AUD/USD bulls cheer a less hawkish outcome at the Fed

- AUD/USD bulls move in on a dovish tilt at the Fed.

- The bulls have broken a key daily resistance level and eye space in the 0.7000s ahead of the RBA.

AUD/USD is moving through a critical level on the daily chart (see below) and has reached a high of 0.7000 following a dovish outcome at the Federal Reserve. AUD/USD has climbed by over 0.8% on the day so far from a low of 0.6911 to a high of 0.7000.

The US dollar has come under pressure along with US yields which have given a lifeline to the commodities sector and US stocks following a dovish tilt at the Federal Reserve that raised rates by the expected 75bps, but lower than the 100 bps that in part had been anticipated in the face of rising inflation. However, the Fed's acknowledgement of the risks to the US economy and a moderation in the labour market going forward has put the breaks on big interest rate hike expectations among investors.

Main takeaways from the Fed statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, the unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Traders are pricing for a more dovish outcome for the September meeting as the Fed turns data-dependent. The Fed's chairman's presser concluded in recent trade and following a cautiously optimistic tone over the US economy, with Jerome Powell warning of a softer labour market, the US dollar is down to the lows of the day at 106.279, losing 0.86% as per the DXY index.

Fed Powell key takeaways,

-

Powell speech: We want to get to 3% to 3.5% by end-2022

-

Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: Another unusually large increase could be appropriate at next meeting

-

Powell speech: Labor market is extremely tight

-

Powell speech: Growth in consumer spending has slowed significantly

-

Powell speech: Another unusually large increase could be appropriate at next meeting

- Powell speech: Time to go to a meeting-by-meeting basis

-

Powell speech: We want to get to 3% to 3.5% by end-2022

-

Powell speech: Want to see demand running below potential for sustained period

- Powell speech: Balance sheet reduction will be picking up steam

- Powell speech: Households are in very strong shape

More to come from the US calendar

Meanwhile, traders will now look to the US growth data tomorrow and inflation readings on Friday. A positive reading for growth in Q2 following the -1.6% QoQ saar plunge in the first quarter could support the greenback as it might ''quash talk of recession, at least for the H1'', analysts at Rabobank argued. ''That said, speculation will remain as to the size and extent of any potential downturn in 2023.'' On Friday, the Fed’s favoured PCE deflator numbers will also be key.

RBA in focus

Domestically, AUD was choppy ahead of the Fed following the inflation data in the Asian session and in anticipation of an interest rate hike at next week's Reserve Bank of Australia meeting. ''We had forecast a 75bps RBA hike at next week's meeting. We now expect the Bank to hike 50bps at the meeting,'' analysts at TD Securities argued following the inflation data.

''With Q2 Aus Headline inflation underwhelming ours and street forecasts and the Fed unlikely to deliver a 100bps hike tomorrow, a 75bps RBA hike is difficult to justify. Headline inflation above 6% YoY and trimmed mean inflation at 4.9% YoY, the highest since 2003, keeps 50bps RBA hikes on the map.''

The analysis said that aside from amending their Augustcall, their rate hike path remains unchanged in 2022 - Sep +50bps, with 25bps hikes in Oct, Nov, Dec taking the year-end cash rate at 3.10%. ''Our terminal rate forecast remains unchanged at 3.35%, but is now reached in Feb'23, not Dec'22, as per our prior forecast.''

AUD/USD technical analysis

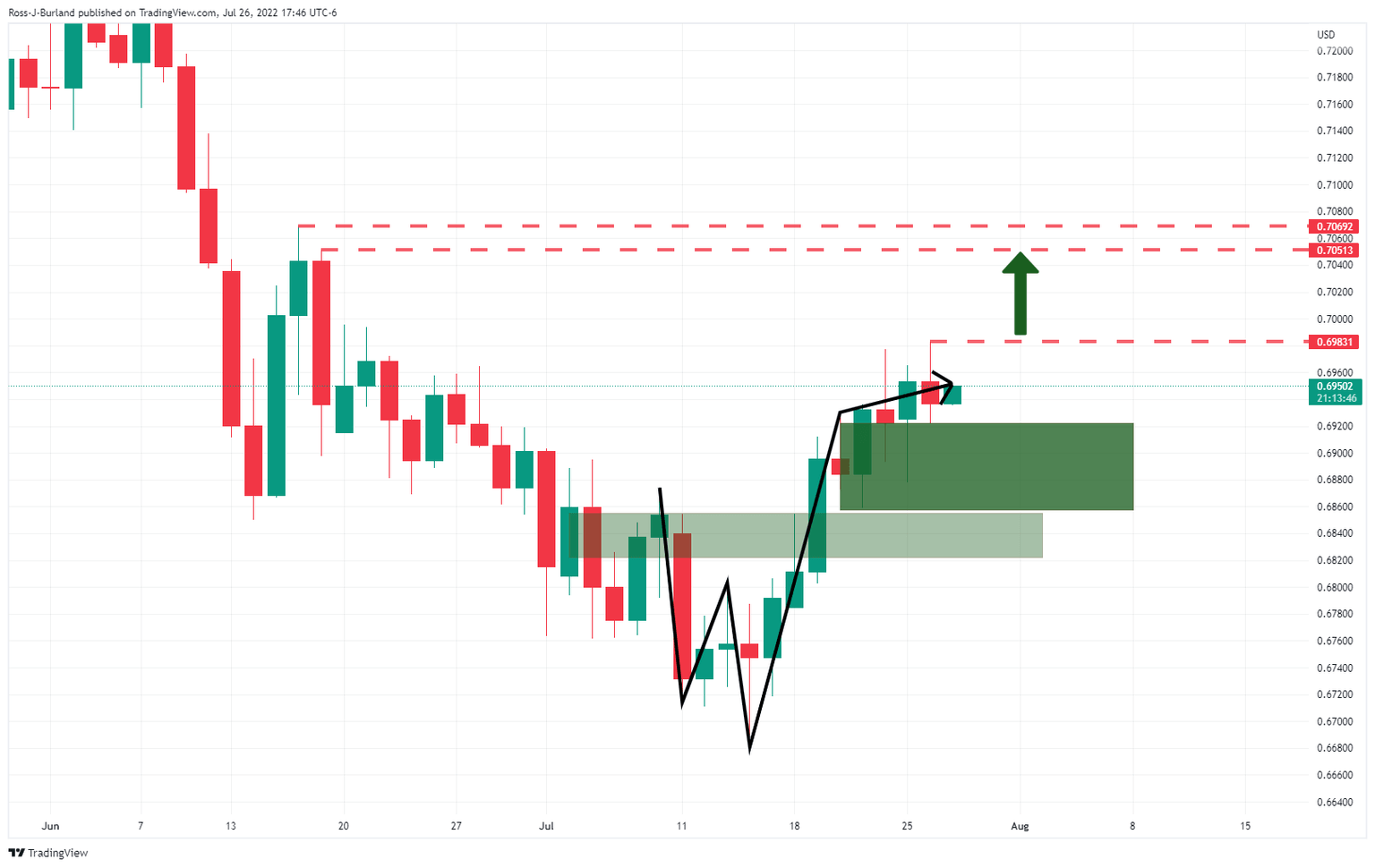

As per the prior analysis, AUD/USD Price Analysis: Bulls eye a break of 0.6980 or face a move lower, the bulls have indeed moved through the resistance and now can target higher.

AUD/USD, daily chart, prior analysis:

From a 4-hour perspective, below, the price has almost completely mitigated the price imbalance between 0.7003 and 0.7013 which now leaves the scope for a bearish correction in the immediate future, prior to the next bullish impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.