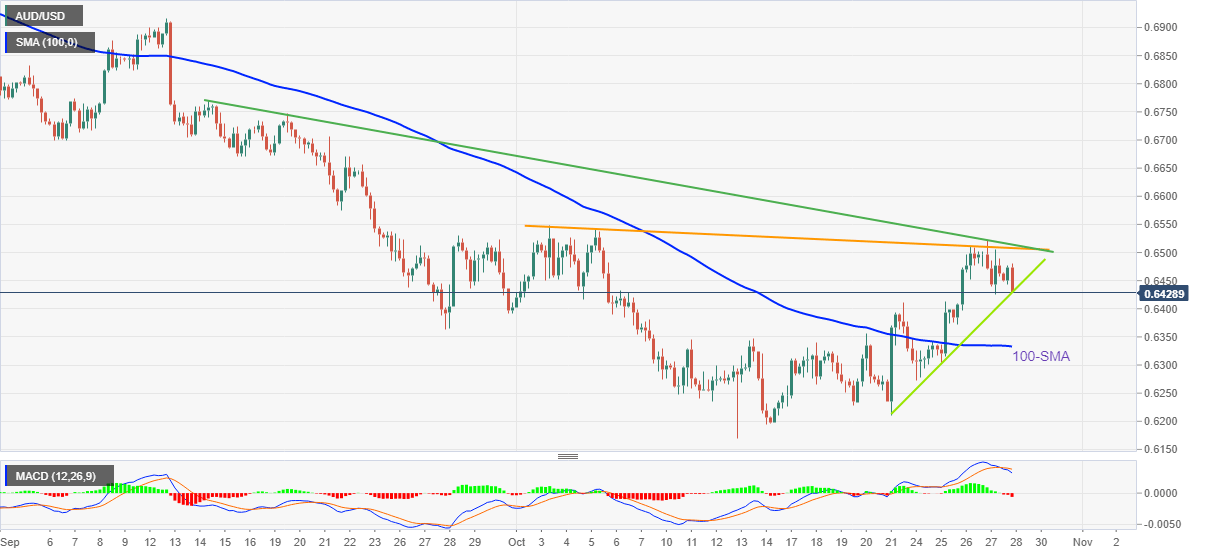

AUD/USD Price Analysis: Bears seek validation from 0.6430 support

- AUD/USD holds lower ground near intraday bottom, keeps latest pullback from three-week high.

- Bearish MACD signals, clear U-turn from the key resistance lines keep sellers hopeful.

- 100-SMA could probe bears on the way to yearly low.

AUD/USD sellers poke the weekly support line near the intraday low surrounding 0.6430. In doing so, the Aussie pair prints the second consecutive intraday loss during early Friday morning in Europe.

Given the bearish MACD signals, as well as the pair’s sustained pullback from the six-week-old and three-week-long resistance lines near 0.6500, the AUD/USD prices are likely to break the immediate support line near 0.6430.

Following that, the 100-SMA support level near the 0.6330 and the 0.6300 round figure may test the AUD/USD bears before directing them to the yearly low surrounding 0.6170.

Alternatively, a confluence of the aforementioned resistance lines around 0.6500 appears a tough nut to crack for the AUD/USD buyers, a break of which could quickly propel the prices towards the monthly high near 0.6550.

In a case where AUD/USD buyers keep the reins past 0.6550, the mid-September highs near 0.6770 could gain the market’s attention ahead of the previous monthly peak of 0.6915. If the quote remains firmer past 0.6915, the 0.7000 psychological magnet will be crucial to track.

Overall, AUD/USD remains on the bear’s radar even as a short-term rebound can’t be ruled out.

AUD/USD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.