AMC stock ends Tuesday flat, risk appetite likely to provide support

- AMC stock stages a remarkable gain of over 40% on Monday.

- Gold mine investment Hycroft Mining hits pay dirt.

- AMC Entertainment also tops social media mentions on Monday as meme stocks surge.

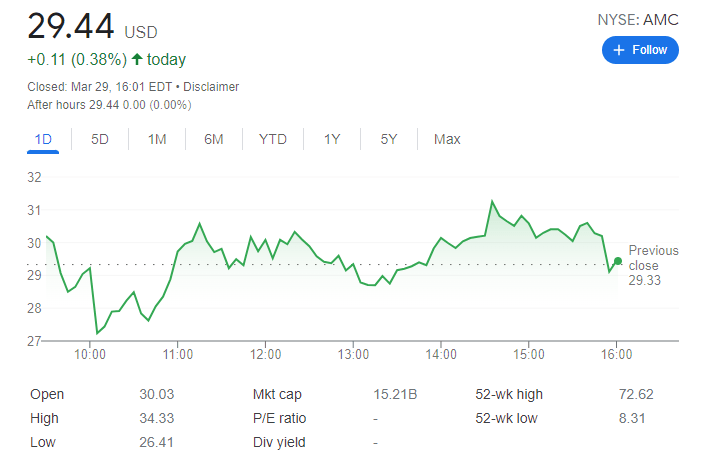

Update: AMC Entertainment buyers paused on Tuesday, with the share ending the day up a modest 0.38% at $29.44. Wall Street had a great day, as all major indexes closed in the green. The Dow Jones Industrial Average was up 0.92%, while the S&P Composite added 54 points. Finally, the Nasdaq Composite settled at 14,608.40, up 1.77%.

Global stocks rallied amid progress in peace talks, as reported by Russian and Ukrainian representatives. Despite there’s still a long way to go, both partS have noted material progress in negotiations, boosting high-yielding assets. The better perception of risk maintained AMC afloat, although it was not enough to push it higher, after Monday’s crazy run.

Meanwhile, US traders saw the yield curve temporarily inverting as the 2-year and 10-year Treasury notes temporarily hovered around 2.40%. At the end of the day, the first stands at 2.36%, while the longer-term one settled at 2.39%.

Previous update: AMC stock opened as high as $34.33 on Tuesday, but the meme stock could not hold onto such a mesmerizing two-day spike. Shares are now down 5.5% at $27.72 at the time of writing – about one hour into the morning session. This may be the famous AMC apes taking profits as the stock did advance by 40% on Monday. After such a run, a breather is usually in the cards. The growth-heavy Nasdaq is up 0.9% at the same time, while the Dow and the S&P 500 are both advancing by half a percentage point. The $30 calls expiring this Friday, April 1, are down a little over 1% at $3.80. Volume for the contract shows more than 28,300 contracts trading hands, while open interest is nearly 18,800.

AMC stock is back, baby. The stock surged on Monday as AMC Entertainment (AMC) investors sent the stock surging on the back of a successful investment in Hycroft Mining (HYMC). Hycroft Mining stock surged 80% as it managed to raise badly needed funds, and AMC CEO Adam Aron spoke glowingly about the prospects for further AMC investments.

AMC apes pushed the market cap of the stock ahead by nearly $5 billion on Monday – a $5 billion revaluation on the back of a 22% stake in HYMC stock. HYMC now has a market cap of $248 million after Monday's manic move. 22% of that is worth $50 million, give or take. This investment has doubled in value. Nice work, but investors see fit to push AMC up by 20 times the entire value of HYMC. Ok, that makes sense!

AMC, GameStop (GME), and others are a law unto themselves, as we know only too well, especially when it comes to valuations. This one still takes the biscuit though. Just for clarity, there was not any other news flow from AMC. AMC CEO Adam Aron just spoke bullishly, which is his job.

AMC Stock News: To the moon

Now the above paragraph is probably a bit too cynical. Yes, the bland statistics of the valuations look a little odd, but in truth, we can put a lot of yesterday's stocks market moves down to the pure risk of being back on in a big big way. After all, AMC stock had dropped massively at the start of the year, so a lot of this was retail traders looking at the price and thinking, "This looks cheap," so they piled back in.

Momentum is a powerful tool in trading and a profitable one if used wisely. Short-term trading does not need to concern itself with valuations. This momentum was generated from overselling across all equities: large and small-cap and meme stocks. We then had two powerful cheerleaders. Ryan Cohen stumped for more shares in GameStop, and then AMC CEO Adam Aron gave an interview to Reuters that was bullish. He also appeared on CNBC to discuss the future for more AMC investments. AMC will look to capitalize on this meme craze and seek out other companies it can help with financing.

