AUD/NZD Price Outlook: Aussie looking for a floor against Kiwi, slumps to 1.0780

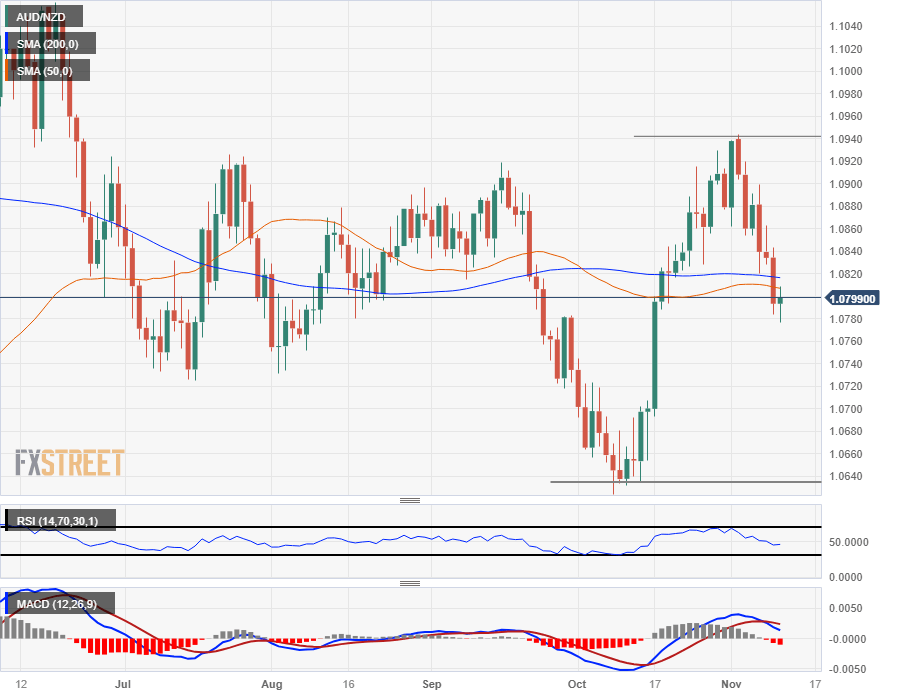

- The AUD/NZD has etched in a new weekly low at 1.0780 after a week of declines.

- The Aussie's backslide comes after reaching a technical ceiling at 1.0940.

- Buyers to be pushed to the back end for next week if they can't grab ahold of moving average barriers.

The AUD/NZD has managed to hold on for Friday, closing out the trading week close to flat on the last day after declining over 1.1% peak-to-trough from Monday's peak near 1.0900.

The pair still remains down almost 1.4% from the last meaningful swing high into 1.0945 and Aussie bidders are beginning to run out of track as the AUD/NZD rotates into a bearish technical pattern, slipping below the 200-day Simple Moving Average (SMA) and on pace to extend declines back into the last low set in October near 1.0640.

The Moving Average Convergence-Divergence (MACD) on the daily candles is confirming a bearish signal following a slow and fast moving average crossover, and a Relative Strength Index (RSI) still near the midrange but declining slowly is implying there's still room to run on the down side before hitting oversold conditions.

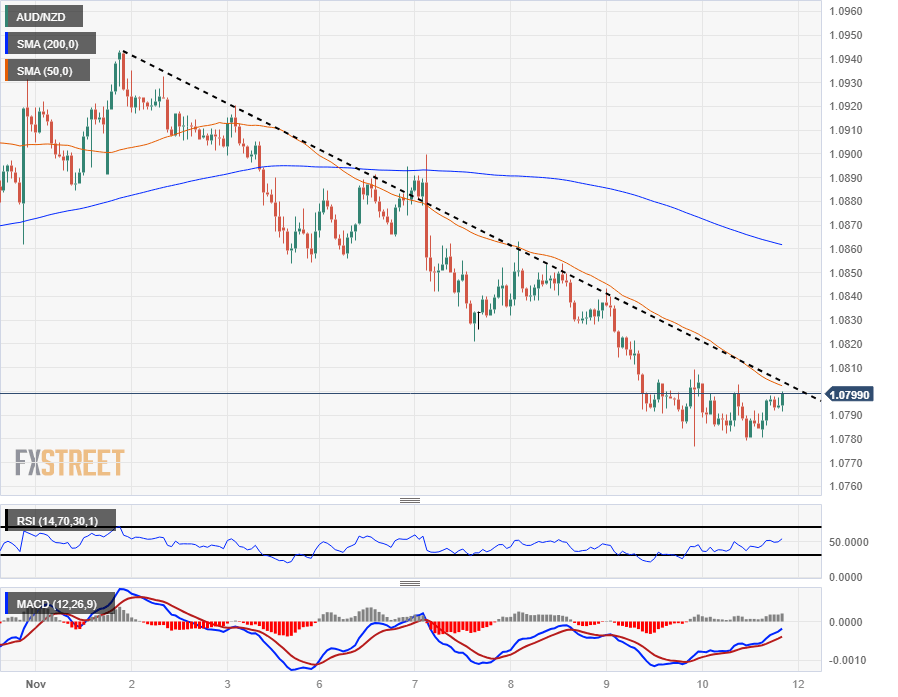

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.