Apple (AAPL) Stock Forecast: Why is Apple up on Tuesday? UBS ups price target ahead of earnings

- AAPL stock recovers some lost ground from Monday.

- Apple releases earnings on Tuesday, July 27.

- The tech giant stock now targets key $137 support.

Update: Apple stock is showing some nice gains on Tuesday as equity markets recover after a torrid start to teh week on Monday. AAPL stock caught a bullish move from UBS who raised their price target on the stock ahead of earnings next week. Technically the stock is just trying to get back above the 9-day moving average and retake the prvious record high at $145.08. The MACD needs careful attention though as it nearly signalled a bearish crossover on Monday.

Apple shares suffered a pretty nasty fall on Monday with the tech behemoth giving up nearly 3% to close at $142.45. In the process, Apple stock broke the previous record high at $145.09 and also broke the 9-day moving average. The negative price action was not Apple related though, as stock markets across the globe suffered steep falls on Monday. High valuations were a concern and so too was the emergence and dominance of the Delta variant of covid.

Markets had performed exceptionally strongly for 2021 and Apple had staged a very strong move for most of June and into July. The move was not too surprising as it had lagged some mega tech, FAANG peers and needed to play catch up. But now the rally has stalled so is it a case of buying the dip or has something changed?

Apple key statistics

| Market Cap | $2.44 trillion |

| Enterprise Value | $2.1 trillion |

| Price/Earnings (P/E) | 32 |

|

Price/Book | 38 |

| Price/Sales | 9 |

| Gross Margin | 0.4 |

| Net Margin | 0.23 |

| EBITDA | $100 billion |

| Average Wall Street rating and price target | Buy $159 |

Apple stock forecast

Apple (AAPL) has performed nicely for those on the long side with returns nearing 10% over the last month alone. So, is this current setback a buy-the-dip opportunity or a turn and the start of a bearish trend? We probably need to wait for results to confirm that, as the news flow is currently relatively light. There have been some concerns over Apple's return to work policy which may have a negative slant but nothing too serious here for bears to get excited about.

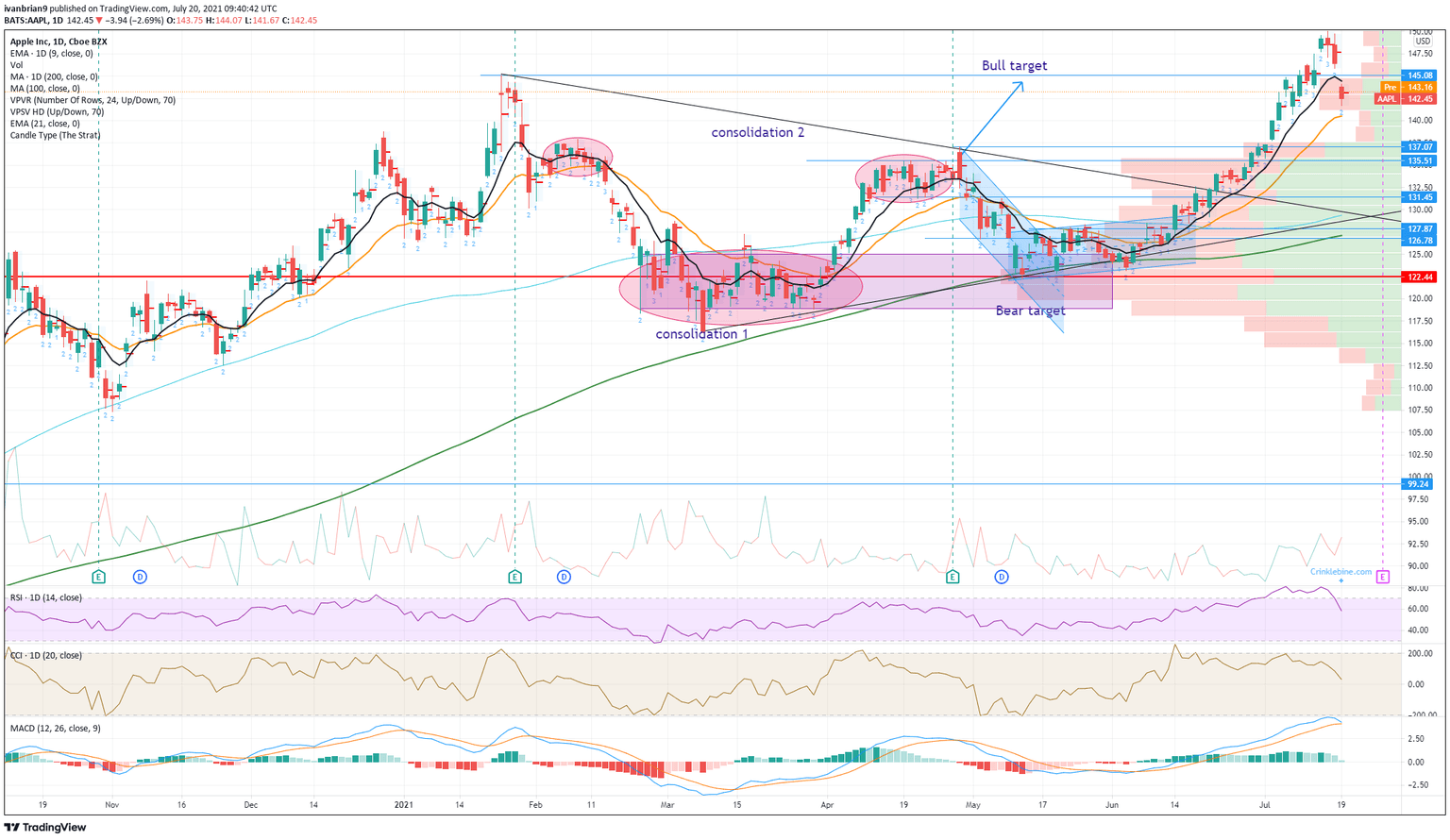

Looking purely at the chart and technical levels we can see now the 9-day moving average has broken so the short-term trend has turned. The next level comes at the 21-day moving average at $140.51 but this is not strong support. Better to wait for $137 before trying a long position, as from $142 to 137 the volume profile is light meaning, less price support. But is there a possibility to buy at current levels?

Tuesday is likely to see a bounce after Monday's sharp falls and a break of the 9-day moving average would be an opportunity to get long Apple stock again. Just use a stop or some form of risk management as this is not a strong risk-reward trade. Ahead of earnings next week the direction is likely to be choppy. Keep an eye also on the Moving Average Convergence Divergence (MACD) as it appears to be about to crossover, which is a bearish signal.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637623709937031243.png&w=1536&q=95)