AUD/USD Price Analysis: Bulls eye a break of 0.6980 or face a move lower

- AUD/USD bulls need to break 0.6890 for bullish prospects ahead.

- There is scope for a meanwhile bearish correction ahead of and around key events.

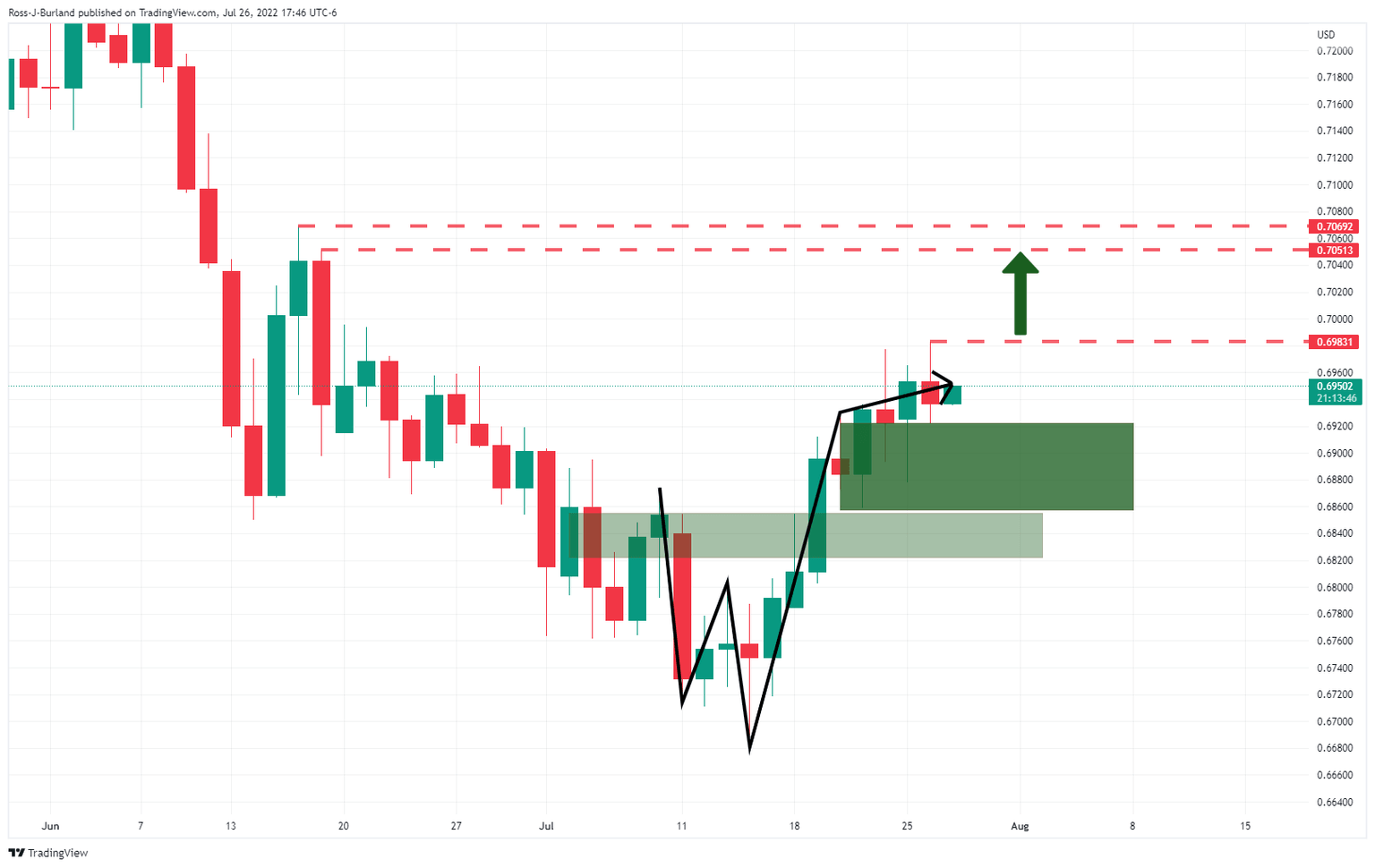

AUD/USD is on the from foot put there are prospects of a bearish correction as we head into the key data events for the day ahead that include Aussie inflation and the Federal Reserve. With that being said, if the bulls commit at this juncture, and break 0.6980/90, then the 0.7050/70s will come into focus. The following illustrates the price structure across a number of time frames.

