AUD/USD bounces after Australian trimmed mean CPI data, Fed rate-cut bets

- AUD/USD sees a brief up lift following higher trimmed mean CPI out of Australia in October.

- Figures showed headline CPI at multi-year lows but this was put down to lower energy and fuel prices.

- Further gains result from a slight increase in bets the Federal Reserve will cut rates in December.

AUD/USD bounces within a prolonged downtrend to trade in the 0.6870s on Wednesday after the release of Australian inflation data fails to change the widespread view that the Reserve Bank of Australia (RBA) will keep its “arms folded” at the next meeting, leaving its cash rate unchanged at a comparatively high 4.35%.

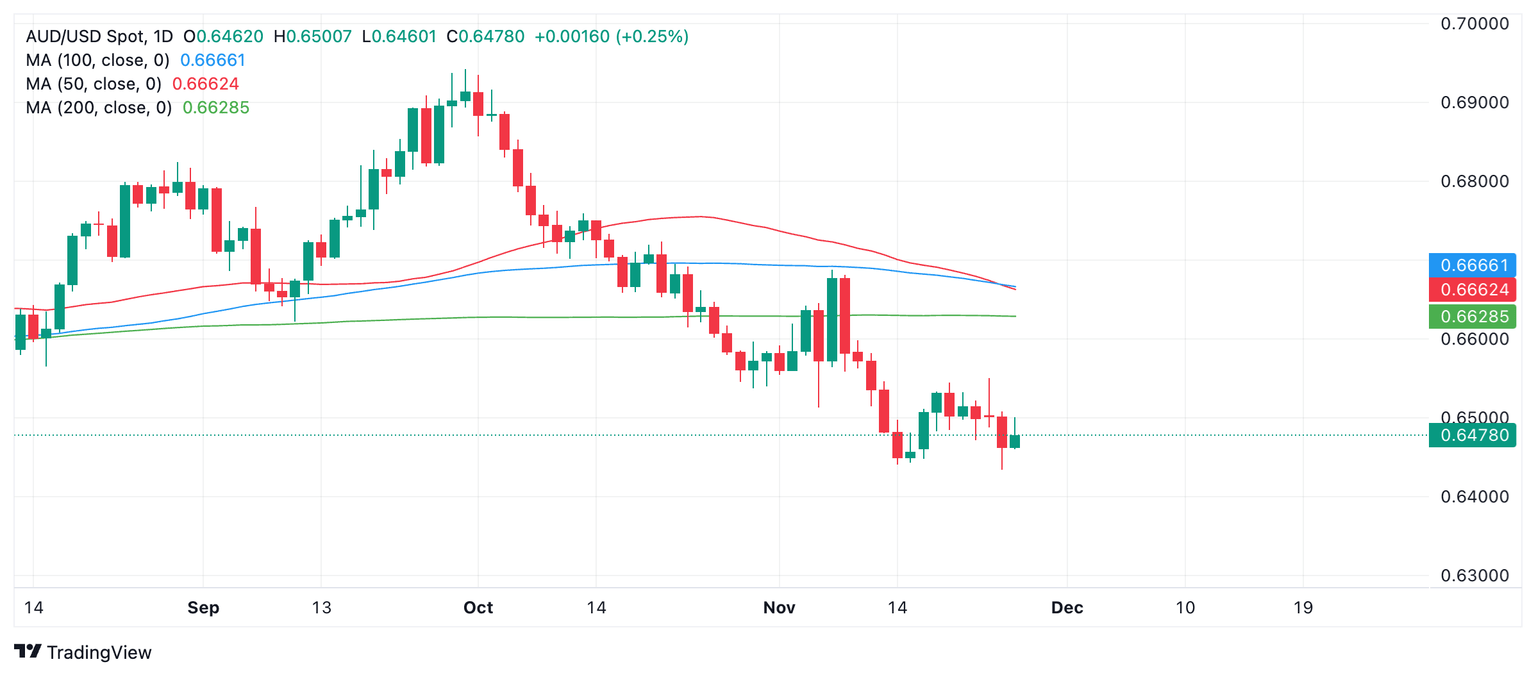

AUD/USD Daily Chart

The differential between central bank interest rates is a key driver of FX valuations, with central banks that have – or are expected to keep – interest rates relatively high compared to their peers seeing an appreciation in their country’s currencies.

AUD/USD is trading higher on Wednesday because unlike the RBA, the US Federal Reserve (Fed) is increasingly seen as likely to cut its key interest rate by 25 basis points (bps), or 0.25%, to a range of 4.50% – 4.75% at the Bank’s December policy meeting. Further, the US central bank has already cut by 75 bps this year whilst the RBA has not lowered rates at all.

The CME FedWatch tool calculates the probability of the Fed cutting by a quarter of a percentage point in December as 66.5% on Wednesday, up from the circa 56% at the beginning of the week.

Although still higher than the RBA rate, the greater likelihood of the Fed cutting is mildly supportive of the Australian Dollar (AUD) and AUD/USD.

AUD/USD’s downtrend since the beginning of October has been due to a radical change in market expectations about the trajectory of interest rates in the US. Prior to October these had been for the Fed to lower interest rates aggressively but robust US economic data led to a revision of these expectations. The outcome of the US Presidential election was a further factor supporting the pair.

Australian CPI data fails to encourage AUD

Data out overnight showed the Australian monthly Consumer Price Index (CPI) remained at 2.1% in October – the same as September – and lingering at three-year lows. This was below the 2.3% forecast by economists.

The Trimmed Mean CPI, however, rose by 3.5% in October from 3.2% in the previous month.

In addition, most of the weakness in price growth of the headline 2.1% figure was put down to falling energy prices due to the ongoing impact of the Energy Bill Relief Fund rebate. The data showed that energy prices as a subcomponent fell 35.6% in October. Lower global Oil prices also impacted headline inflation as petrol prices fell by 11.5%.

Since these factors are seen as transitory and not as representative of underlying inflation, the RBA is seen as unlikely to respond to them by lowering interest rates.

Although the headline CPI data failed to meet expectations the rise in trimmed mean CPI meant there was no change to the outlook for the RBA’s cash rate or the AUD.

Indeed, the RBA focuses more on the quarterly inflation figures, according to analysts at Brown Brothers Harriman (BBH) when it decides policy.

“It’s worth noting that the RBA focuses on the quarterly CPI prints because it’s less volatile and captures more items than the monthly CPI indicator. RBA cash rate futures continue to imply a first full 25bps rate cut to 4.10% in May (2025),” said Elias Haddad, Senior Markets Strategist at BBH.

The view was echoed by analysts at Societe Generale, who see no change in the cash rate at the RBA’s December meeting.

“The wait for lower rates in Australia continues and the RBA will sit on the fence until 2Q25 after another disappointing inflation print. Core CPI picked up to 3.5% YoY in October,” said Kenneth Broux, a senior FX strategist with the French lender.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.

-638683085962702896.png&w=1536&q=95)