See Hycroft Mining (HYMC) stock news

AMC Stock Forecast: $30 waits in the willows

A small bit of traffic is apparent, and resistance sits at $29.82. $30 is a psychological round number to boot, so take your pick. This level may slow things down, and really after a 40% plus move you would expect it to slow. $34.60 is the next big resistance. Holding above $22.35, the high from March 23, keeps the phase intact. Below and it is back to neutral. Also, look at that massively overbought Relative Strength Index (RSI). The last time AMC's RSI got above 80 was June 2021 when it spiked and then collapsed, so be warned.

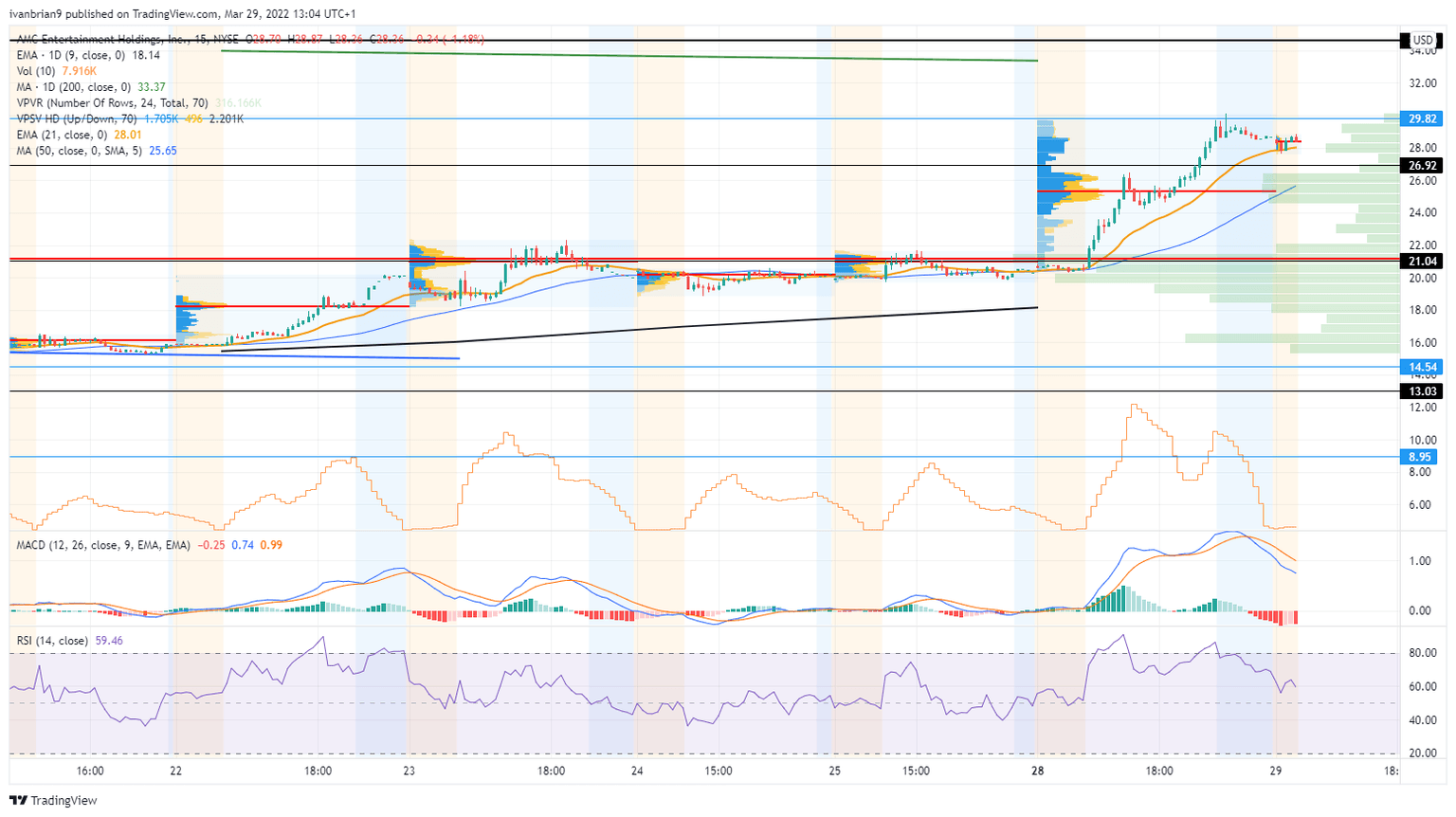

AMC stock chart, daily

For shorter moves look to the 15-minute chart below. Most of Monday's volume took place at $26, the point of control. This is the intraday short-term pivot point. Breaking sees a volume gap back to $21.04. Holding above keeps the intraday move bullish.

AMC stock chart,15-minute

Prior Update: Here we go again. AMC is number two on the wallstreetbets list Tuesday, right behind its old friend GameStop (GME). But AMC looks determined to regain the top spot as the stock surges from the open on Tuesday. After a modest and jumpy opening when AMC stock opened positively but flirted with breakeven. Now however the AMC apes are back in and pushing AMC up 12% at the time of writing, just five minutes into the regular session. Meme stocks look set for more gains as risk-on is the ongoing theme in US equity markets. How high can you go?

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.