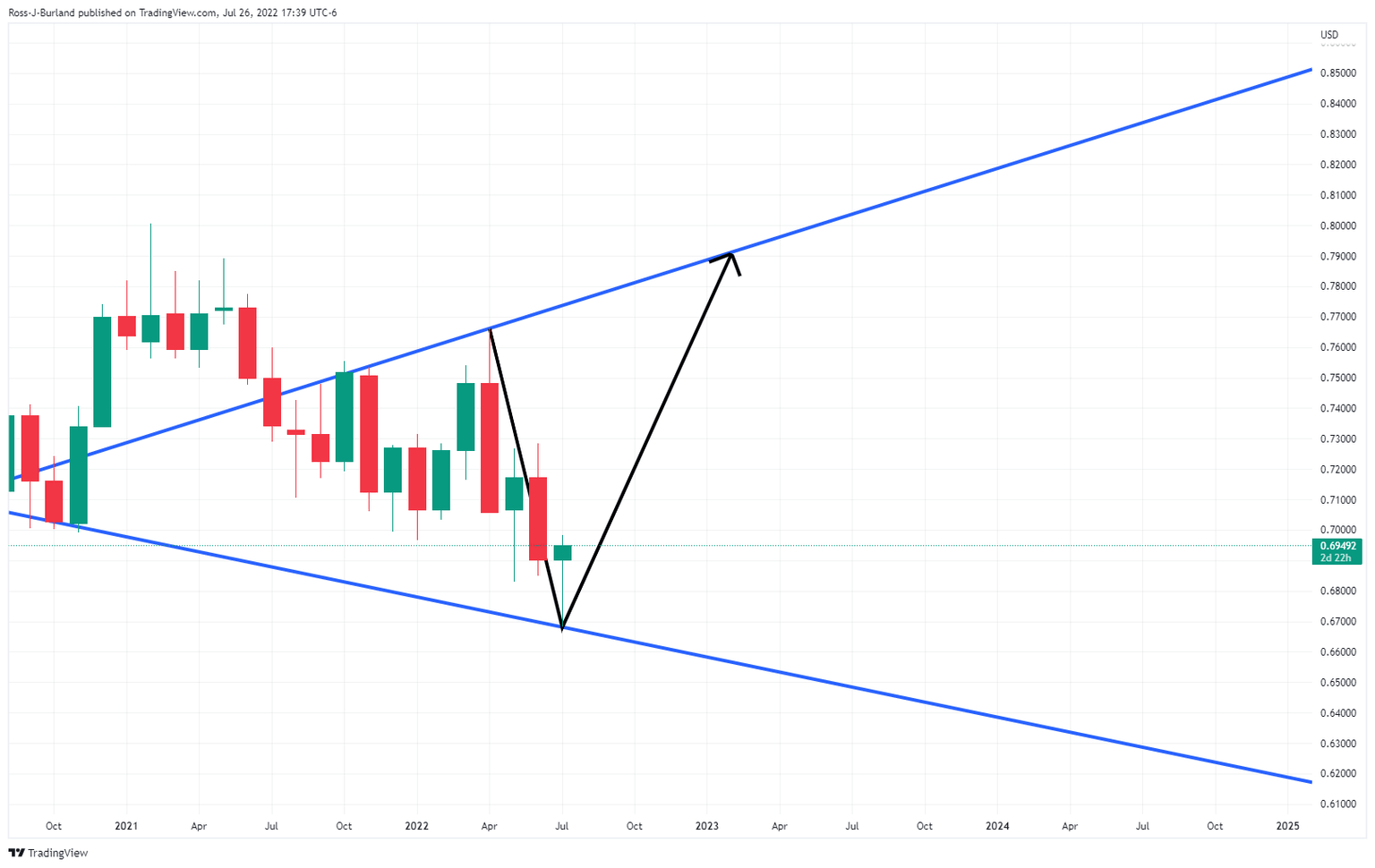

AUD/USD monthly chart

The monthly chart is showing the price is making its way into an extreme of the lower end of the broadening formation. This leaves scope for upside for the weeks and months ahead. 0.6990 will be important in that respect as the prior swing lows and structure point looking left.

