AUD/USD Price Analysis: RBA Minutes in focus, break of 0.7220s eyed

- AUD/USD attempts a recovery towards 23.6% or 38.2% Fibonacci ratios.

- RBA Minutes could rock the apple cart in near-term trade.

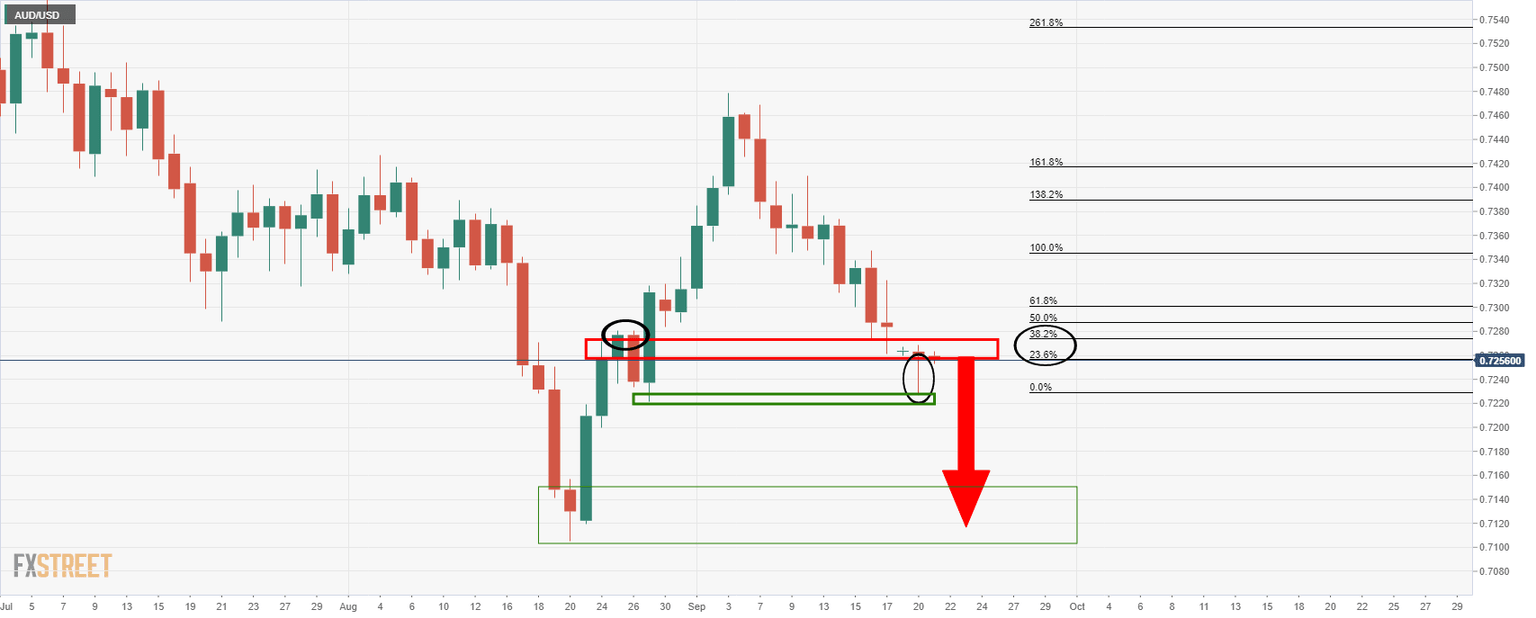

From a daily perspective, the price was offered into prior lows overnight that had been acting as a support structure.

Ordinarily, we would expect a correction at this juncture to test at least the 23.6% or 38.2% Fibonacci ratios before the next leg to the downside:

AUD/USD daily chart

A move to the downside would target the overnight lows in the 0.7220s and fill in the wick. The wick represents a lower time frame correction.

The mid-Aug lows of 0.7105 are thereafter. However, if sentiment really deteriorates a big risk-off move making for disorderly gyrations in the financial markets would be expected to weigh heavily on proxy currencies such as the Aussie.

