AUD/USD bulls eye a bull correction as Evergrande risks start to abate

- Evergrande contagion risk is abating and global stocks are back on track, supporting corrective prospects for AUD.

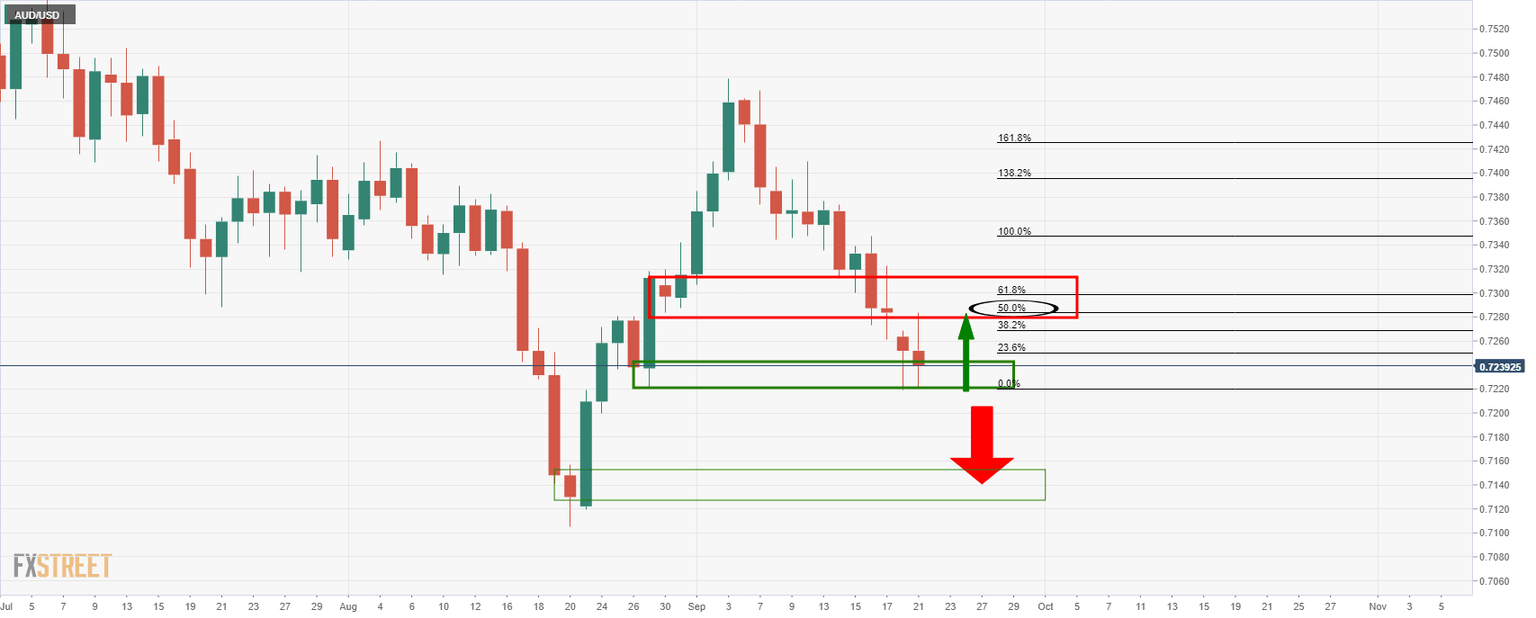

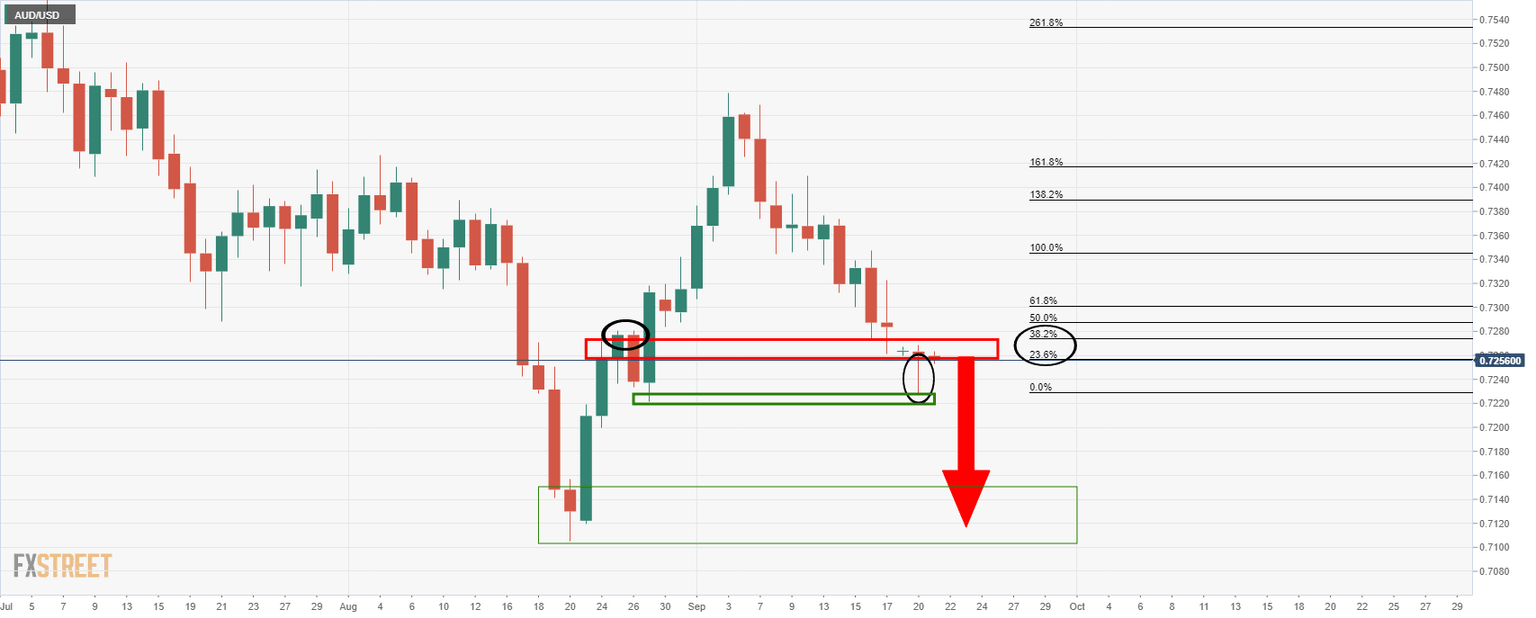

- Bulls eye a run back to a 50% mean reversion that meets old structure could be targetted near 0.7280. Failures below 0.7220 open risk of a retest of the mid-Aug lows and 071 the figure.

AUD/USD has been pressured and faded below a 21 and 50 moving average cloud on Tuesday, headed into the Wall Street closing bell down some 0.17% on the day so far. AUD/USD has travelled from a high of 0.7283 to a low of 0.7221. The commodity complex is attempting a comeback but a cautionary tone persists surrounding the Evergrande debt troubles and the prospects for the Fed's taper before the end of the year.

Evergrande contagion risk abates

However, a light at the end of the tunnel is growing as investors grew more confident that contagion from the distress of Evergrande would be limited. In turn, MSCI's gauge of stocks across the globe gained 0.35%, following Monday's biggest percentage drop in two months. European indexes also rose solidly. The Cboe Volatility Index retreated after hitting a four-month high a day earlier, last down 2.25 points to 23.46 and Wall Street could be in for a bullish close which bodes well for the correlated AUD:

US Stocks, S&P 500 closing bell forecast: Bullish prospects for the close

On Tuesday, the S&P Global Ratings report Monday gained traction where it stated that it does not expect Beijing to provide any direct support to Evergrande. "We believe Beijing would only be compelled to step in if there is a far-reaching contagion causing multiple major developers to fail and posing systemic risks to the economy," the rating agency said. "Evergrande failing alone would unlikely result in such a scenario," S&P said.

AUD pressured as CNY remains offered

The offshore yuan remains around a one-month low on Tuesday vs the US dollar. Safe haven correlations in forex remain in play which is hurting AUD as investors stay on the sidelines due to the potential default by property developer China Evergrande.

The yuan stood at 6.4655 per dollar 30-minutes into the closing bell on Wall Street after weakening as far as 6.4879 on Monday for the first time since Aug 23.