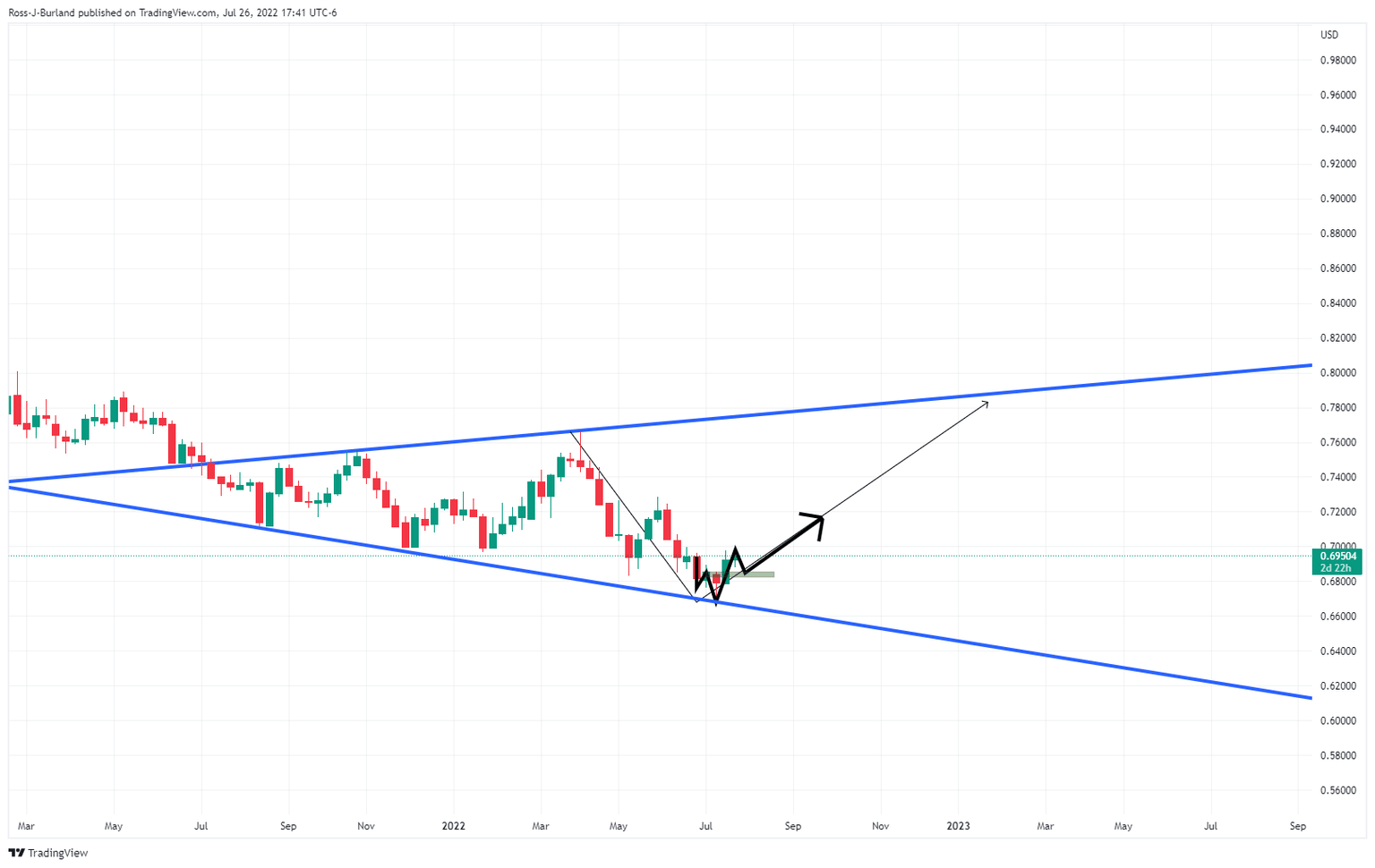

AUD/USD weekly chart

The price has already made a move higher but it has left a W-formation on the weekly chart and this leaves prospects of a meanwhile correction on the cards for the days and week ahead. The bulls could well engage from the neckline between 0.6850 and 0.6880.