The RBA Minutes September meeting are scheduled for near term trade which could rock the apple cart if they will provide colour on the risks to the central case forecasts. An overtly dovish theme could see AUD move lower over the release. A hawkish tilt, which is unlikely, would be expected to support the currency.

Governor Philip Lowe recently argued that “there is a clear path out of the current difficulties and it is likely that we will return to a stronger economy next year.” But he admitted to a lower degree of confidence about the economic rebound on looser restrictions, given that Australia won’t return to ‘Covid zero.’

Lowe also took aim at money market pricing: “I find it difficult to understand why rate rises are being priced in next year or early 2023.” He argued that “it will take some time for wage increases to lift to a rate that is consistent with achieving the inflation target.”

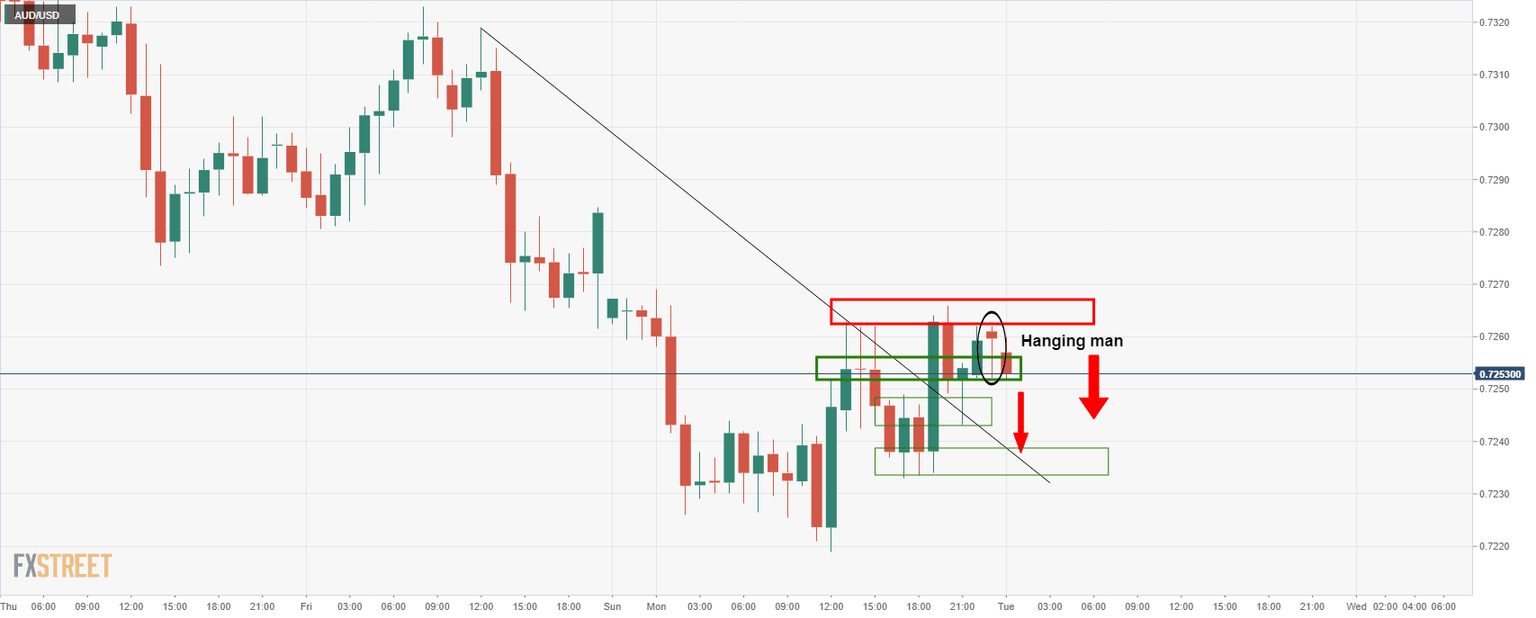

Meanwhile, we have a hanging man on the hourly chart at resistance which does not bode well for a market that is trying to move higher:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.