Mainland markets have been shut for holidays but open again on Wednesday.

RBA considers modifications to QE

Overall, the RBA’s September Board meeting minutes on Monday were dovish.

Analysts at ANZ Bank indicated, in light of the Delta outbreak, the RBA considered two possible modifications to its QE program:

''To maintain the recent rate of purchases at AUD5bn per week until at least November and then review the program.

To reduce the purchases to AUD4bn per week but then delay the next review period to mid-February 2022.''

The analysts explained that the central bank went with the second option, and stated that the minutes indicate why:

''The most pertinent factor was the view that the economy will rebound relatively quickly, so tapering was preferred. 'With the economy expected to return to its pre-Delta path by mid-2022, members assessed that, on balance, tapering remained appropriate.' We agree with the assessment and expect the economy to rebound in Q4 and continue its recovery in 2022.

This is why we think that, at the next review in February, we are likely to see a further tapering of the QE program down to AUD3bn per week and an eventual end in August.''

Moreover, the bank expects progress towards its inflation and employment goals will be slowed by the delta variant, noting “There was considerable uncertainty about the timing and pace of the recovery, which was likely to be slower than experienced earlier in 2021.”

Additionally, the RBA noted that since lockdowns are likely to be lifted gradually, the recovery could be slower than what was seen earlier in the pandemic.

The next policy meeting is October 4 and another dovish hold is expected.

AUD/USD technical analysis

As per the analysis ahead of the RBA Minutes, AUD/USD Price Analysis: RBA Minutes in focus, break of 0.7220s eyed, the price has indeed moved in on the 0.7220 level with an exact low of 0.7221 so far.

AUD/USD prior analysis

AUD/USD live market

The daily wick as illustrated in the prior daily chart was filled into the target and now the bulls could well see value here. A run back to a 50% mean reversion that meets old structure could be targetted near 0.7280. However, failures below 0.7220 open risk of a retest of the mid-Aug lows and 071 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.