AUD/NZD Price Analysis: The big day has arrived for this cross

- AUD/NZD outlook into the RBNZ event is bullish on a 25BP hike.

- Traders are fully pricing in a 25bp hike, although 50bp is the biggest risk.

The RBNZ meets today and analysts are overwhelmingly expecting a 25bp hike rather than 50bp. This is where the risk is for the cross. A 50bp increase will see the kiwi fly considering the market has clipped it wings on the basis that a hike has been well telegraphed for a long time

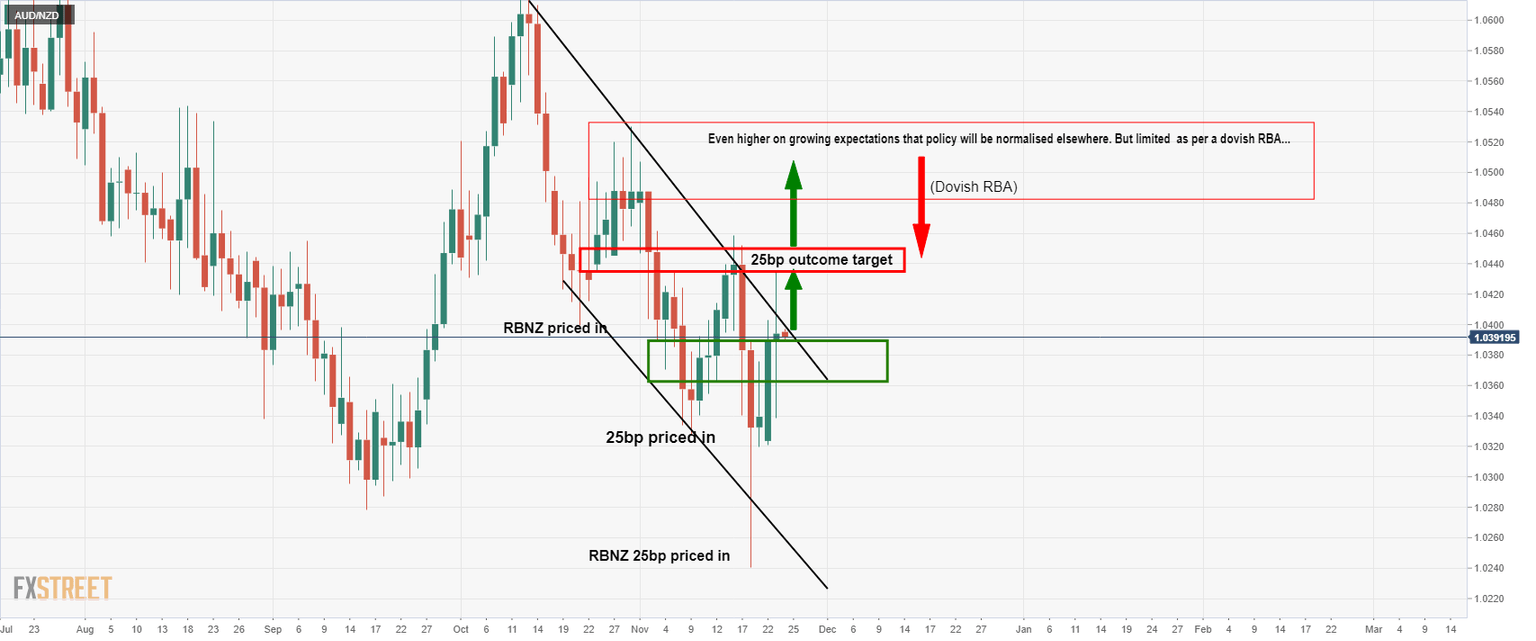

This brings us to the charts:

AUD/NZD daily chart

For the near term, this is the potential outlook for today's main event. Given the market will not be surprised that the RBNZ hikes, a move higher would not be unrealistic, especially as traders factor in the path of central banks in general. The RBNZ’s OCR track will be key in determining how far the kiwi could fall.

If there is a tendency towards an endpoint near 3% but dovish rhetoric, in so much that 25 bp OCR rate hikes will possibly be all we will get from the RBNZ between now and then, this leaves plenty of room for the RBA to catch up. Thus, there could be more value in the Aussie moving forward should a 2023 rate hike remain a possibility if inflation, wages and growth surprise to the upside.

In the event that there is a 50bp hike, there will be the toss-up between how detrimental this might be for the economy vs what this will mean to a market that is already long of NZD. The knee jerk will undoubtedly see a bid in the kiwi, especially as markets are nervous going into the meeting and waiting on the sidelines, waiting to pile in on such an outcome.

AUD/NZD H1 chart

The price would be expected to extend distribution that has started to take place ahead of the meeting. A break of the dynamic support would open the risk of a knee-jerk run on 1.0380 and then 1.0320 stops.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.