Apple stock is up 36% in two months: Is it time to sell AAPL?

- Apple stock has surged to near all-time highs in this rally.

- AAPL surge needs strong iPhone sales to back it up.

- iPhone 14 is rumored to be released on September 14.

Apple (AAPL) stock continues its relentless rise as it breaks above key trend line resistance. In doing so, Apple has nearly moved up in a straight line from the June lows. The adage that nothing goes up and down in a straight line may need to be ignored in the case of this one. Rising 36% in 42 trading sessions is an impressive feat, especially for such a large company.

Also read: Apple Stock Deep Dive: AAPL price target at $100 on falling 2023 revenues

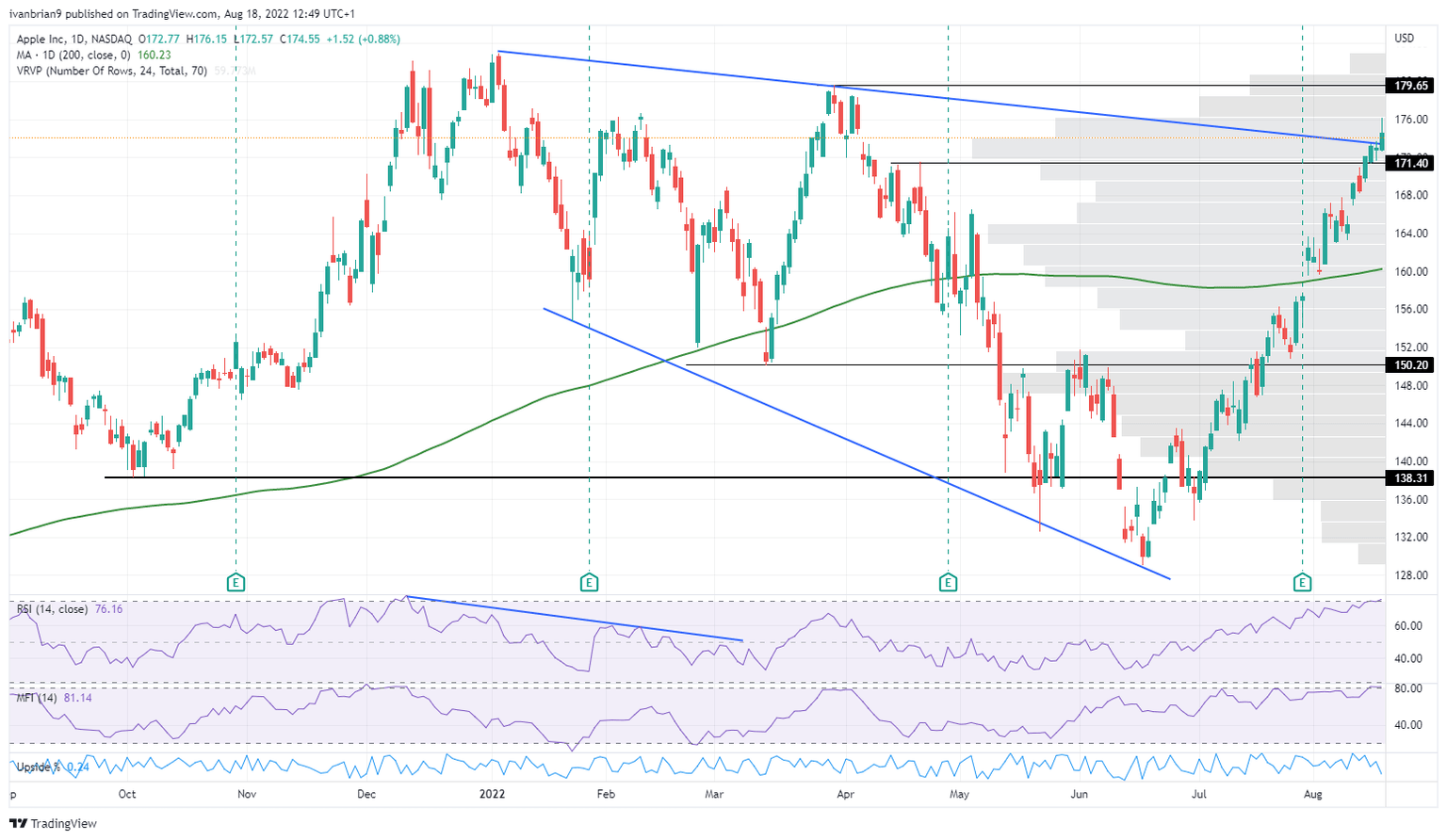

AAPL chart showing last two months of price action

Apple Stock News: Is the iPhone 14 due September 7?

Bloomberg carried a report on Wednesday that the new iPhone 14 is due for launch on September 7, with the article stating that $100 price increases across the model range are in the cards. It remains to be seen how consumers react to price hikes in an inflationary environment, but so far with wages also rising it may be acceptable to the notoriously loyal Apple fanbase. iPhone launches are usually not especially positive for AAPL stock performance with a separate Bloomberg article from last year claiming that iPhone launches result in AAPL stock falling 75% of the time. Certainly, with such a recent rise, it would appear to be lining up for a repeat performance, but why such a turnaround of meme stock proportions?

Apple is seen as a tech haven and global economic bellwether. Investors have become especially concerned over inflation, deteriorating economic growth, and supply chain issues. Once it became clear that inflation was so far not hitting consumer spending and that US employment growth and wages remained strong, that set the market up for a tech rally. Supply chain issues also appear to have eased, which further helped. Perhaps the biggest factor though was sentiment and positioning. Investors had become overly bearish, and positions were overly light. With Apple being the biggest stock in all major indices, once fund managers decided to increase equity weightings Apple was also going to receive large net inflows. Now the question is: can this rally continue?

Apple stock forecast

Is the AAPL stock breakout a bull signal or a false breakout?

Apple stock is now strongly overbought on the Relative Strength Index (RSI) and the Money Flow Index (MFI). Also, the volume is heavy above $170, meaning the move should at least slow if not fall over.

My trading view: I view the risk-reward on AAPL stock as skewed to the downside. I would be looking at bearish strategies around current levels with an exit on a break of resistance at $179. My first target is the 200-day moving average at $160, and then I would reassess. The earnings gap of $157 should also be filled.

AAPL 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637964196161328037.png&w=1536&q=95)