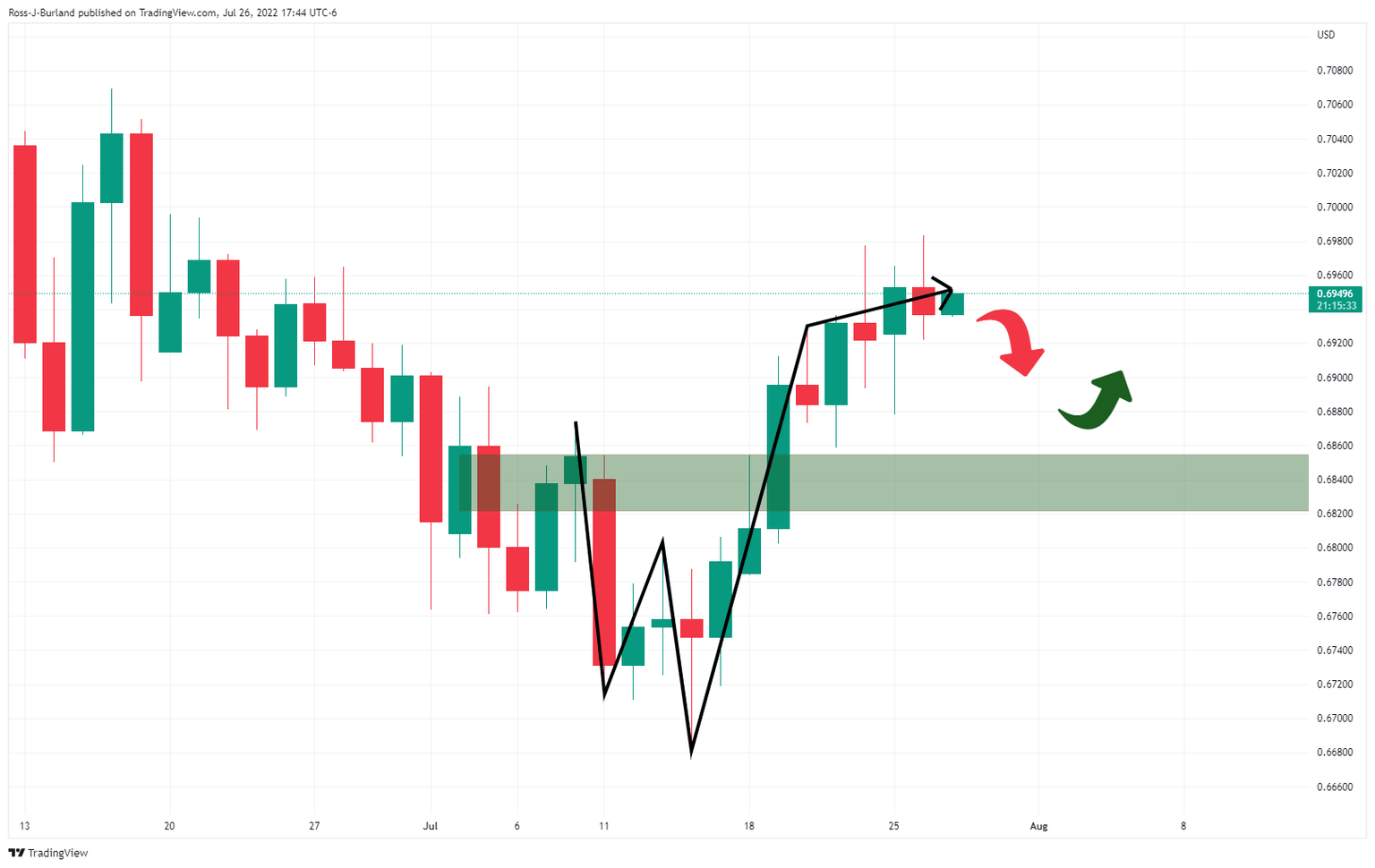

AUD/USD daily chart

The price is forming a rounding formation on the daily chart with a lack of bullish momentum which exposes the aforementioned levels to the downside for the days ahead.

With that being said, if the bulls commit at this juncture, and break 0.6980/90, then the 0.7050/70s will come into focus.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.