AUD/JPY Price Analysis: Further upside hinges on 83.40 break

- AUD/JPY stays sidelined after refreshing the monthly high.

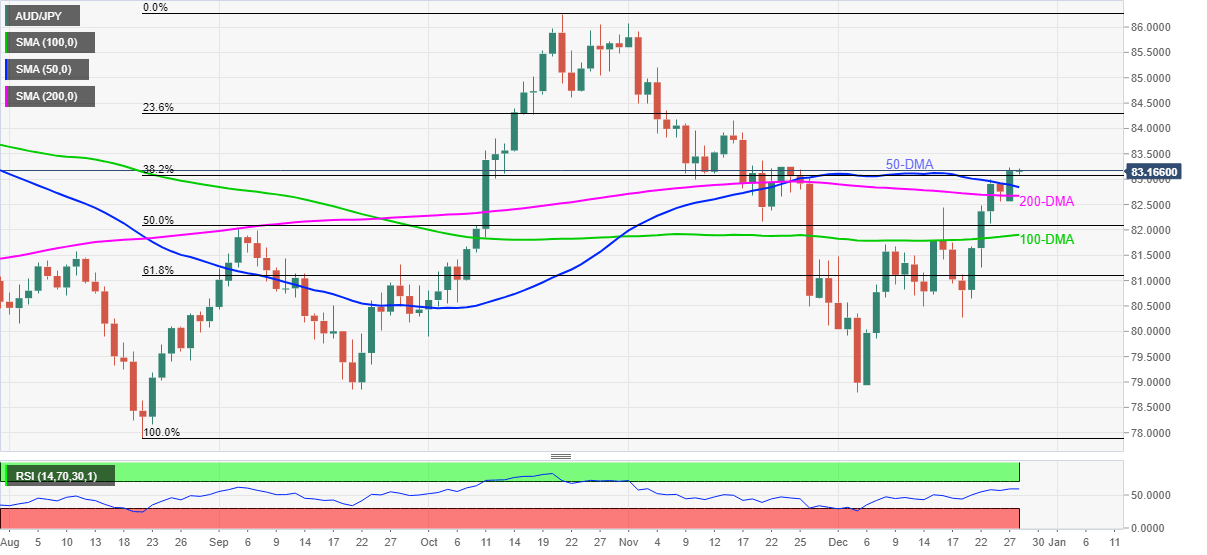

- Clear upside break of 50-DMA, firmer RSI hint at further advances of the quote.

- Late November swing highs challenge bulls, 100-DMA restricts the bear’s entry.

AUD/JPY bulls take a breather after renewing the monthly top near 83.20 during early Tuesday’s Asian session.

The cross-currency pair’s upside momentum gains support from the first daily closing beyond the 50-DMA in over a month and firmer RSI line, not overbought. However, tops marked during late November, around 83.40, seem to restrict the quote’s additional run-up.

Should the quote rises past 83.40, the 84.00 threshold and mid-November’s high near 84.15 will be in focus ahead of late October’s bottom of 84.60.

Meanwhile, pullback moves remain elusive until staying beyond the 50-DMA and the 200-DMA levels, respectively near 82.80 and 82.60.

Even so, the 100-DMA and 61.8% Fibonacci retracement of August-October upside, close to 81.90 and 81.10 in that order, will test the AUD/JPY bears before giving them the controls.

AUD/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.