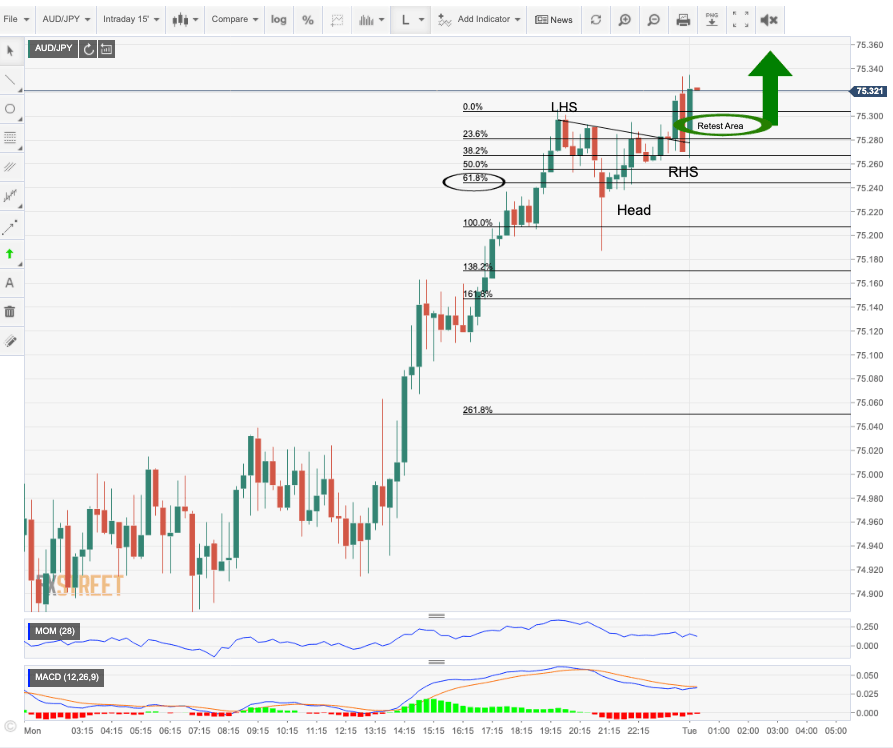

AUD/JPY 15-min chart long entry strategy playing out

This was a live price action developing trade story.

The objectives of the following are as follows:

- Protect capital.

- Breakeven.

- Hit 15-min profit target 1@ 75.35.

- Hit daily profit target 2@ 75.44.

The bulls have just broken up from a bullish Reverse Head and Shoulders completion pattern on the 15-min time frame.

A retest and hold above the neckline and support structure could confirm the bullish bias for a long entry with a stop below the structure.

So far, so good

As can be seen, as time goes by, the trade set-up is solid.

Bulls will look to move to their stop that is protected by structure to a breakeven point on a break and hold above new upside structure around 75.33 at the time of publishing the latest update.

Breakeven achieved:

Profit target 1 achieved:

Additional technical notes

- AUD/JPY is showing a 1-month high.

- Trend Strenght 4HR chart.

From a daily perspective, bulls hold above key structure as seen in the following chart with the upside target formed from the daily correction at wave 2.

Fundamental backdrop

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.