AUD/USD declines towards 0.6500 as USD Index prints a fresh 10-week high amid hawkish Fed bets

- AUD/USD is expected to find support around 0.6500 as the USD index has refreshed its 10-week high at 104.45.

- Rising US consumer spending could force the Federal Reserve (Fed) to remain hawkish ahead.

- Reserve Bank of Australia Lowe is expected to deliver interest rate guidance for the June policy meeting on Wednesday.

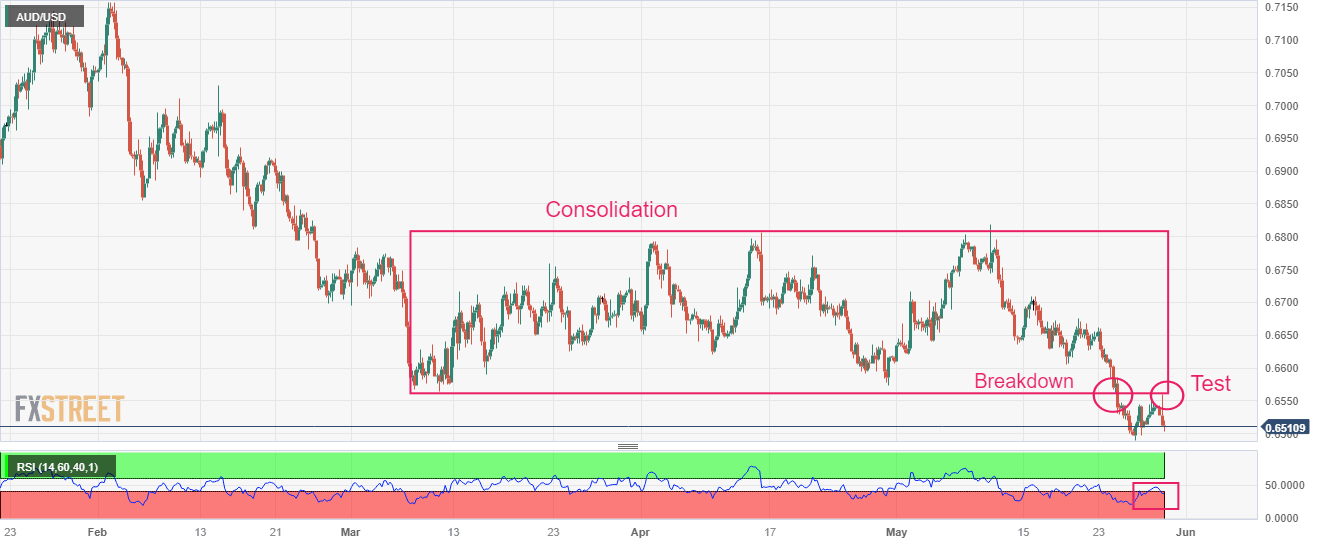

- AUD/USD has been critically dumped after testing the breakout region of the prolonged consolidation around 0.6560.

AUD/USD is declining towards the round-level support at 0.6500 in the early European session. The Aussie asset has witnessed immense selling pressure as the US Dollar Index (DXY) has printed a fresh 10-week high at 104.45 on expectations that the Federal Reserve (Fed) will not halt the policy0-tightening spell in June and will continue hiking interest rates further to keep weigh on stubborn United States inflation.

S&P500 futures have continuously eased gains in Asia posted on Monday as investors are worried that Tuesday’s trading session could be extremely volatile after an extended weekend. The overall market mood has turned cautious as investors are anticipating one more interest rate elevation from the Federal Reserve.

The US Dollar Index (DXY) has refreshed its 10-week high as investors have shifted their focus from the US debt-ceiling issues amid optimism that it will get passage from Congress to June’s monetary policy meeting by the Federal Reserve after observing resilience in consumer spending.

Meanwhile, a confirmation of a raise in the US borrowing cap by the White House has put sheer pressure on the US Treasury yields. The yields offered on 10-year US government bonds have slipped below 3.77%.

Resilience in US consumer spending accelerates hawkish Fed bets

Consumption expenditure data released on Friday showed that United States households are showing stubbornness in lowering their consumption despite higher interest rates by the Federal Reserve and higher cost of living. Federal Reserve’s preferred inflation tool Personal Consumption Expenditure (PCE) Price Index rebounded firmly. Monthly headline and core PCE Inflation (April) accelerated by 0.4%. Also, monthly Personal Spending data expanded by 0.8% vs. the estimates of 0.4% and the former expansion pace of 0.1%. While Personal Income matched expectations at 0.4%. This indicates that consumer spending is deepening significantly, which would force the Federal Reserve (Fed) to remain hawkish ahead.

US Employment to provide base for Federal Reserve’s policy stance

This week, the release of the United States Employment data will provide a base to Federal Reserve policymakers for designing June’s monetary policy stance. The Employment data will kick off with US JOLTS Job Openings data, which will release on Wednesday. The economic data is seen falling to 9.35M vs. the prior release of 9.59M. This indicates that firms have slowed down their hiring process due to a bleak economic outlook. Later on, US Automatic Data Processing (ADP) Employment Change (May) will be in focus. As per the consensus, the US economy added fresh 170K jobs in May, lower than the prior addition of 269K. The week will be ended with Nonfarm Payrolls (NFP) data, which will be extremely crucial.

An overall ease in labor market conditions could fade the impact of resilience in consumer spending and would allow the Federal Reserve to go neutral on interest rates.

Australian Inflation to remain in spotlight

A power-pack action is anticipated in the Australian Dollar amid the release of the Australian monthly Consumer Price Index (April), which is scheduled for Wednesday. The economic data is seen rebounding to 6.4% from the former release of 6.3%. Investors should note that Australian monthly CPI has quickly softened in the past four months from December’s height of 8.4% to March's 6.3% figure. Australian Retail Sales have remained stagnant earlier as the higher living cost is biting deep pockets of households.

Apart from that, Reserve Bank of Australia (RBA) Governor Philip Lowe’s speech will be keenly watched. Reserve Bank of Australia Lowe is expected to deliver interest rate guidance for the June policy meeting.

AUD/USD technical outlook

AUD/USD has been critically dumped by the market participants after testing the breakout region of the prolonged consolidation around 0.6560 on a four-hour scale. The consolidation formed in a wide range of 0.6562-0.6810 in which inventory adjustment took place.

The Relative Strength Index (RSI) (14) has slipped into the bearish range of 20.00-40.00, which indicates more downside ahead.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.