AUD/USD bulls and bears battle it out for territory post RBA

- AUD/USD is at a technically critical juncture as bulls and bears go head to head post the RBA.

- Mixed risk sentiment is making for testing conditions for AUD at this juncture after bulls made fresh three week highs.

AUD/USD is currently trading at 0.6953, down some 0.28% at the time of writing after giving back gains between 0.6997 and 0.6921.

The Aussie has been in favour of late, holding in the realms of the daily highs, an area between 0.6774 and 0.7064 set following a resurgence from the coronavirus driven lows set in March down at 0.5506.

The drive higher in the currency was partly down to a surplus current account and iron ore sale, but a major contributor was the drop in the US dollar which commenced on the 20th March.

Another contributed to the Aussie's allure is down to how well the nation appeared on the COVID-19 scoreboard.

A clean bill of health from that standpoint encouraged flows into the Aussie.

However, one stumbling block this week has been the news of the renewed outbreaks of the virus in Victoria which has seen lockdown in some suburbs of Melbourne an the closure of the border with New South Wales.

Victoria makes up a little over 20% of economic activity.

News that Stage 3 restrictions over 6 weeks are to be implemented for metropolitan Melbourne weighed on equities, the AUD, and gave bonds bid in the final hour of Australian trade.

This downside correction followed a nudge higher in the currency as the Reserve Bank of Australia left rates steady at 0.25% while Chinese stocks supported risk appetite globally.

The bulls scored a three-week top which drew in a focus for the June peak at 0.7069.

However, the RBA reiterated that it stood ready to pull the trigger to ease further if need be, considering an uncertain outlook for economic activity pertaining to a very fluid coronavirus tail risk.

Markets had been looking out for commentary around the recent strength of the currency.

However, while the Bank refrained from discussing the AUD, analysts at TD Securities believe the RBA commentary heading into the Sep/Oct RBA meetings will be more telling as many of the government benefits are expected to end.

AUD/USD levels

From an hourly perspective, the price action tallies up with that over on the DXY daily chart.

The DXY could be on the verge of a downside extension following a bullish corrective phase that looks as though it has run its course.

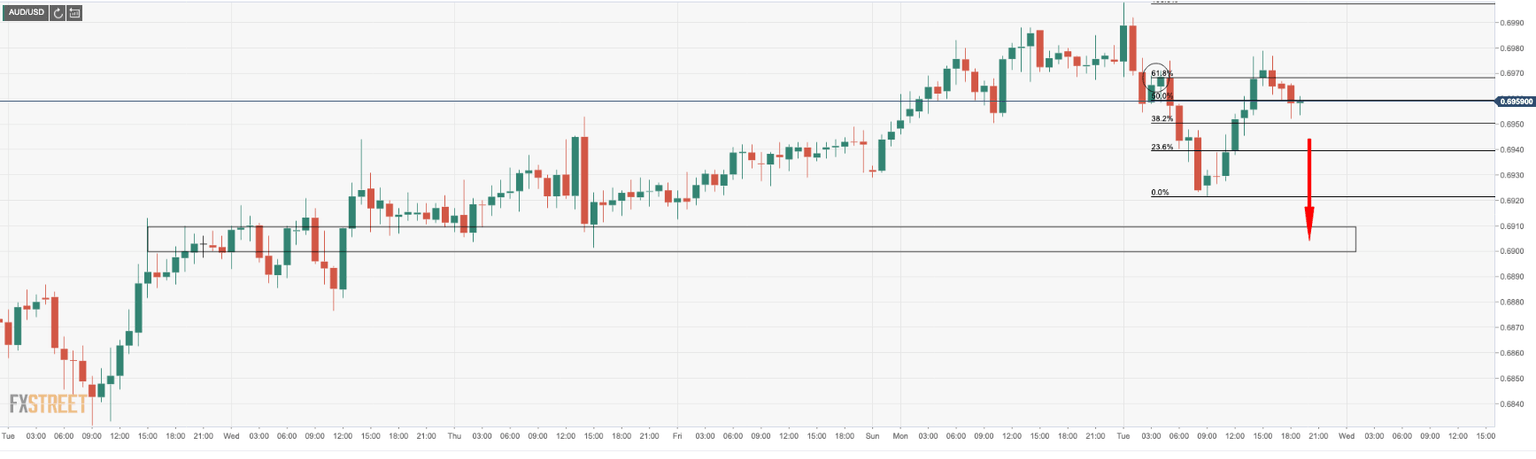

AUD/USD, on the other hand, is testing a 38.2% Fibonacci retracement support of the latest you'll impulse form the lows of the day.

0.6980 could be net on the bulls playbook ahead of a challenge of the recent peak at 0.6997 where bulls will set sights for the June peak at 0.7069 agaiin.

On the flip side, if the recent impulse is, in fact, a 61.8% retracement and correction of the recent downside from the peak to the lows, then a new wave of selling at this juncture opens risk back to test 0.69 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.