AUD/JPY Price Analysis: MACD teases bulls on a key day

- AUD/JPY attacks 76.00 after posting the biggest gains since Wednesday the previous day.

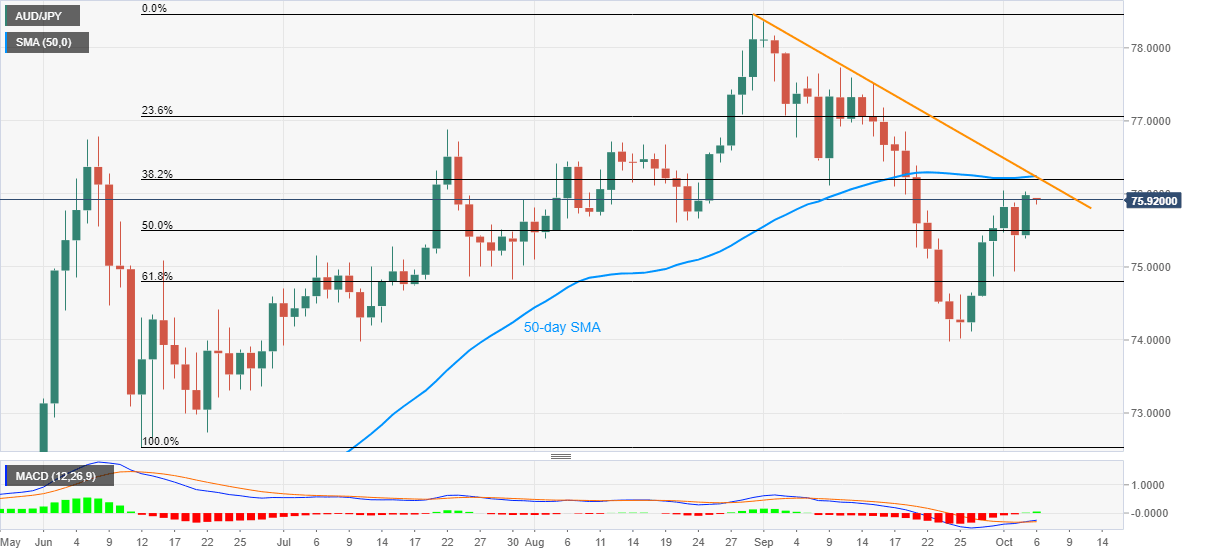

- 50-day SMA, falling trend line from August 31 and 38.2% Fibonacci retracement of June-August upside together offers strong resistance.

- Risk-on mood, upbeat momentum indicator favor the pair buyers ahead of RBA, Aussie budget.

- Important Fibonacci retracement levels can offer immediate support.

AUD/JPY takes the bids near 75.95 during the early Tuesday morning in Asia. The risk barometer earlier benefited from market optimism concerning US President Donald Trump’s health recovery, as he contracted the coronavirus (COVID-19) on Friday.

Even so, the quote trades below 76.20/25 resistance confluence including 50-day SMA, a five-week-old falling trend line and a 38.2% Fibonacci retracement level.

Other than the on-going market optimism, mildly bullish signals from MACD also lure the AUD/JPY buyers towards the important resistance ahead of the RBA Interest Rate Decision and Australia’s Federal Budget announcement, respectively around 03:30 GMT and 08:30 GMT.

Read: AUD/USD: Wavers below 0.7200 ahead of RBA, Aussie budget

In a case where the bulls manage to cross 76.25, the early August tops near 76.70 and the July month’s high surrounding 76.90 will be in the spotlight.

Meanwhile, 50% and 61.8% Fibonacci retracement levels, 75.50 and 74.80 in that order, can restrict the short-term downside of AUD/JPY.

Though, the pair’s downside break of 74.80 will make it vulnerable to revisit the September month’s low under the 74.00 threshold.

AUD/JPY daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.