AUD/USD Price Analysis: Bears have eyes on 0.70 the figure

- AUD/USD is in the hands of the bears, but a meanwhile correction can not be ruled out.

- 0.7000 is calling the bears while the 0.7050/'60s could be re-tested first.

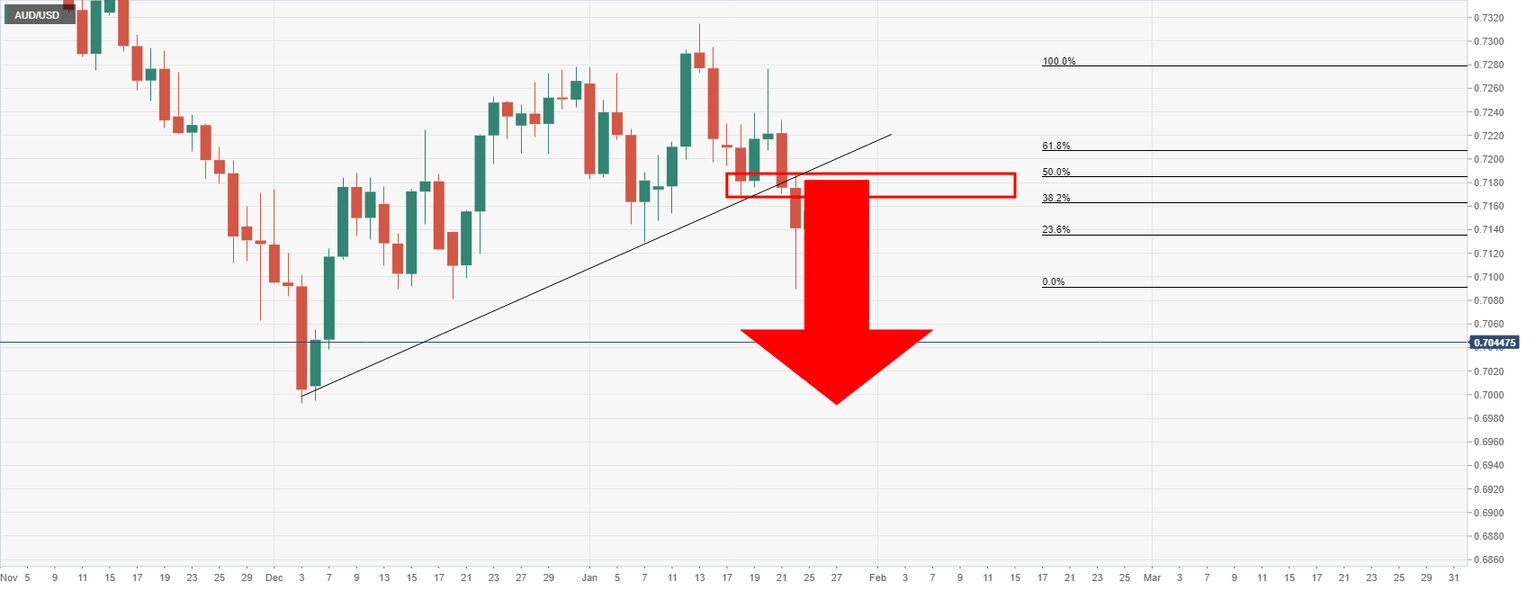

Following a break of daily trendline support, AUD/USD has been in the hands of the bears in a sharp and decisive impulse on the daily chart which could be destined to test the December swing lows:

AUD/USD daily chart

Since the break of the trendline support, the price retested the old support area and was subsequently resisted which led to a downside continuation as follows:

The bears are well and truly in control and a daily close below the midpoint of the 0.70 area could indicate that the path of least resistance will continue to be to the downside for the rest of the week.

With that being said, a bullish correction on the lower time frames could be in order first:

The M-formation is a risk for bears considering the high probability that the price will revert back to, or towards the neckline of the pattern. The 38.2% Fibonacci could come under pressure in this regard before the next wave of selling occurs at a discount from current levels. This puts the 0.7050/'60s on the map for the remaining sessions ahead for the week in the first instance. On the other hand, should the bears commit prior to there, then 0.7000 could be seen first.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.